Spotlighting Zhejiang Huace Film & TV And 2 Other Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets experience a mix of optimism and caution, with the S&P 500 and Nasdaq Composite showing notable gains driven by sectors like utilities, real estate, and tech, investors are keeping a keen eye on growth opportunities. In this environment, companies with high insider ownership can indicate strong internal confidence in their potential for expansion and resilience amidst fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

We'll examine a selection from our screener results.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥13.47 billion.

Operations: The company's revenue primarily comes from its activities in the creation, distribution, and derivative products of film and television dramas both domestically and abroad.

Insider Ownership: 21.8%

Revenue Growth Forecast: 23.5% p.a.

Zhejiang Huace Film & TV is anticipated to see significant earnings growth of 28.7% annually, surpassing the Chinese market's average. Despite this, recent financial results show a sharp decline in revenue and net income compared to the previous year, raising concerns about its unstable earnings quality due to large one-off items. The company's share price has been highly volatile recently, and it lacks substantial insider trading activity over the past three months.

- Navigate through the intricacies of Zhejiang Huace Film & TV with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Zhejiang Huace Film & TV's share price might be on the expensive side.

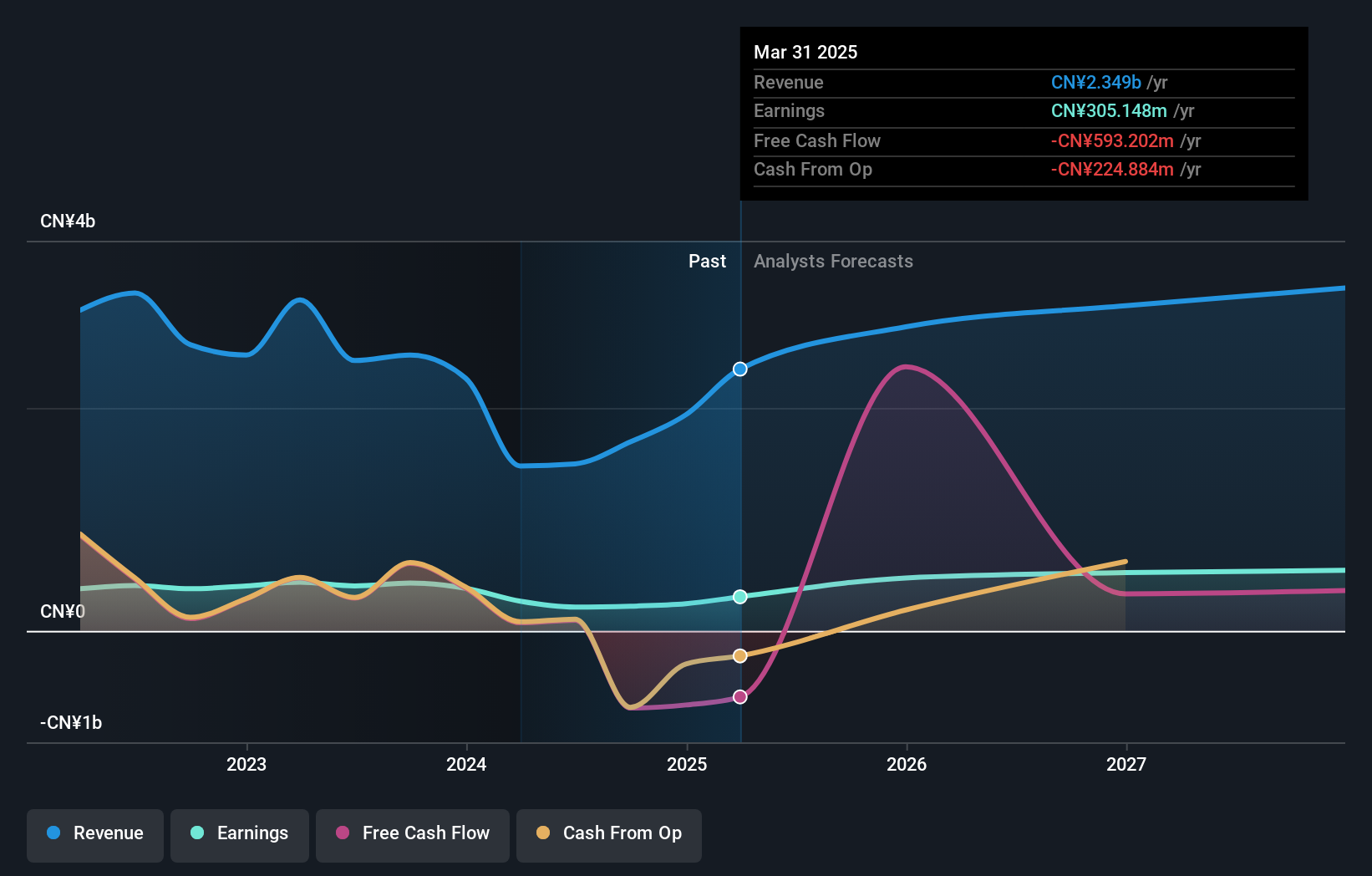

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China with a market capitalization of approximately CN¥23.05 billion.

Operations: The company generates revenue primarily from its digital publishing activities in China.

Insider Ownership: 12.4%

Revenue Growth Forecast: 20.6% p.a.

COL Group Ltd. is forecasted to achieve profitability within three years, with revenue growth expected at 20.6% annually, outpacing the Chinese market's average. However, recent financial results show a decline in sales and an increased net loss compared to the prior year, indicating potential challenges ahead. The company completed a share buyback of CNY 20.05 million recently but has experienced significant share price volatility and lacks substantial insider trading activity in the past three months.

- Dive into the specifics of COL GroupLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that COL GroupLtd's current price could be inflated.

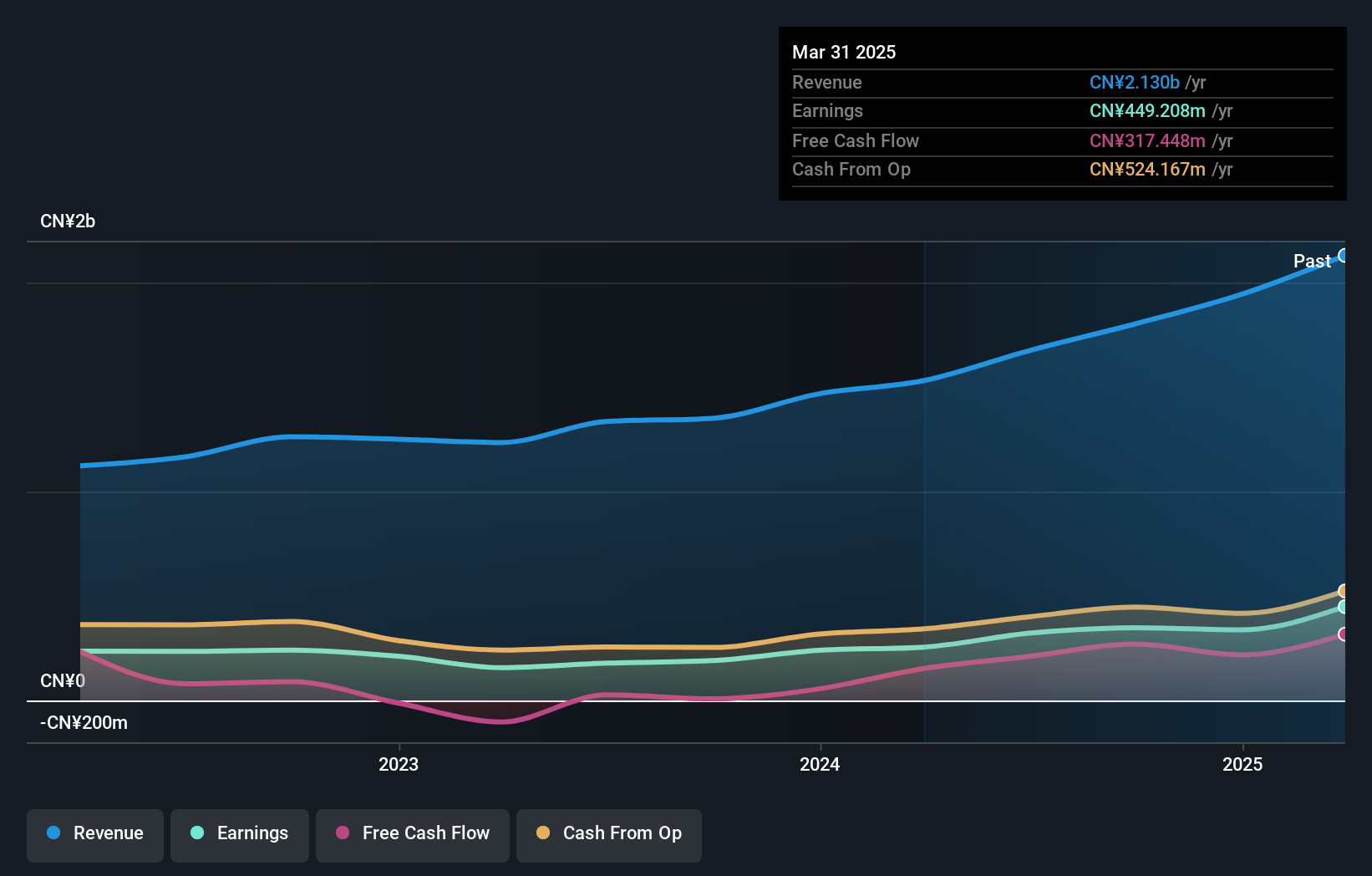

Shenyang Xingqi PharmaceuticalLtd (SZSE:300573)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic medications in China with a market capitalization of approximately CN¥17.22 billion.

Operations: Shenyang Xingqi Pharmaceutical Co., Ltd. generates its revenue primarily from the research, development, production, and sale of ophthalmic medications within China.

Insider Ownership: 30.9%

Revenue Growth Forecast: 23.1% p.a.

Shenyang Xingqi Pharmaceutical Ltd. is poised for substantial growth, with earnings expected to rise significantly at 32.64% annually over the next three years, outpacing the Chinese market average. Despite high share price volatility and a dividend not well-covered by earnings, its recent inclusion in the FTSE All-World Index highlights investor confidence. The company reported strong financial performance with net income increasing to CNY 169.32 million from CNY 87.75 million year-on-year.

- Click here and access our complete growth analysis report to understand the dynamics of Shenyang Xingqi PharmaceuticalLtd.

- Our comprehensive valuation report raises the possibility that Shenyang Xingqi PharmaceuticalLtd is priced higher than what may be justified by its financials.

Next Steps

- Navigate through the entire inventory of 1486 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300573

Shenyang Xingqi PharmaceuticalLtd

Engages in the research and development, production, and sale of ophthalmic drug in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives