Some Confidence Is Lacking In Shanghai Fengyuzhu Culture Technology Co., Ltd.'s (SHSE:603466) P/S

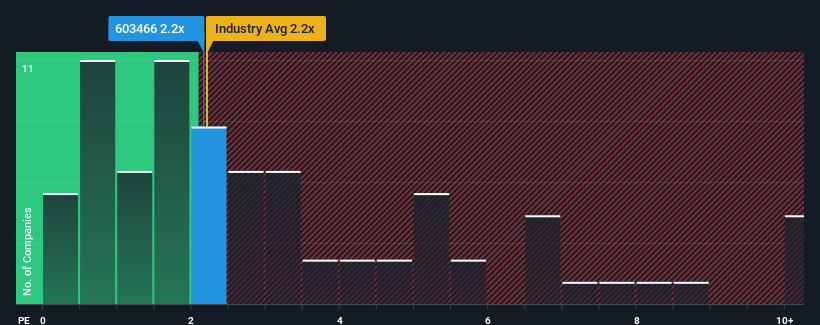

It's not a stretch to say that Shanghai Fengyuzhu Culture Technology Co., Ltd.'s (SHSE:603466) price-to-sales (or "P/S") ratio of 2.2x seems quite "middle-of-the-road" for Media companies in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Shanghai Fengyuzhu Culture Technology

How Has Shanghai Fengyuzhu Culture Technology Performed Recently?

Shanghai Fengyuzhu Culture Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Fengyuzhu Culture Technology will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Shanghai Fengyuzhu Culture Technology?

In order to justify its P/S ratio, Shanghai Fengyuzhu Culture Technology would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. The last three years don't look nice either as the company has shrunk revenue by 26% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth is heading into negative territory, declining 3.6% over the next year. With the industry predicted to deliver 13% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Shanghai Fengyuzhu Culture Technology's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Shanghai Fengyuzhu Culture Technology's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Shanghai Fengyuzhu Culture Technology's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Shanghai Fengyuzhu Culture Technology (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603466

Shanghai Fengyuzhu Culture Technology

Shanghai Fengyuzhu Culture Technology Co., Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives