- China

- /

- Communications

- /

- SZSE:300590

High Growth Tech Stocks To Watch In None

Reviewed by Simply Wall St

Global markets have recently seen significant gains, with the Dow Jones Industrial Average, S&P 500 Index, and Russell 2000 Index reaching record highs amid robust trading activity and geopolitical developments. In this context of heightened market optimism and economic indicators showing mixed signals, identifying high-growth tech stocks requires a focus on companies that demonstrate strong innovation potential and resilience against broader economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Hangzhou Raycloud TechnologyLtd (SHSE:688365)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Raycloud Technology Co., Ltd is an e-commerce software and service technology company with operations in China and internationally, holding a market cap of approximately CN¥3.99 billion.

Operations: Raycloud generates revenue primarily from its internet software and services segment, amounting to CN¥476.40 million. The company's focus is on providing e-commerce solutions both within China and internationally.

Hangzhou Raycloud TechnologyLtd has shown resilience and potential in the tech sector with a notable reduction in net loss to CNY 55.74 million from CNY 91.87 million year-over-year, reflecting improved operational efficiency. Despite a marginal increase in revenue to CNY 352.63 million, the company's commitment to innovation is evident from its R&D investments aimed at fostering growth in software development. With earnings forecasted to surge by an impressive 71.3% annually, Raycloud is strategically positioning itself above the market average growth rate of 26.2%, although it operates under a highly volatile share price environment which could signal caution for risk-averse investors.

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation is an entertainment media company operating in China and internationally, with a market cap of CN¥9.24 billion.

Operations: The company generates revenue primarily through film and television production, distribution, and related entertainment services. It also engages in the operation of theaters and theme parks, contributing to its diverse income streams.

Huayi Brothers Media has demonstrated a robust turnaround in its financial health, with revenue climbing to CNY 399.54 million, a significant rebound from previous figures. This improvement is underscored by a drastic reduction in net loss to CNY 42.48 million from CNY 281.8 million year-over-year, showcasing effective cost management and operational efficiency. The company's commitment to innovation is evident with R&D expenses aimed at catalyzing future growth; this strategic focus is anticipated to propel earnings by an impressive 110.5% annually. Despite recent volatility and being dropped from the FTSE All-World Index, Huayi's aggressive growth strategy and improved financial metrics position it as a noteworthy contender in the entertainment technology landscape, with revenue growth projected at 41.2% per year—far surpassing the Chinese market average of 13.8%.

- Click here and access our complete health analysis report to understand the dynamics of Huayi Brothers Media.

Assess Huayi Brothers Media's past performance with our detailed historical performance reports.

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Queclink Wireless Solutions Co., Ltd. provides IoT solutions globally and has a market cap of CN¥6.67 billion.

Operations: Queclink Wireless Solutions focuses on providing IoT solutions worldwide. The company's revenue streams are primarily derived from its diverse range of IoT products and services.

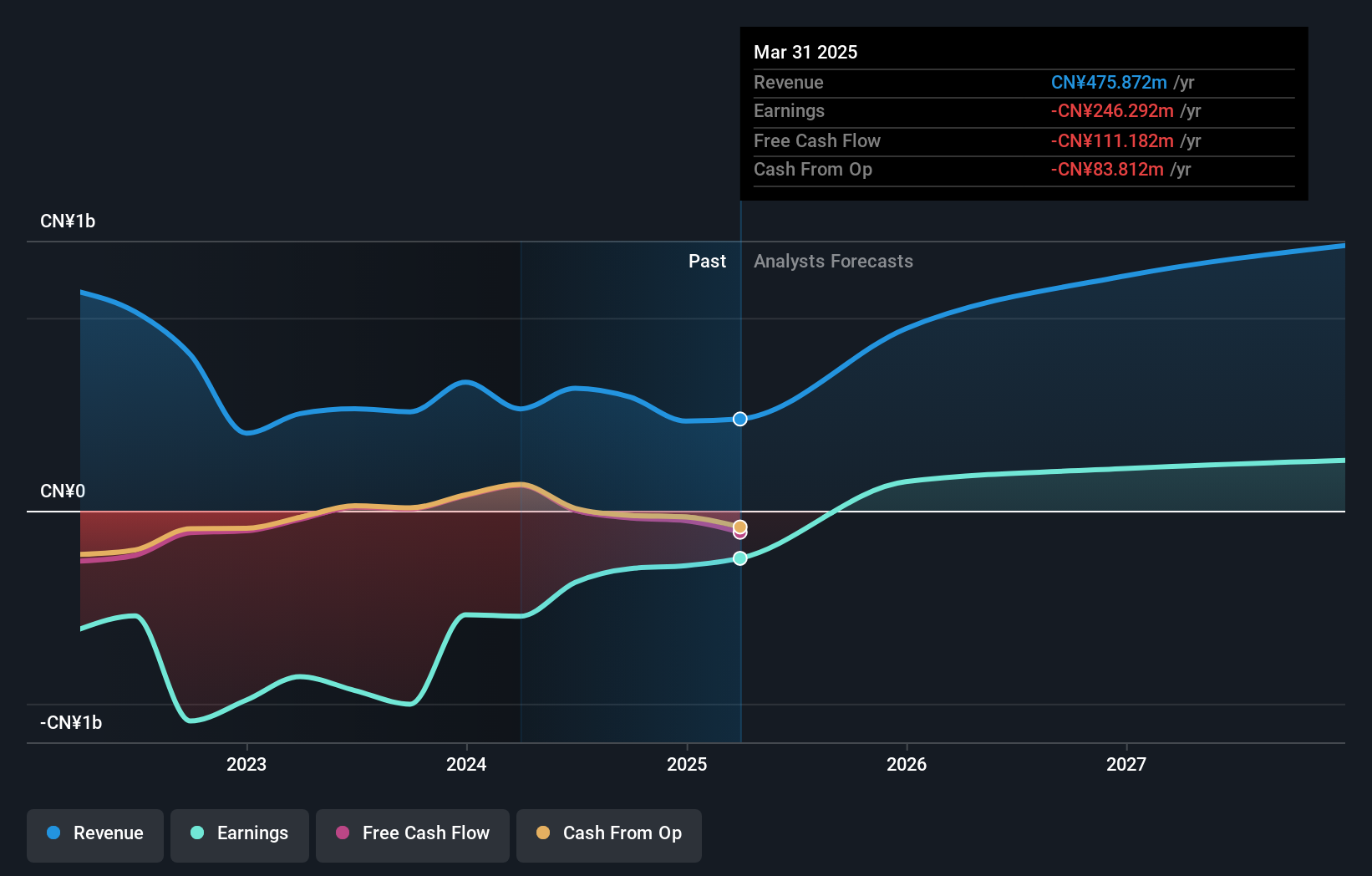

Queclink Wireless Solutions has demonstrated robust growth with a 6.5% increase in revenue year-over-year, reaching CNY 693.75 million, while net income surged by 36.4% to CNY 133.94 million, reflecting effective operational management and market expansion strategies. The company's commitment to innovation is evident from its R&D expenses which are strategically aimed at enhancing product offerings like the GL533CG tracker—this focus on technological advancement is expected to drive future growth with earnings projected to grow by an impressive 26.7% annually. This performance is particularly notable in the context of its industry, where Queclink not only outpaces average market growth rates but also demonstrates potential through strategic asset tracking solutions that cater to diverse industrial needs, ensuring sustained revenue streams and client engagement in increasingly competitive tech landscapes.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1282 High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Queclink Wireless Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300590

Queclink Wireless Solutions

Queclink Wireless Solutions Co., Ltd. IoT solutions worldwide.

Flawless balance sheet with high growth potential.