Investors Still Aren't Entirely Convinced By Beijing Yuanlong Yato Culture Dissemination Co.,Ltd.'s (SZSE:002878) Revenues Despite 39% Price Jump

Those holding Beijing Yuanlong Yato Culture Dissemination Co.,Ltd. (SZSE:002878) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

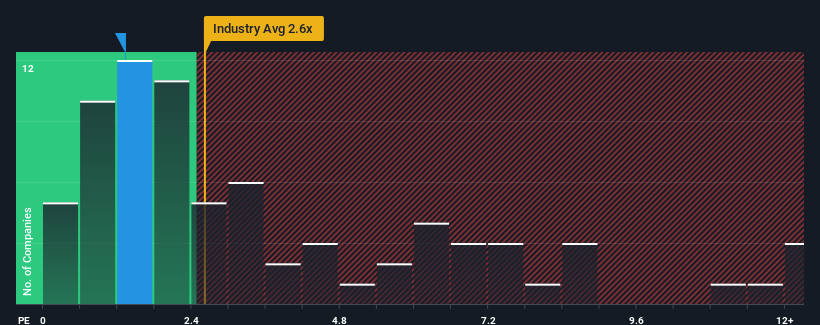

Even after such a large jump in price, Beijing Yuanlong Yato Culture DisseminationLtd's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a buy right now compared to the Media industry in China, where around half of the companies have P/S ratios above 2.6x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Beijing Yuanlong Yato Culture DisseminationLtd

How Beijing Yuanlong Yato Culture DisseminationLtd Has Been Performing

Beijing Yuanlong Yato Culture DisseminationLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Yuanlong Yato Culture DisseminationLtd.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Beijing Yuanlong Yato Culture DisseminationLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. Still, the latest three year period has seen an excellent 44% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 36% over the next year. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we find it odd that Beijing Yuanlong Yato Culture DisseminationLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Beijing Yuanlong Yato Culture DisseminationLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Beijing Yuanlong Yato Culture DisseminationLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 5 warning signs for Beijing Yuanlong Yato Culture DisseminationLtd (2 are a bit concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Yuanlong Yato Culture DisseminationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002878

Beijing Yuanlong Yato Culture DisseminationLtd

Beijing Yuanlong Yato Culture Dissemination Co.,Ltd.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives