Investors Continue Waiting On Sidelines For BlueFocus Intelligent Communications Group Co., Ltd. (SZSE:300058)

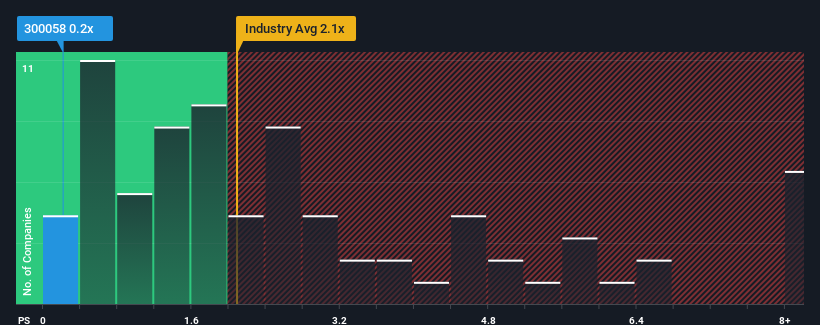

With a price-to-sales (or "P/S") ratio of 0.2x BlueFocus Intelligent Communications Group Co., Ltd. (SZSE:300058) may be sending bullish signals at the moment, given that almost half of all the Media companies in China have P/S ratios greater than 2.1x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for BlueFocus Intelligent Communications Group

How Has BlueFocus Intelligent Communications Group Performed Recently?

Recent times have been advantageous for BlueFocus Intelligent Communications Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on BlueFocus Intelligent Communications Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For BlueFocus Intelligent Communications Group?

In order to justify its P/S ratio, BlueFocus Intelligent Communications Group would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 52%. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 10% over the next year. Meanwhile, the rest of the industry is forecast to expand by 11%, which is not materially different.

With this in consideration, we find it intriguing that BlueFocus Intelligent Communications Group's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that BlueFocus Intelligent Communications Group currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for BlueFocus Intelligent Communications Group with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BlueFocus Intelligent Communications Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300058

BlueFocus Intelligent Communications Group

BlueFocus Intelligent Communications Group Co., Ltd.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives