- China

- /

- Electronic Equipment and Components

- /

- SZSE:300789

Discovering February 2025's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs with growth stocks leading the charge. Despite small-cap stocks lagging behind their larger counterparts, this environment presents a unique opportunity to explore lesser-known companies that may offer potential value. Identifying these undiscovered gems often involves looking for strong fundamentals and resilience in challenging economic conditions, making them intriguing considerations for investors seeking diversification in their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that offers a range of products including hardware, electrical, multimedia, home, and leisure items across Sweden, Norway, Finland, and internationally with a market capitalization of approximately SEK15.91 billion.

Operations: Clas Ohlson generates revenue primarily through its retail specialty segment, amounting to SEK11 billion. The company's net profit margin is a critical financial metric to observe, reflecting the efficiency of its operations and cost management.

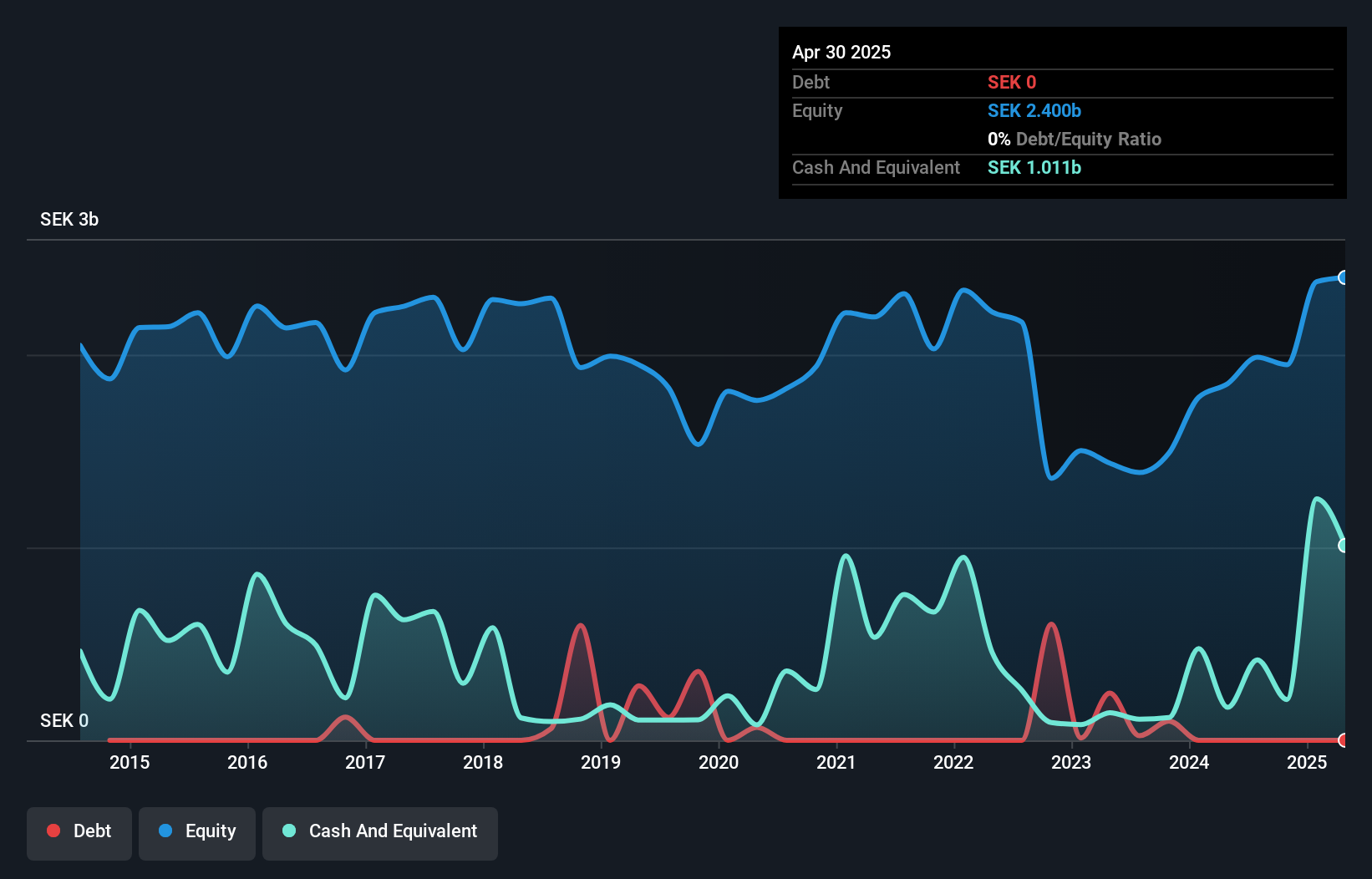

Clas Ohlson has demonstrated remarkable performance, with earnings growth of 161.3% over the past year, significantly outpacing the Specialty Retail industry's 7.6%. The company operates debt-free, highlighting its financial robustness and eliminating concerns related to interest payments. Recent sales figures show a strong trajectory, with net sales for January 2025 reaching SEK 901 million compared to SEK 794 million a year prior, marking a healthy increase of 14%. This growth is bolstered by an expanding store network now totaling 238 locations and strategic omni-channel initiatives that integrate digital and physical retail channels effectively.

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Value Rating: ★★★★★★

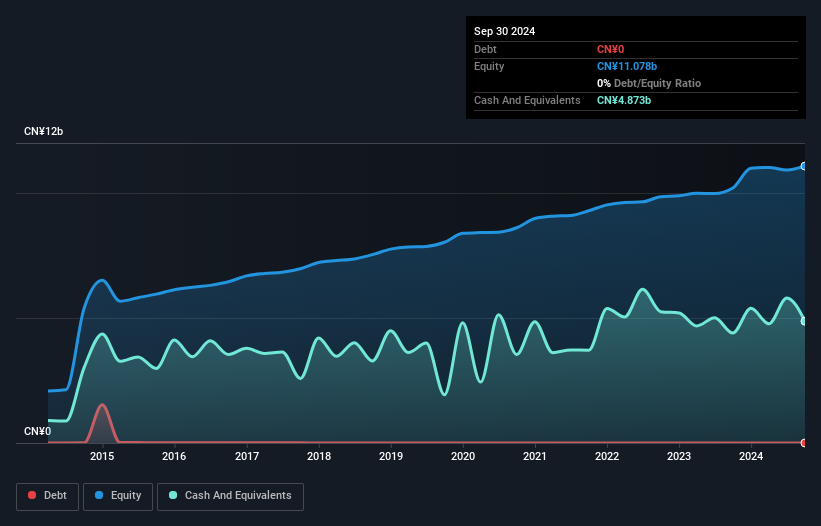

Overview: Central China Land Media Co., Ltd, along with its subsidiaries, is involved in the editing, production, and marketing of publications in China and has a market cap of CN¥11.80 billion.

Operations: The company generates revenue primarily through the editing, production, and marketing of publications. Its net profit margin has shown fluctuations over recent periods.

Central China Land Media, a relatively small player in the media industry, has been making waves with its strong financial footing. The company is debt-free and boasts high-quality earnings, which grew by 14.6% last year, significantly outpacing the media sector's -10.2%. Trading at a substantial 63.7% below estimated fair value suggests it offers good relative value compared to peers. Despite these strengths, future projections indicate an average annual earnings decline of 4.8% over the next three years; however, its positive free cash flow position provides some cushion against potential downturns in revenue growth prospects.

- Take a closer look at Central China Land MediaLTD's potential here in our health report.

Learn about Central China Land MediaLTD's historical performance.

Chengdu Tangyuan ElectricLtd (SZSE:300789)

Simply Wall St Value Rating: ★★★★★☆

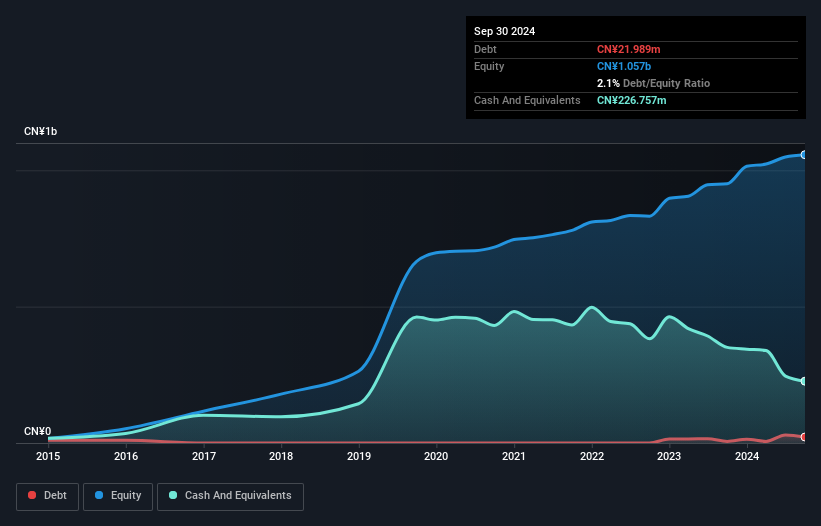

Overview: Chengdu Tangyuan Electric Co., Ltd. is a Chinese company specializing in rail transit operation and maintenance solutions, with a market cap of CN¥2.68 billion.

Operations: Chengdu Tangyuan Electric Co., Ltd. generates revenue primarily from its rail transit operation and maintenance solutions in China. The company has reported a net profit margin of 12.5% in the recent period, reflecting its efficiency in managing costs relative to revenue generated.

Chengdu Tangyuan Electric, a small player in the electronics sector, is trading at 82.2% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings grew by 1.9%, outpacing industry growth and reflecting high-quality past earnings. The company's debt-to-equity ratio has increased to 2.1% over five years but remains manageable with more cash than total debt and sufficient interest coverage from profits. Recent discussions at a shareholder meeting might indicate strategic shifts or future plans that could impact performance positively or negatively, depending on execution and market conditions in China’s dynamic electronics market.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4711 more companies for you to explore.Click here to unveil our expertly curated list of 4714 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300789

Chengdu Tangyuan ElectricLtd

Operates as a rail transit operation and maintenance solution provider in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives