With global markets showing resilience as U.S. stock indexes approach record highs and inflationary pressures persist, investors are keenly observing how these dynamics influence interest rate expectations and market volatility. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, especially in times of economic uncertainty. A good dividend stock often combines a reliable payout history with the potential for growth, making them appealing in today's fluctuating market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1977 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

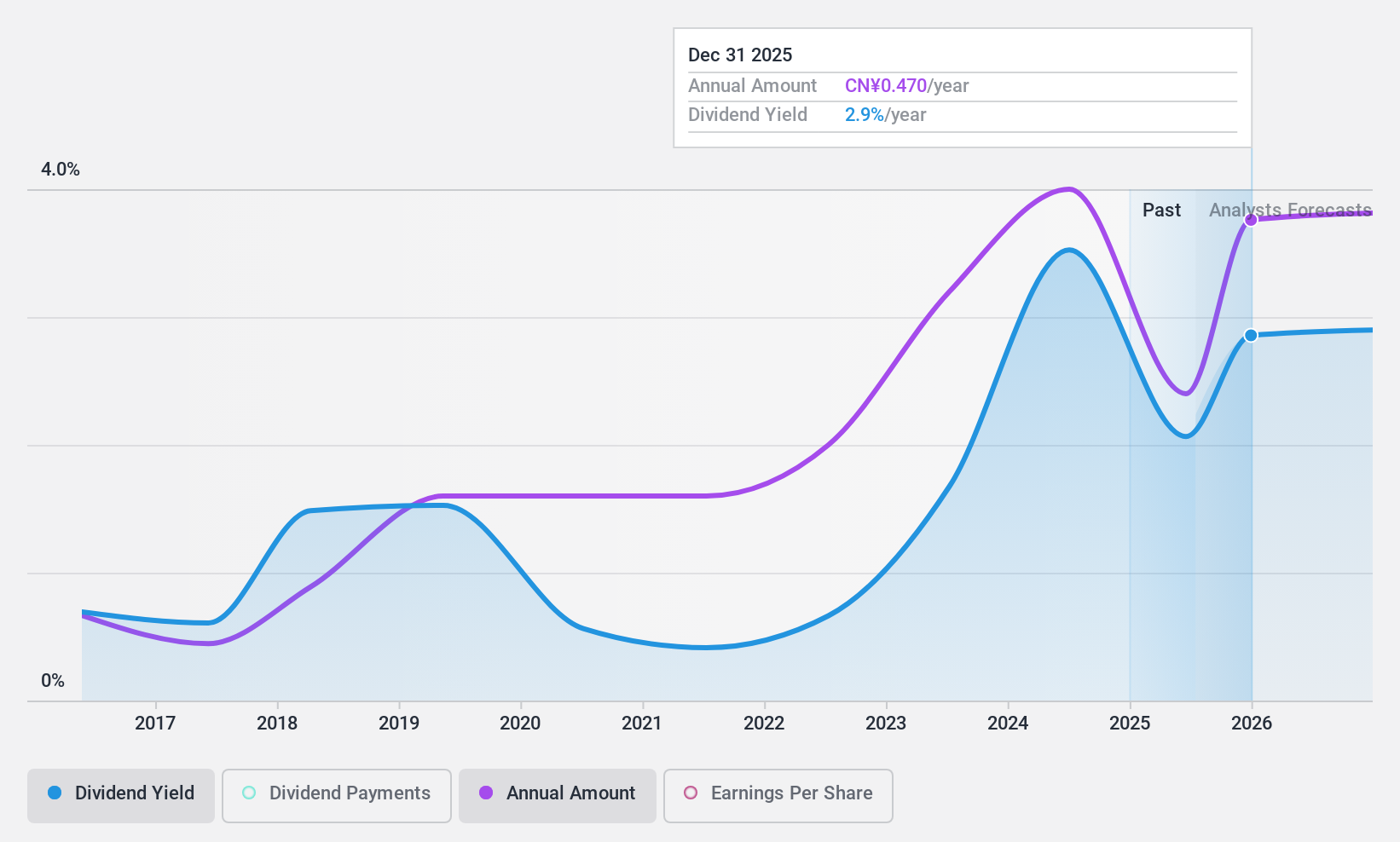

Zhejiang Jiuzhou Pharmaceutical (SHSE:603456)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jiuzhou Pharmaceutical Co., Ltd is a contract development and manufacturing organization company operating in China and internationally, with a market cap of approximately CN¥12.43 billion.

Operations: Zhejiang Jiuzhou Pharmaceutical Co., Ltd generates revenue through its operations as a contract development and manufacturing organization both domestically in China and on an international scale.

Dividend Yield: 3.6%

Zhejiang Jiuzhou Pharmaceutical offers a 3.6% dividend yield, placing it in the top 25% of CN market payers. However, dividends have been volatile with inconsistent growth over the past decade and are not supported by free cash flow, despite a reasonable payout ratio of 64.6%. The stock trades at a favorable price-to-earnings ratio of 17.8x compared to the CN market's average, suggesting good relative value among peers.

- Unlock comprehensive insights into our analysis of Zhejiang Jiuzhou Pharmaceutical stock in this dividend report.

- Our valuation report unveils the possibility Zhejiang Jiuzhou Pharmaceutical's shares may be trading at a discount.

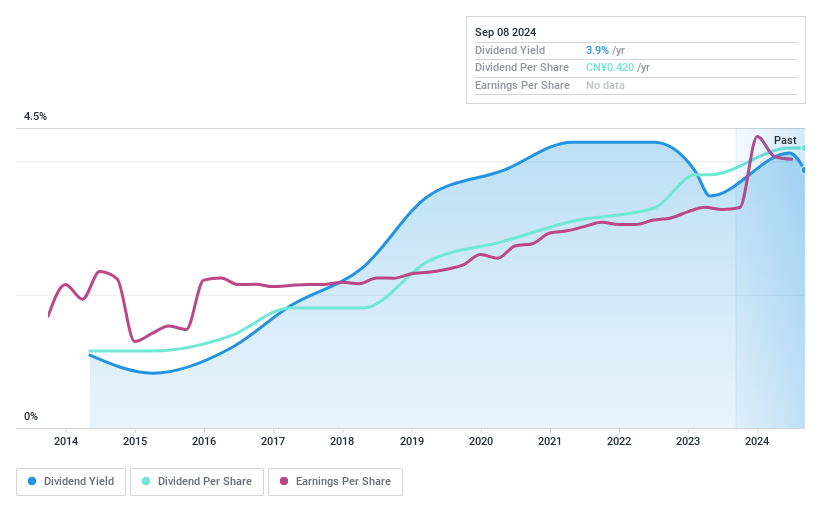

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central China Land Media Co., Ltd, along with its subsidiaries, is involved in the editing, production, and marketing of publications in China and has a market cap of CN¥11.80 billion.

Operations: Central China Land Media Co., Ltd's revenue segments include editing, production, and marketing of publications in China.

Dividend Yield: 3.6%

Central China Land Media's dividend yield of 3.64% ranks in the top 25% of CN market payers, yet its high payout ratio of 422.7% indicates dividends are not covered by earnings. Despite this, dividends have been stable and growing over the past decade, supported by a low cash payout ratio of 21.6%. The stock is trading at a significant discount to its estimated fair value, suggesting attractive relative valuation within its industry.

- Delve into the full analysis dividend report here for a deeper understanding of Central China Land MediaLTD.

- Our comprehensive valuation report raises the possibility that Central China Land MediaLTD is priced lower than what may be justified by its financials.

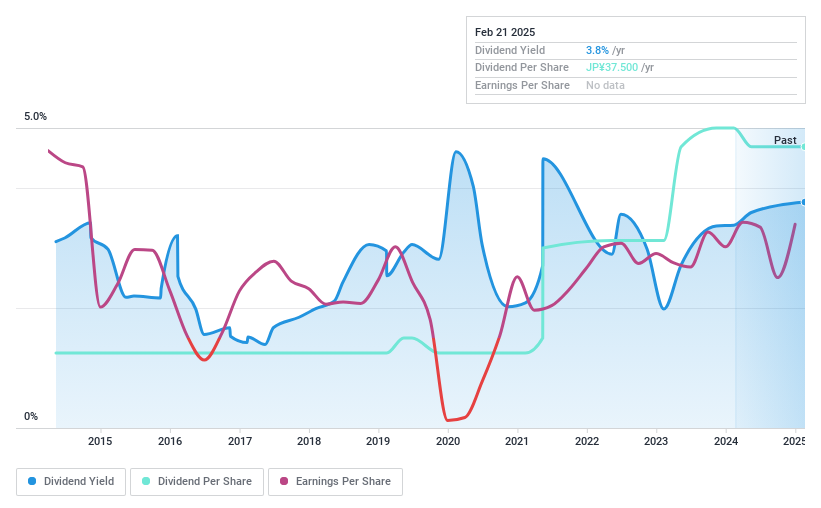

Y.A.C. Holdings (TSE:6298)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Y.A.C. Holdings Co., Ltd. is involved in the provision of mechatronics, display, industrial machinery, and electronics-related products both in Japan and internationally, with a market cap of ¥16.82 billion.

Operations: Y.A.C. Holdings Co., Ltd. generates revenue through its mechatronics, display, industrial machinery, and electronics-related product segments across domestic and international markets.

Dividend Yield: 4.1%

Y.A.C. Holdings offers a dividend yield of 4.11%, placing it in the top 25% of JP market payers, with dividends well-covered by earnings and cash flows due to low payout ratios of 26.4% and 31.8%. However, its dividend history has been volatile over the past decade, indicating unreliability despite financial coverage. The stock trades at a notable discount to its estimated fair value but faces challenges with debt coverage by operating cash flow.

- Take a closer look at Y.A.C. Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Y.A.C. Holdings is trading beyond its estimated value.

Next Steps

- Embark on your investment journey to our 1977 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000719

Central China Land MediaLTD

Engages in the editing and publishing, printing and reproduction, marketing and distribution, and material supply of books, periodicals, newspapers, electronic audio-visual products, online publications, and other media products.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives