- China

- /

- Interactive Media and Services

- /

- SZSE:300418

Pulling back 3.6% this week, Kunlun Tech's SZSE:300418) three-year decline in earnings may be coming into investors focus

It might be of some concern to shareholders to see the Kunlun Tech Co., Ltd. (SZSE:300418) share price down 14% in the last month. But that doesn't change the fact that the returns over the last three years have been pleasing. After all, the share price is up a market-beating 100% in that time.

Since the long term performance has been good but there's been a recent pullback of 3.6%, let's check if the fundamentals match the share price.

Given that Kunlun Tech only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years Kunlun Tech has grown its revenue at 2.0% annually. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably broadly reflected in the share price, which is up 26%, per year over 3 years. The real question is when the business will generate profits, and how quickly they will grow. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

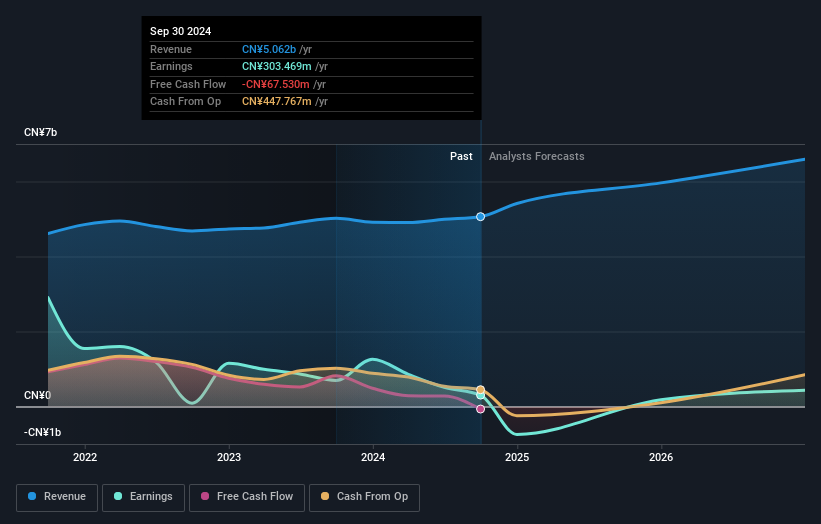

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Kunlun Tech shareholders are down 12% for the year (even including dividends), but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 15%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Kunlun Tech .

We will like Kunlun Tech better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kunlun Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300418

Kunlun Tech

Engages in the business of gaming and social entertainment platforms in China and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives