As global trade tensions show signs of easing, Asian markets have been buoyed by expectations of government stimulus and strategic economic measures, fostering a cautiously optimistic environment for investors. In this context, growth companies with high insider ownership are particularly noteworthy as they may reflect strong internal confidence and alignment with shareholder interests amidst the evolving market landscape.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| M31 Technology (TPEX:6643) | 30.8% | 69.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

BlueFocus Intelligent Communications Group (SZSE:300058)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BlueFocus Intelligent Communications Group Co., Ltd. operates as a comprehensive communications and marketing services provider, with a market cap of CN¥21.63 billion.

Operations: BlueFocus Intelligent Communications Group Co., Ltd. generates its revenue from various segments within the communications and marketing services industry.

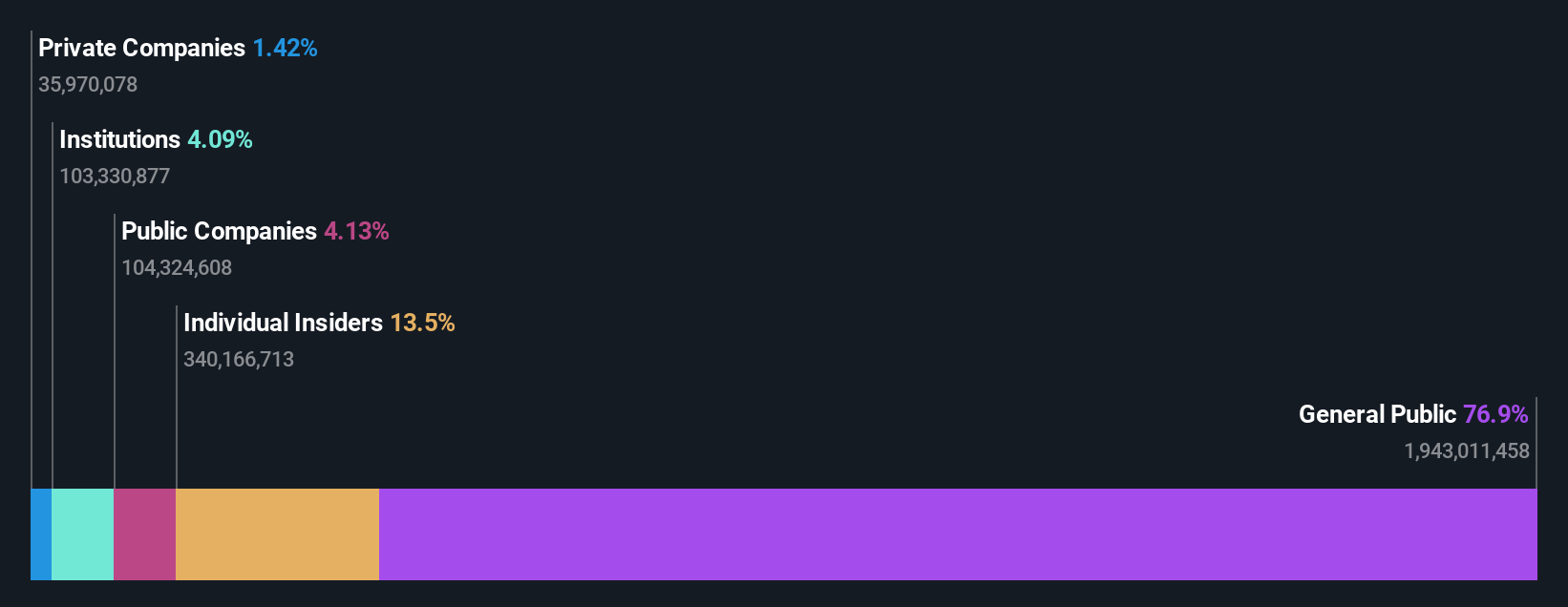

Insider Ownership: 13.5%

Revenue Growth Forecast: 14.5% p.a.

BlueFocus Intelligent Communications Group demonstrates strong growth potential with expected annual profit growth surpassing market averages. Despite a recent decline in quarterly sales to CNY 14.26 billion, net income improved to CNY 95.5 million, indicating operational resilience. The company is trading at a good value relative to peers and industry standards, although its share price has been highly volatile recently. Revenue growth is projected at 14.5% annually, outpacing the broader Chinese market's forecasted rate of 12.8%.

- Click here to discover the nuances of BlueFocus Intelligent Communications Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of BlueFocus Intelligent Communications Group shares in the market.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China and has a market capitalization of approximately CN¥15.82 billion.

Operations: The company's revenue segments are not provided in the text.

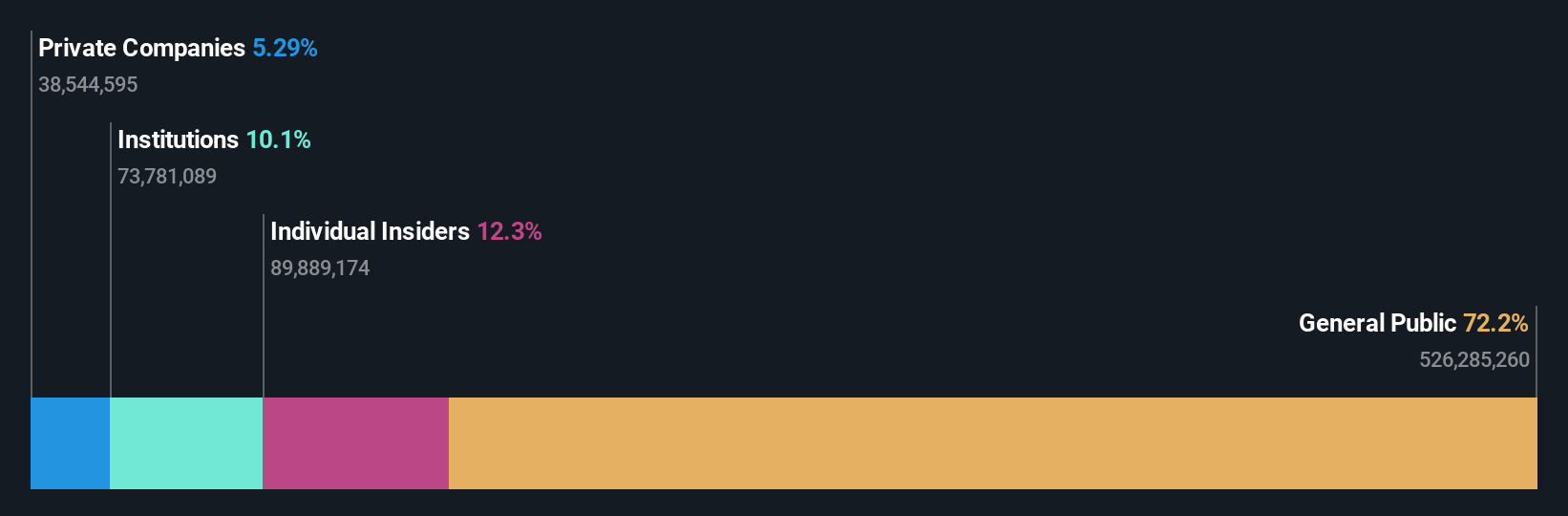

Insider Ownership: 12.5%

Revenue Growth Forecast: 20.9% p.a.

COL Group Ltd. showcases significant growth potential with revenue expected to increase by 20.9% annually, surpassing the Chinese market's average of 12.8%. Despite a net loss of CNY 87.94 million in Q1 2025, the company is forecasted to become profitable within three years, exceeding market growth expectations. The recent share buyback indicates management's confidence in future prospects, although its share price has been notably volatile over the past three months.

- Navigate through the intricacies of COL GroupLtd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, COL GroupLtd's share price might be too optimistic.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sharetronic Data Technology Co., Ltd. operates as a provider of wireless IoT products in China and internationally, with a market cap of CN¥25.65 billion.

Operations: Sharetronic Data Technology Co., Ltd. generates revenue primarily through its provision of wireless IoT products both domestically and globally.

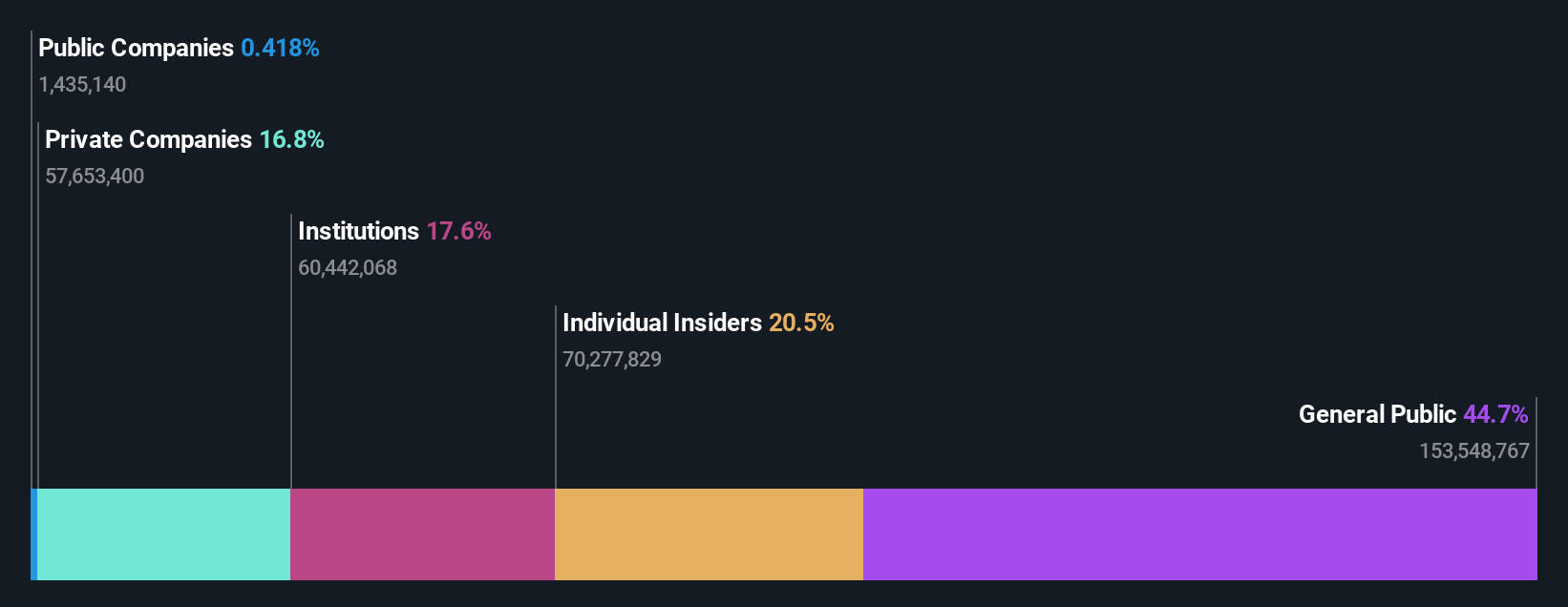

Insider Ownership: 20.5%

Revenue Growth Forecast: 25.2% p.a.

Sharetronic Data Technology demonstrates robust growth potential, with forecasted earnings and revenue growth rates of 32.2% and 25.2% annually, exceeding the Chinese market averages. Recent Q1 2025 results show increased sales at CNY 2.08 billion, up from CNY 1.76 billion a year prior, alongside stable net income growth. Despite high insider ownership supporting long-term alignment, the company's financial position is challenged by debt not well-covered by operating cash flow and recent share price volatility.

- Take a closer look at Sharetronic Data Technology's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Sharetronic Data Technology is priced higher than what may be justified by its financials.

Next Steps

- Explore the 622 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BlueFocus Intelligent Communications Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300058

BlueFocus Intelligent Communications Group

BlueFocus Intelligent Communications Group Co., Ltd.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives