- China

- /

- Entertainment

- /

- SHSE:600576

High Growth Tech Stocks to Watch in May 2025

Reviewed by Simply Wall St

In mid-May 2025, global markets have been buoyed by a significant easing of trade tensions between the U.S. and China, leading to a positive rally in U.S. equities, particularly with the Nasdaq Composite advancing over 7% for the week. This optimistic backdrop has created an environment where high growth tech stocks are garnering attention, as investors look for companies that can capitalize on technological advancements and robust market conditions driven by favorable trade developments and cooling inflation pressures.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.42% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Elicera Therapeutics | 75.80% | 107.14% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 57.11% | ★★★★★★ |

| CD Projekt | 33.41% | 37.39% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| Arabian Contracting Services | 20.05% | 27.78% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Zhejiang Sunriver Culture TourismLtd (SHSE:600576)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Sunriver Culture Tourism Co., Ltd. operates in the cultural and tourism industry, focusing on developing and managing tourist attractions, with a market capitalization of CN¥10.85 billion.

Operations: Zhejiang Sunriver Culture Tourism Co., Ltd. generates revenue primarily through the development and management of tourist attractions.

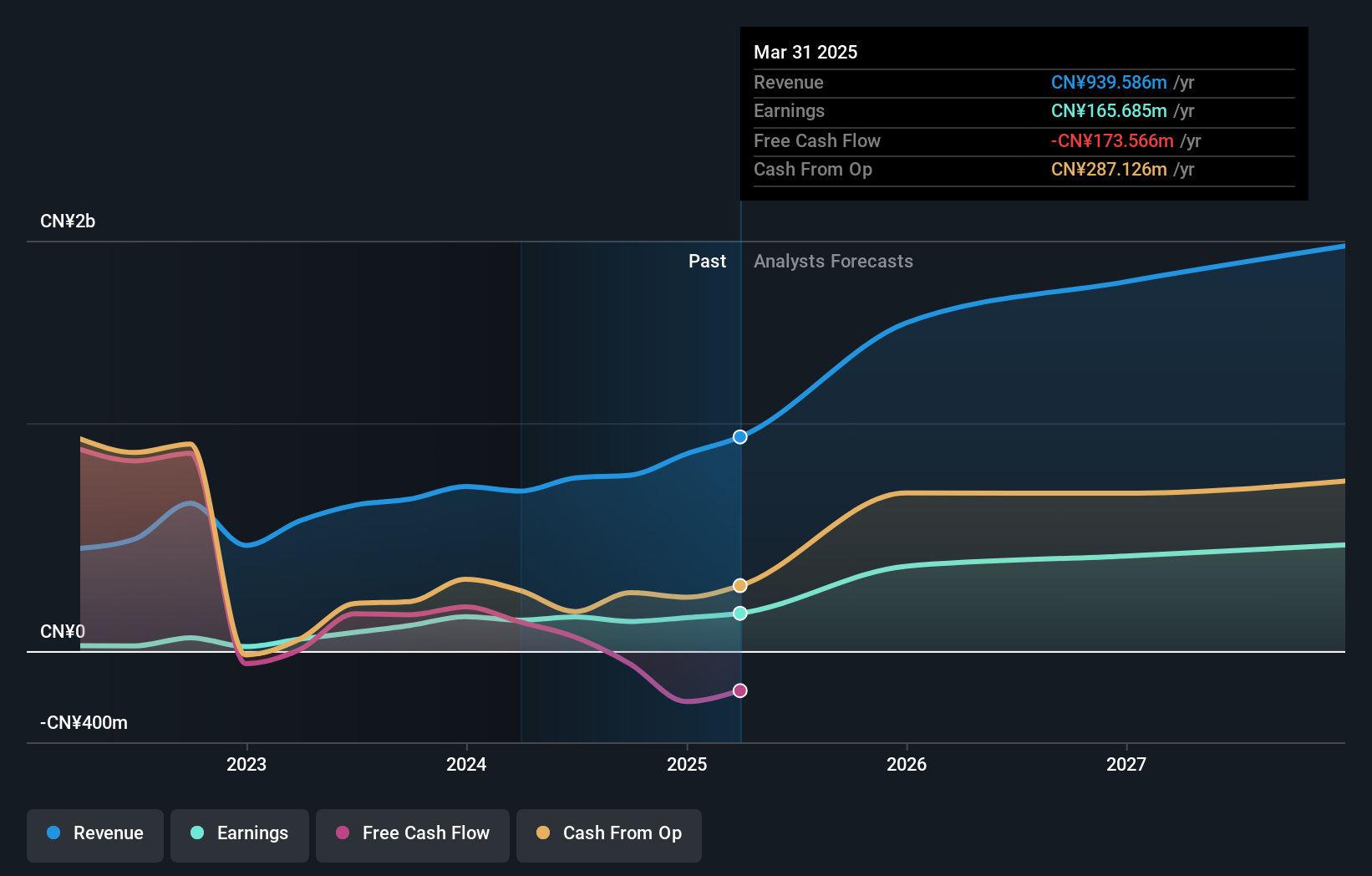

Zhejiang Sunriver Culture Tourism Co., Ltd. has demonstrated a robust growth trajectory, with earnings expanding by 22.5% over the past year, outpacing the Entertainment industry's average of 4.2%. This growth is supported by a significant increase in annual revenue and earnings projections at 19.7% and 27.9%, respectively, both surpassing broader market expectations in China. Notably, the company's recent quarterly report highlighted a surge in sales to CNY 212.14 million from CNY 136.68 million year-over-year, alongside an increase in net income to CNY 31.19 million from CNY 12.06 million, reflecting strong operational execution and market demand for its cultural tourism offerings.

- Get an in-depth perspective on Zhejiang Sunriver Culture TourismLtd's performance by reading our health report here.

Learn about Zhejiang Sunriver Culture TourismLtd's historical performance.

Sinocelltech Group (SHSE:688520)

Simply Wall St Growth Rating: ★★★★★☆

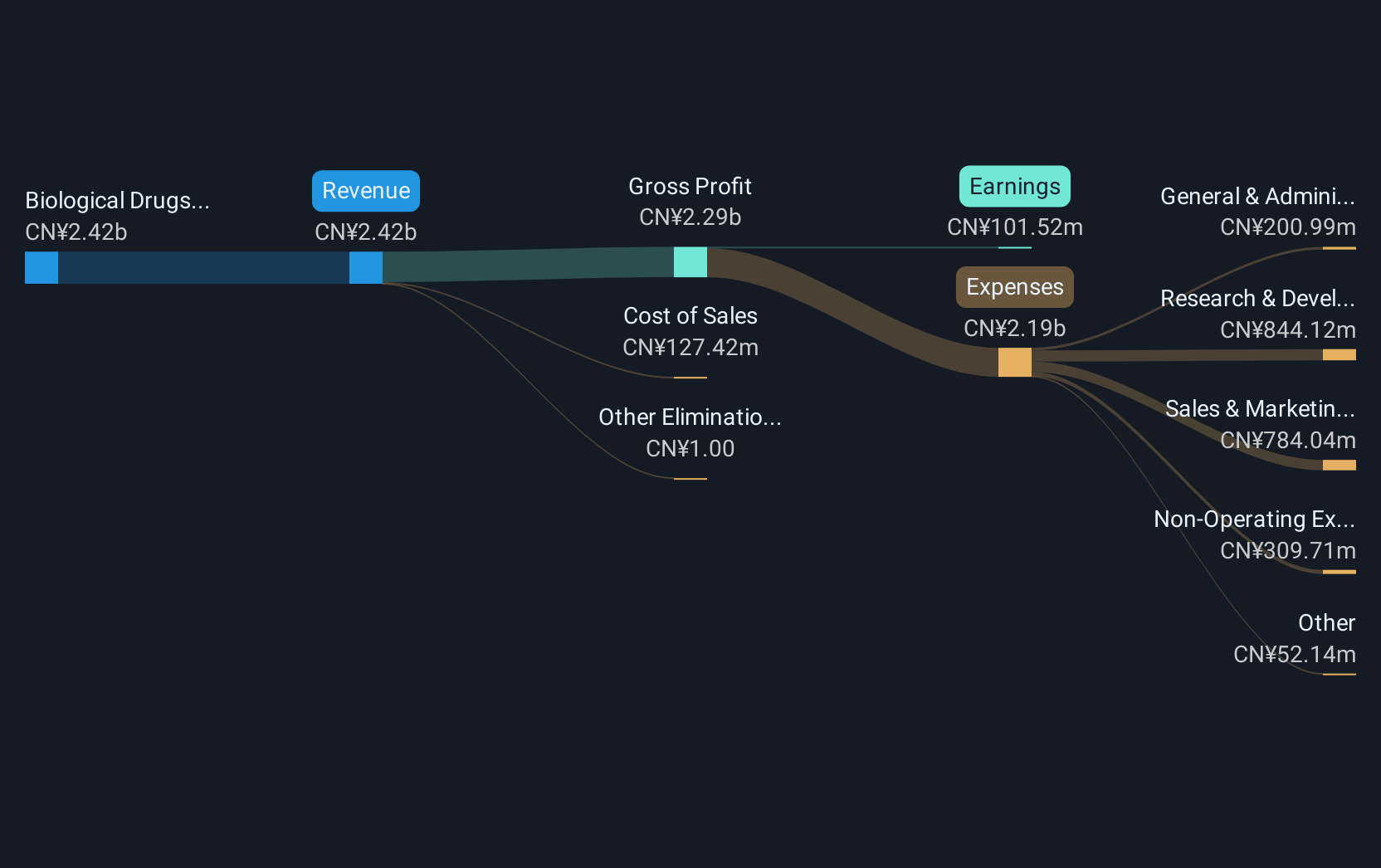

Overview: Sinocelltech Group Limited, with a market cap of CN¥16.28 billion, is a biotech company focused on the research, development, and industrialization of recombinant proteins, monoclonal antibodies, and innovative vaccines in China.

Operations: Focused on biotechnology, Sinocelltech Group generates revenue primarily from its Biological Drugs segment, which includes drugs and vaccines, amounting to CN¥2.42 billion.

Sinocelltech Group, amidst a challenging market, has shown resilience with a notable turnaround from a net loss of CNY 396.02 million in the previous year to a net profit of CNY 111.95 million in 2024. This recovery is underscored by an impressive annual revenue jump from CNY 1.89 billion to CNY 2.51 billion, reflecting a growth rate of approximately 33%, significantly outpacing the broader Chinese market's average growth. Furthermore, the company's commitment to innovation is evident from its R&D investments which have strategically focused on enhancing biotechnological competencies—critical as the firm aims to cement its foothold in high-growth sectors like biotech where rapid advancements are paramount for competitiveness and growth sustainability.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. is a company that acquires, builds, and manages vertical market software businesses to provide mission-critical software solutions for both public and private sector markets, with a market cap of CA$107.38 billion.

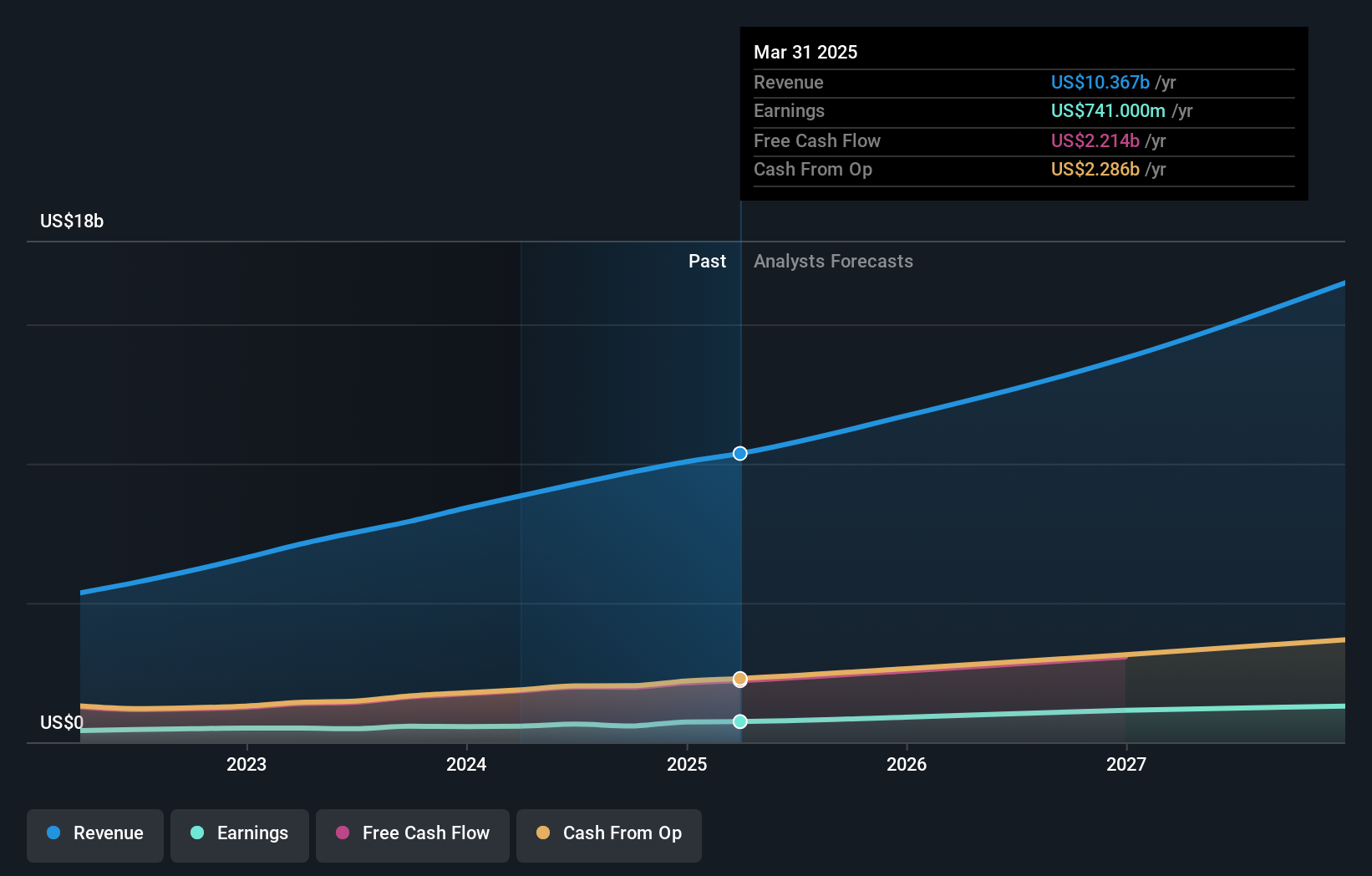

Operations: With a focus on vertical market software, Constellation Software generates revenue primarily from its software and programming segment, amounting to $10.37 billion.

Constellation Software, with its recent first-quarter revenue rising to USD 2.65 billion from USD 2.35 billion the previous year, demonstrates robust growth and operational efficiency. This performance is complemented by an increase in net income to USD 115 million, up from USD 105 million, reflecting a solid earnings trajectory with a basic EPS growth from USD 4.95 to USD 5.44. The firm’s commitment to shareholder value is evident in its consistent dividend payouts, recently affirming a quarterly distribution of $1 per share. These financial milestones are underpinned by strategic R&D investments that not only fuel innovation but also enhance competitive edge in the rapidly evolving tech landscape.

- Click to explore a detailed breakdown of our findings in Constellation Software's health report.

Explore historical data to track Constellation Software's performance over time in our Past section.

Taking Advantage

- Unlock our comprehensive list of 748 Global High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sunriver Culture TourismLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600576

Zhejiang Sunriver Culture TourismLtd

Zhejiang Sunriver Culture Tourism Co.,Ltd.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives