- China

- /

- Communications

- /

- SZSE:300627

3 Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets continue their upward trajectory, buoyed by optimism around potential trade deals and advancements in artificial intelligence, growth stocks have notably outperformed value shares. In this environment of heightened investor confidence, companies with strong insider ownership often signal robust internal belief in their future prospects, making them compelling considerations for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's review some notable picks from our screened stocks.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stadler Rail AG, operating through its subsidiaries, manufactures and sells trains across Switzerland, Germany, Austria, various parts of Europe, the Americas, CIS countries and internationally with a market cap of CHF2.03 billion.

Operations: Stadler Rail's revenue segments include CHF135.68 million from Signalling, CHF3.10 billion from Rolling Stock, and CHF789.41 million from Service & Components.

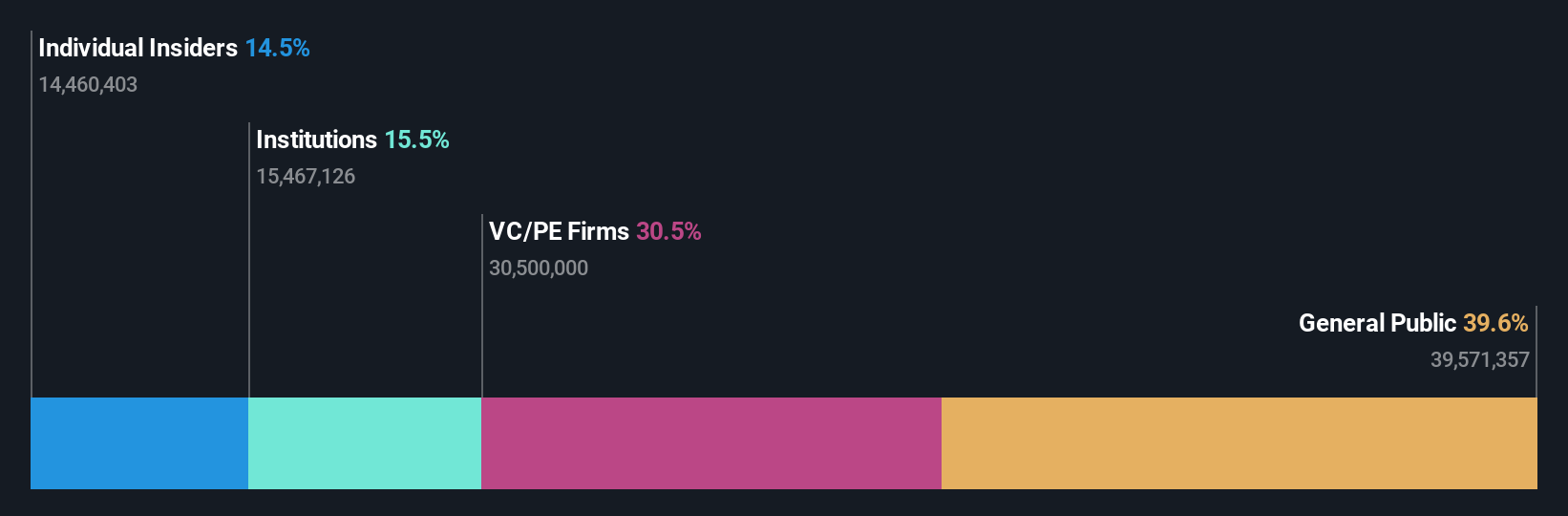

Insider Ownership: 14.5%

Stadler Rail's earnings are projected to grow significantly at 22.9% annually, outpacing the Swiss market's 11.2%. Despite trading at 44.7% below its estimated fair value and offering good relative value compared to peers, concerns arise from a low forecasted Return on Equity of 18.8% in three years and an unsustainable dividend of 4.4%. Revenue growth is expected at a moderate 5.7%, exceeding the Swiss market's rate but remaining below high-growth benchmarks.

- Get an in-depth perspective on Stadler Rail's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Stadler Rail's current price could be quite moderate.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China, with a market cap of CN¥27.77 billion.

Operations: The company's revenue primarily comes from its activities in film and television project investment, production, and distribution within China.

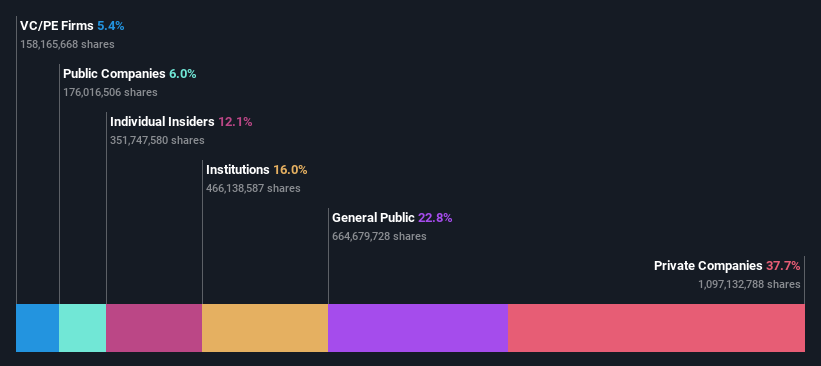

Insider Ownership: 12.1%

Beijing Enlight Media's earnings are forecast to grow significantly at 35.3% annually, surpassing the Chinese market's 25.1%. Recent earnings results showed a net income increase to CNY 460.88 million from CNY 368.47 million year-on-year, indicating strong growth momentum. However, its Return on Equity is expected to be low at 10.1% in three years, and it has an unstable dividend track record with no recent insider trading activity reported over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Beijing Enlight Media.

- Our comprehensive valuation report raises the possibility that Beijing Enlight Media is priced higher than what may be justified by its financials.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation and positioning technologies, with a market cap of CN¥22.06 billion.

Operations: Shanghai Huace Navigation Technology Ltd. generates revenue through its operations in navigation and positioning technologies.

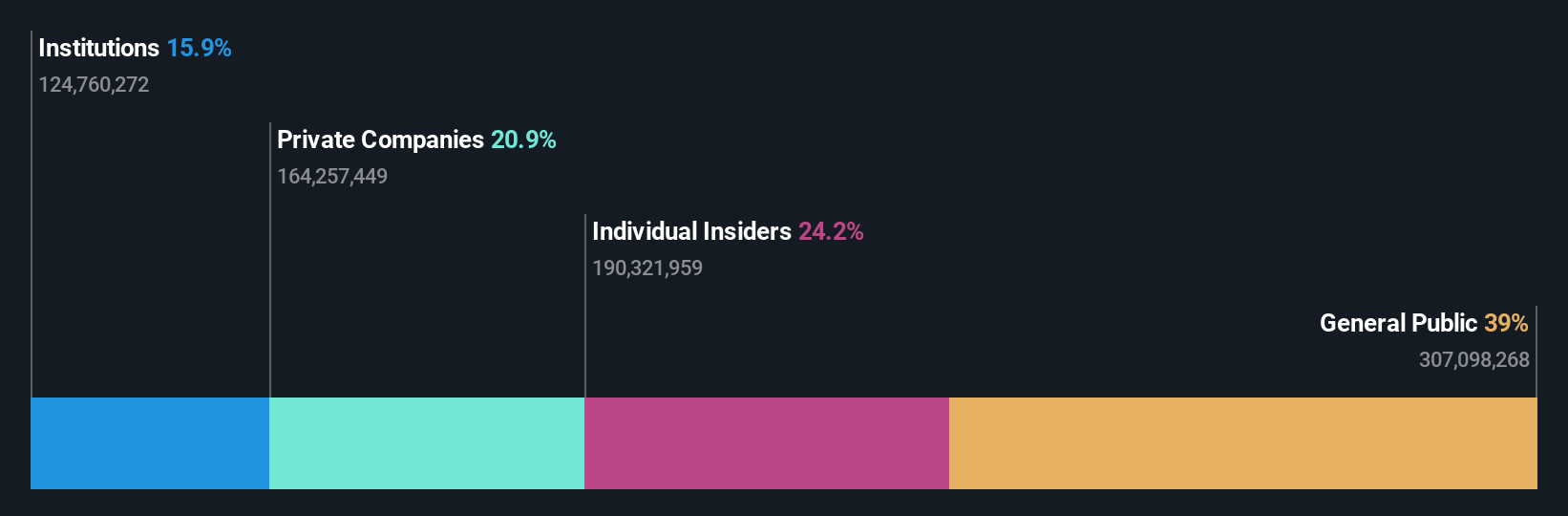

Insider Ownership: 24.7%

Shanghai Huace Navigation Technology's revenue is projected to grow at 26.2% annually, outpacing the Chinese market's 13.4%. Despite a lower forecasted Return on Equity of 19.7% in three years, its earnings are expected to rise significantly by over 20% per year. Recent inclusion in Shenzhen Stock Exchange indices and a collaboration with Swift Navigation highlight its strategic advancements in GNSS technology, enhancing its positioning capabilities for autonomous vehicles and other applications without substantial recent insider trading activity.

- Dive into the specifics of Shanghai Huace Navigation Technology here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Shanghai Huace Navigation Technology's share price might be too optimistic.

Next Steps

- Delve into our full catalog of 1470 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300627

Shanghai Huace Navigation Technology

Shanghai Huace Navigation Technology Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives