Beijing Yuanlong Yato Culture Dissemination Co.,Ltd.'s (SZSE:002878) Shares Leap 31% Yet They're Still Not Telling The Full Story

Despite an already strong run, Beijing Yuanlong Yato Culture Dissemination Co.,Ltd. (SZSE:002878) shares have been powering on, with a gain of 31% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

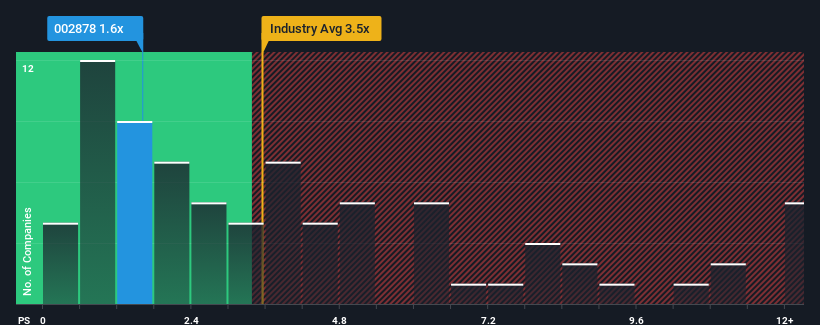

In spite of the firm bounce in price, Beijing Yuanlong Yato Culture DisseminationLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Media industry in China have P/S ratios greater than 3.5x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Yuanlong Yato Culture DisseminationLtd

What Does Beijing Yuanlong Yato Culture DisseminationLtd's P/S Mean For Shareholders?

Beijing Yuanlong Yato Culture DisseminationLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Beijing Yuanlong Yato Culture DisseminationLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Beijing Yuanlong Yato Culture DisseminationLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Beijing Yuanlong Yato Culture DisseminationLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 8.2% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Beijing Yuanlong Yato Culture DisseminationLtd's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Beijing Yuanlong Yato Culture DisseminationLtd's P/S

Despite Beijing Yuanlong Yato Culture DisseminationLtd's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Beijing Yuanlong Yato Culture DisseminationLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Beijing Yuanlong Yato Culture DisseminationLtd that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Yuanlong Yato Culture DisseminationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002878

Beijing Yuanlong Yato Culture DisseminationLtd

Beijing Yuanlong Yato Culture Dissemination Co.,Ltd.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives