- China

- /

- Entertainment

- /

- SZSE:300113

Hangzhou Shunwang Technology Co,Ltd's (SZSE:300113) Shares May Have Run Too Fast Too Soon

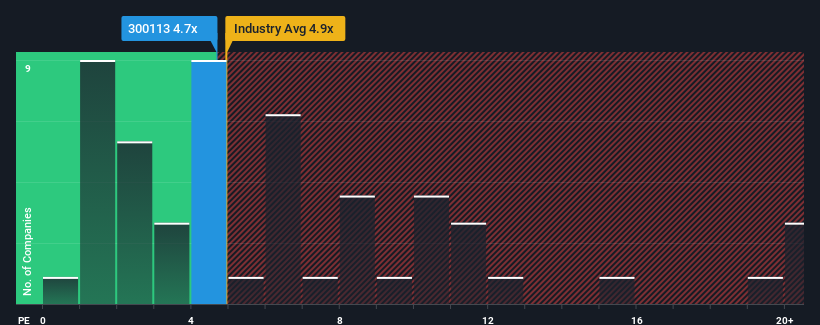

With a median price-to-sales (or "P/S") ratio of close to 4.9x in the Entertainment industry in China, you could be forgiven for feeling indifferent about Hangzhou Shunwang Technology Co,Ltd's (SZSE:300113) P/S ratio of 4.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Hangzhou Shunwang Technology CoLtd

How Hangzhou Shunwang Technology CoLtd Has Been Performing

Hangzhou Shunwang Technology CoLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hangzhou Shunwang Technology CoLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Hangzhou Shunwang Technology CoLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. The strong recent performance means it was also able to grow revenue by 41% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 15% over the next year. Meanwhile, the rest of the industry is forecast to expand by 28%, which is noticeably more attractive.

With this in mind, we find it intriguing that Hangzhou Shunwang Technology CoLtd's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Hangzhou Shunwang Technology CoLtd's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Hangzhou Shunwang Technology CoLtd's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Having said that, be aware Hangzhou Shunwang Technology CoLtd is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Hangzhou Shunwang Technology CoLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Shunwang Technology CoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300113

Hangzhou Shunwang Technology CoLtd

Provides Internet entertainment platform in China.

Flawless balance sheet second-rate dividend payer.