- China

- /

- Interactive Media and Services

- /

- SHSE:600228

Global Penny Stocks Spotlight: Be Friends Holding And Two Promising Picks

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with mixed performances across major indices and ongoing trade discussions influencing investor sentiment. Amid these fluctuating conditions, the appeal of penny stocks remains noteworthy for those looking to explore opportunities outside the mainstream market. Although the term "penny stocks" may seem outdated, it continues to signify smaller or emerging companies that offer potential growth at lower price points. By focusing on firms with strong financials and clear growth prospects, investors can uncover hidden gems in this often-overlooked segment of the market.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.96 | MYR1.5B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.315 | MYR914.18M | ✅ 4 ⚠️ 3 View Analysis > |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.00 | MYR281.48M | ✅ 3 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.12 | HK$46.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.17 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.00 | £309.52M | ✅ 5 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.89 | £438.67M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$68.4M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,647 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Be Friends Holding (SEHK:1450)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Be Friends Holding Limited is an investment holding company offering all-media services in the People’s Republic of China, with a market cap of HK$1.38 billion.

Operations: The company generates revenue primarily from New Media Services, amounting to CN¥1.14 billion, and Television Broadcasting Business, contributing CN¥113.14 million.

Market Cap: HK$1.38B

Be Friends Holding Limited, with a market cap of HK$1.38 billion, primarily generates revenue from New Media Services (CN¥1.14 billion) and Television Broadcasting (CN¥113.14 million). The company has shown stable weekly volatility over the past year and has reduced its debt to equity ratio from 87.1% to 54.7% in five years, maintaining a satisfactory net debt to equity ratio of 27.3%. Despite negative earnings growth last year (-31.6%), it remains profitable with CN¥81.71 million in net income for 2024, though profit margins have decreased from the previous year’s levels.

- Unlock comprehensive insights into our analysis of Be Friends Holding stock in this financial health report.

- Understand Be Friends Holding's track record by examining our performance history report.

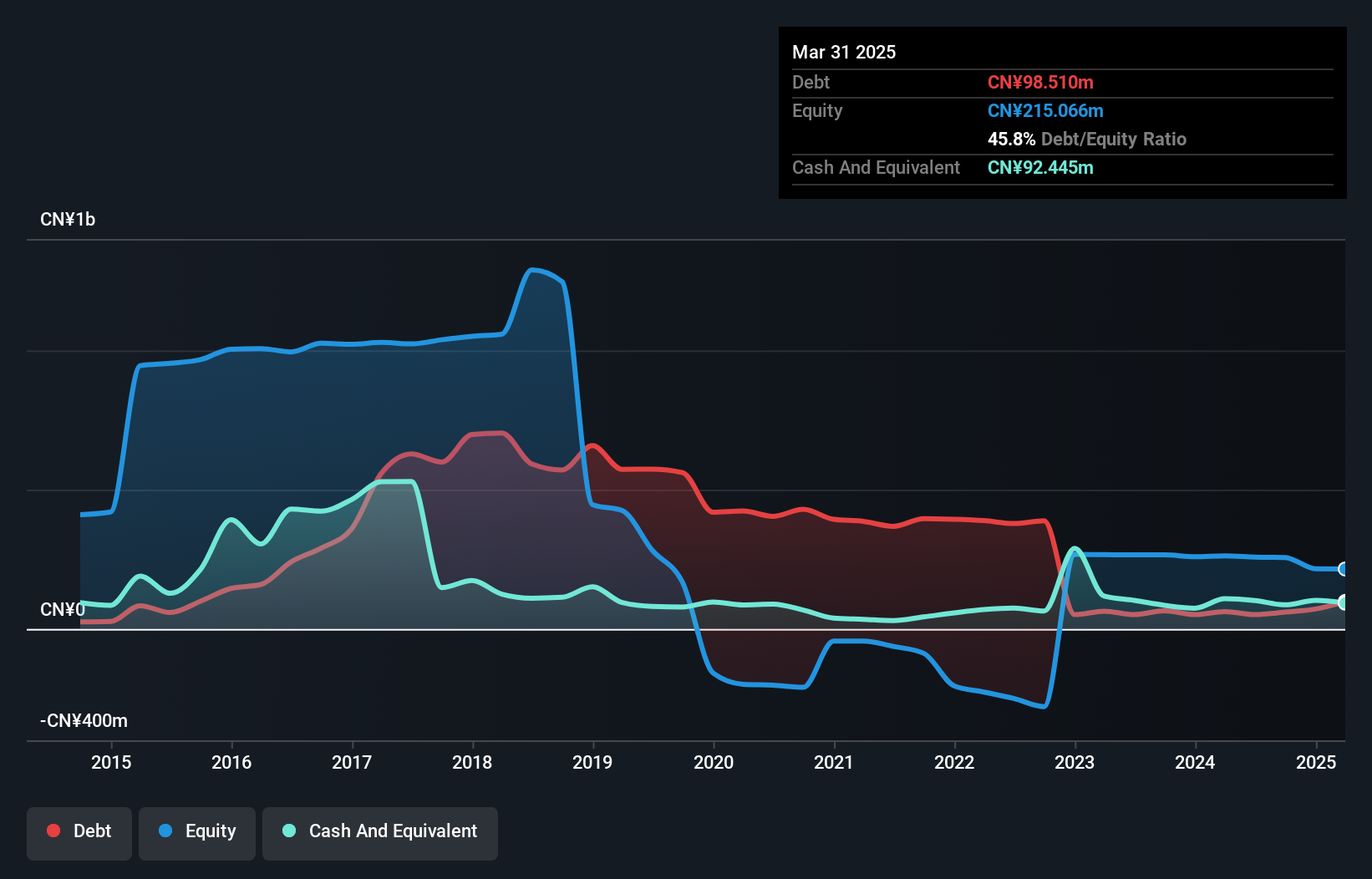

Fanli Digital TechnologyLtd (SHSE:600228)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fanli Digital Technology Co., Ltd operates Fanli.com, an e-commerce shopping guide platform in China, with a market cap of CN¥1.46 billion.

Operations: The company's revenue is primarily derived from its Internet and Related Services segment, amounting to CN¥233.11 million.

Market Cap: CN¥1.46B

Fanli Digital Technology Ltd, with a market cap of CN¥1.46 billion, operates without debt and has a stable short-term financial position, as its short-term assets exceed both its short- and long-term liabilities. Despite this stability, the company remains unprofitable with a negative return on equity of -5.2% and increasing losses over the past five years at an annual rate of 51.7%. Recent earnings reports indicate declining sales from CN¥64.32 million to CN¥53.6 million year-over-year for Q1 2025, alongside an increased net loss from CN¥2.58 million to CN¥13.98 million during the same period.

- Click to explore a detailed breakdown of our findings in Fanli Digital TechnologyLtd's financial health report.

- Review our historical performance report to gain insights into Fanli Digital TechnologyLtd's track record.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cnlight Co., Ltd is a company that manufactures and sells lighting products in China, with a market cap of CN¥2.03 billion.

Operations: Cnlight Co., Ltd does not report distinct revenue segments.

Market Cap: CN¥2.03B

Cnlight Co., Ltd, with a market cap of CN¥2.03 billion, reported Q1 2025 sales of CN¥46.66 million, up from CN¥30.42 million the previous year, yet it faced a net loss of CN¥1.21 million compared to a net income previously. Despite its unprofitability and negative return on equity of -16.1%, the company has reduced losses over five years by 55.1% annually and maintains sufficient cash runway for over three years if free cash flow trends continue. Its short-term assets surpass both short- and long-term liabilities, indicating financial resilience amidst high share price volatility and stable weekly returns volatility at 11%.

- Dive into the specifics of CnlightLtd here with our thorough balance sheet health report.

- Assess CnlightLtd's previous results with our detailed historical performance reports.

Taking Advantage

- Discover the full array of 5,647 Global Penny Stocks right here.

- Curious About Other Options? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600228

Fanli Digital TechnologyLtd

Operates Fanli.com, an e-commerce shopping guide platform in China.

Flawless balance sheet very low.

Market Insights

Community Narratives