- China

- /

- Metals and Mining

- /

- SZSE:301307

Chongqing Millison Technologies INC. (SZSE:301307) Not Flying Under The Radar

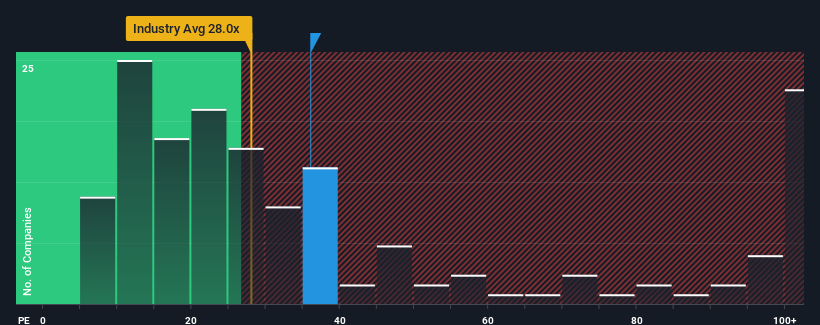

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Chongqing Millison Technologies INC. (SZSE:301307) as a stock to potentially avoid with its 36x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Chongqing Millison Technologies could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chongqing Millison Technologies

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Chongqing Millison Technologies would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 51%. The last three years don't look nice either as the company has shrunk EPS by 15% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 166% over the next year. That's shaping up to be materially higher than the 36% growth forecast for the broader market.

With this information, we can see why Chongqing Millison Technologies is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Chongqing Millison Technologies' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chongqing Millison Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Chongqing Millison Technologies (1 shouldn't be ignored!) that you need to take into consideration.

You might be able to find a better investment than Chongqing Millison Technologies. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301307

Chongqing Millison Technologies

Engages in the research, development, production, and sale of aluminum alloy precision die castings for the communication and automotive sectors in China.

Excellent balance sheet and slightly overvalued.