- China

- /

- Entertainment

- /

- SZSE:300315

Ourpalm Co., Ltd.'s (SZSE:300315) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Ourpalm Co., Ltd. (SZSE:300315) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Indeed, the recent drop has reduced its annual gain to a relatively sedate 3.6% over the last twelve months.

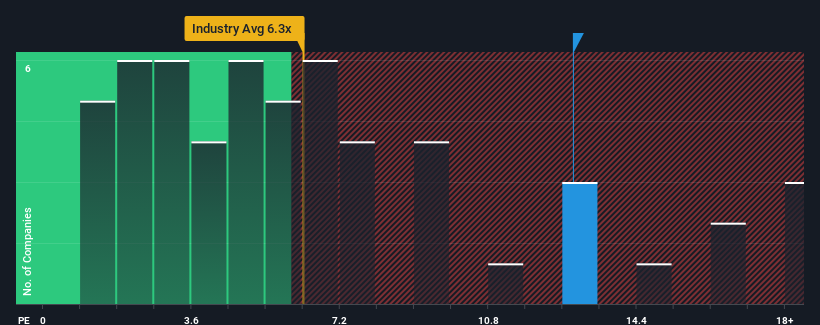

In spite of the heavy fall in price, Ourpalm may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.9x, when you consider almost half of the companies in the Entertainment industry in China have P/S ratios under 6.3x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Ourpalm

How Has Ourpalm Performed Recently?

Ourpalm hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ourpalm.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ourpalm's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. The last three years don't look nice either as the company has shrunk revenue by 45% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 4.7% over the next year. That's shaping up to be materially lower than the 29% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Ourpalm's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Ourpalm's P/S Mean For Investors?

Even after such a strong price drop, Ourpalm's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Ourpalm trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Ourpalm with six simple checks.

If you're unsure about the strength of Ourpalm's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Ourpalm, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300315

Ourpalm

Focuses on the development, distribution, and operation of online games in China and internationally.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives