As Chinese equities face a challenging environment with weak corporate earnings and economic data, investors are increasingly looking for stability and income through dividend stocks. In this article, we explore three Chinese dividend stocks yielding up to 4.4%, offering potential resilience amid market uncertainties.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.76% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.13% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.97% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.58% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 5.39% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.85% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.92% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 6.60% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.70% | ★★★★★★ |

Click here to see the full list of 264 stocks from our Top Chinese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

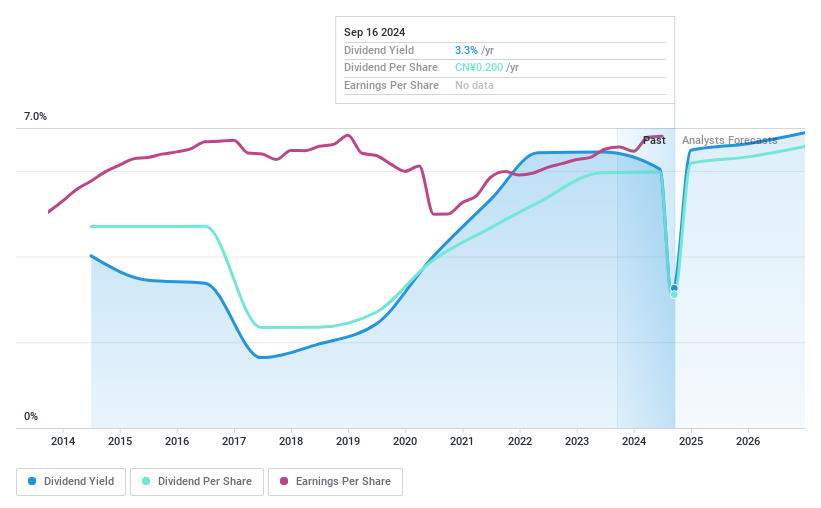

Hua Xia Bank (SHSE:600015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hua Xia Bank Co., Limited offers commercial banking services in China and Hong Kong, with a market cap of CN¥103.77 billion.

Operations: Hua Xia Bank Co., Limited generates revenue from various regions including the Beijing-Tianjin-Hebei Region (CN¥23.73 billion), Yangtze River Delta Region (CN¥17.98 billion), Guangdong-Hong Kong-Macao Greater Bay Region (CN¥4.12 billion), Middle East (CN¥8.25 billion), Western Region (CN¥7.70 billion), and Subsidiary operations (CN¥7 million).

Dividend Yield: 3.1%

Hua Xia Bank's dividend payments have been volatile and unreliable over the past decade, with significant annual drops. However, the bank's dividends are currently well covered by earnings (31.1% payout ratio), and this is forecast to improve to 23.7% in three years. Despite a recent decline in net interest income, net income for H1 2024 increased slightly to ¥12.46 billion from ¥12.11 billion last year, indicating stable profitability which supports future dividend sustainability.

- Unlock comprehensive insights into our analysis of Hua Xia Bank stock in this dividend report.

- According our valuation report, there's an indication that Hua Xia Bank's share price might be on the cheaper side.

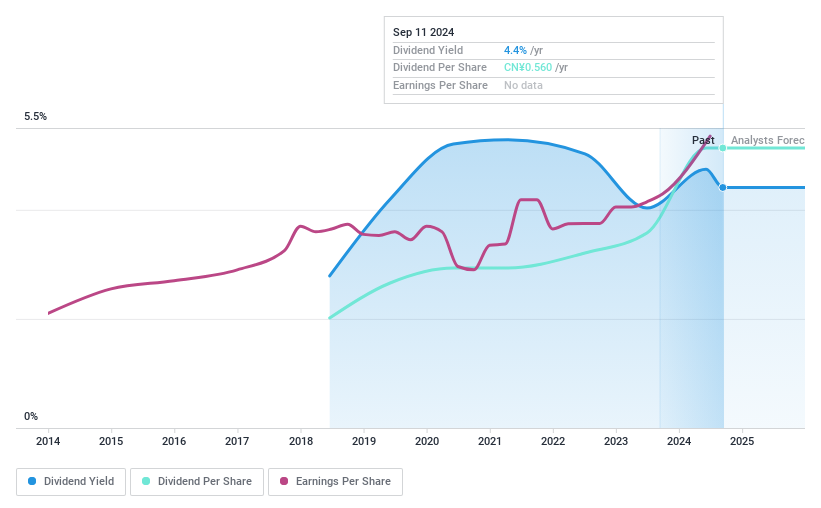

Shandong Publishing&MediaLtd (SHSE:601019)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Publishing&Media Co., Ltd, with a market cap of CN¥26.40 billion, operates in China through its subsidiaries by publishing textbooks, supplementary materials, general books, periodicals, electronic audio-visual products, and digital products.

Operations: Shandong Publishing&Media Co., Ltd generates revenue through the publication of textbooks, supplementary materials, general books, periodicals, electronic audio-visual products, and digital products in China.

Dividend Yield: 4.4%

Shandong Publishing&Media Ltd. reported H1 2024 sales of CNY 5.94 billion, up from CNY 5.23 billion a year ago, but net income fell to CNY 754.44 million from CNY 894.32 million. The company offers a dividend yield in the top quartile of the CN market and has consistently increased dividends over six years, though its payout ratio is high at 82.6%. Trading at a P/E ratio of 11.8x, it remains attractively valued compared to peers and industry averages.

- Click here and access our complete dividend analysis report to understand the dynamics of Shandong Publishing&MediaLtd.

- In light of our recent valuation report, it seems possible that Shandong Publishing&MediaLtd is trading behind its estimated value.

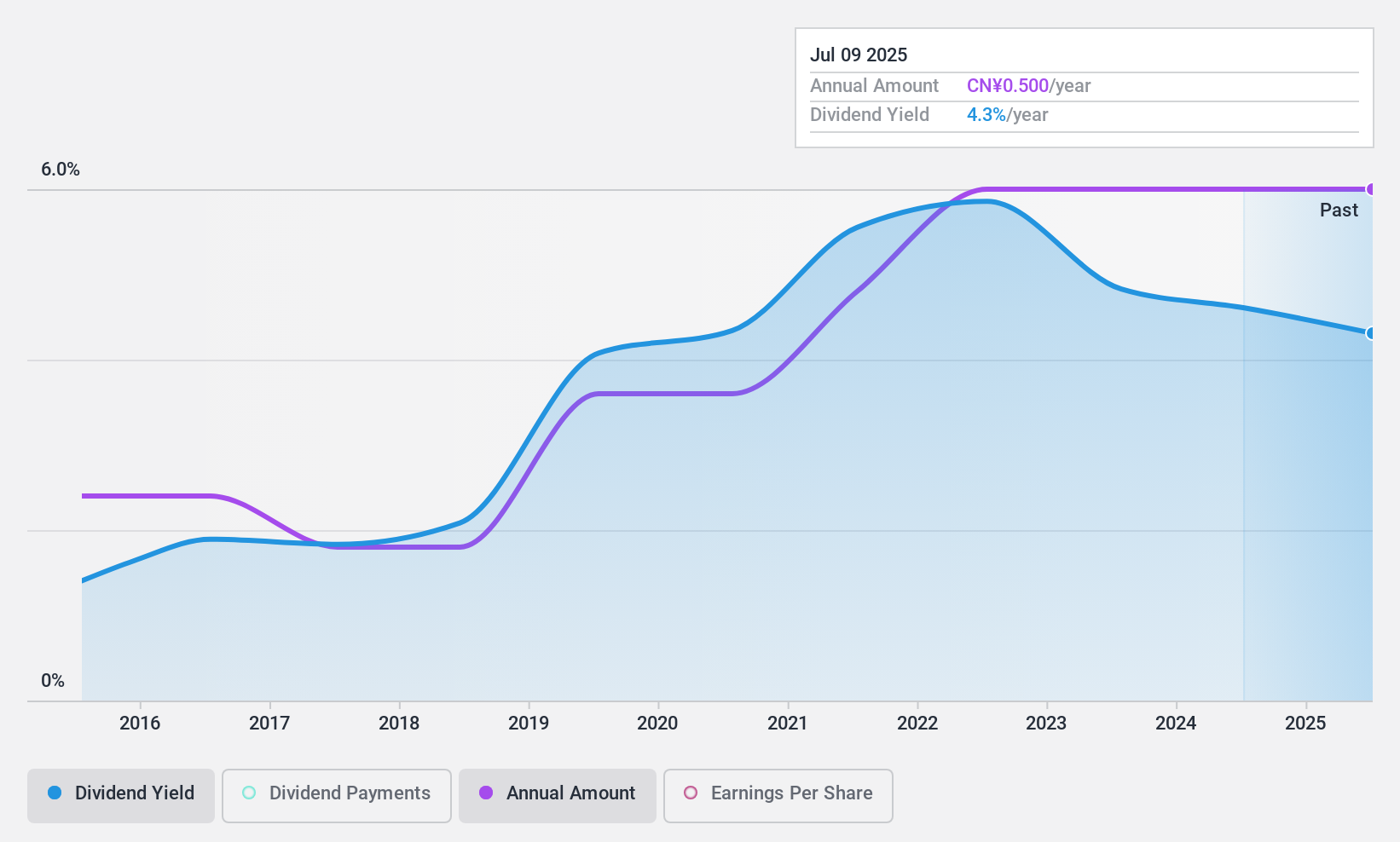

Jiangsu Phoenix Publishing & Media (SHSE:601928)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Phoenix Publishing & Media Corporation Limited engages in the editing, publishing, and distribution of books, newspapers, electronic publications, and audio-visual products in China with a market cap of CN¥29.39 billion.

Operations: Jiangsu Phoenix Publishing & Media Corporation Limited generates revenue through the editing, publishing, and distribution of various media products including books, newspapers, electronic publications, and audio-visual materials in China.

Dividend Yield: 4.3%

Jiangsu Phoenix Publishing & Media reported H1 2024 sales of CNY 6.92 billion, slightly up from CNY 6.89 billion a year ago, while net income declined to CNY 1.22 billion from CNY 1.56 billion. Despite a low payout ratio of 48.6%, its dividend payments are not well covered by cash flows, with a high cash payout ratio of 126.5%. The stock offers an attractive dividend yield in the top quartile of the CN market and trades at a favorable P/E ratio of 11.2x compared to the market average.

- Navigate through the intricacies of Jiangsu Phoenix Publishing & Media with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Jiangsu Phoenix Publishing & Media's share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 264 Top Chinese Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Xia Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600015

Hua Xia Bank

Provides commercial banking services in China and Hong Kong.

Flawless balance sheet, undervalued and pays a dividend.