As global markets hover near record highs, small-cap stocks have been lagging behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 by a notable margin. Amidst this backdrop of inflationary pressures and cautious monetary policies, discovering hidden stock opportunities requires a keen eye for companies with strong fundamentals and growth potential that may be overlooked in broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Shenzhen Jasic TechnologyLtd (SZSE:300193)

Simply Wall St Value Rating: ★★★★★☆

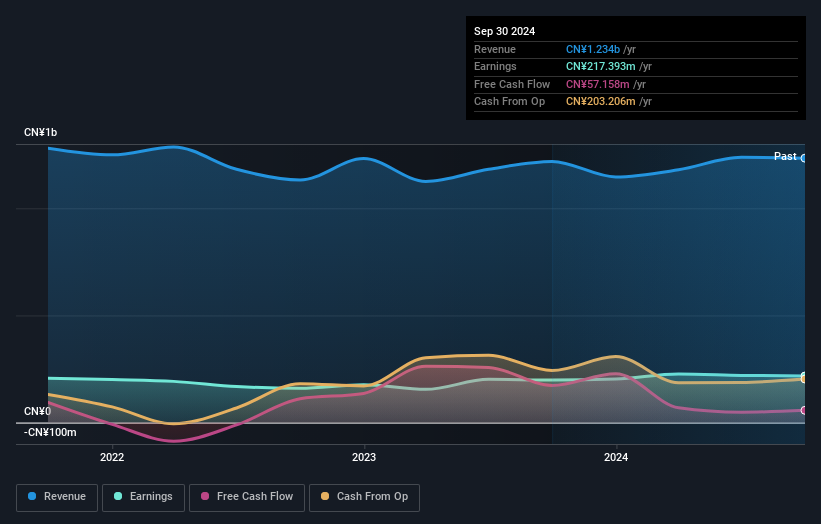

Overview: Shenzhen Jasic Technology Co., Ltd. focuses on the research, development, production, and sale of welding and cutting equipment both in China and globally, with a market capitalization of CN¥4.87 billion.

Operations: Jasic Technology generates revenue primarily from its industrial segment, amounting to CN¥1.23 billion. The company's financial performance is highlighted by a net profit margin that reflects its profitability within the competitive welding and cutting equipment industry.

Jasic Technology, a smaller player in the machinery sector, has been making waves with its impressive 9.3% earnings growth over the past year, outpacing the industry average of -0.06%. The company's financial health seems robust, with cash exceeding total debt and a price-to-earnings ratio of 22.4x, which is attractive compared to the CN market's 36.5x. However, its debt-to-equity ratio has risen from 0.2% to 5.2% over five years, suggesting increased leverage that investors should keep an eye on. Recent shareholder meetings focused on governance changes could signal strategic shifts ahead for Jasic's future trajectory.

- Get an in-depth perspective on Shenzhen Jasic TechnologyLtd's performance by reading our health report here.

Learn about Shenzhen Jasic TechnologyLtd's historical performance.

Fujian Yuanxiang New MaterialsLtd (SZSE:301300)

Simply Wall St Value Rating: ★★★★★★

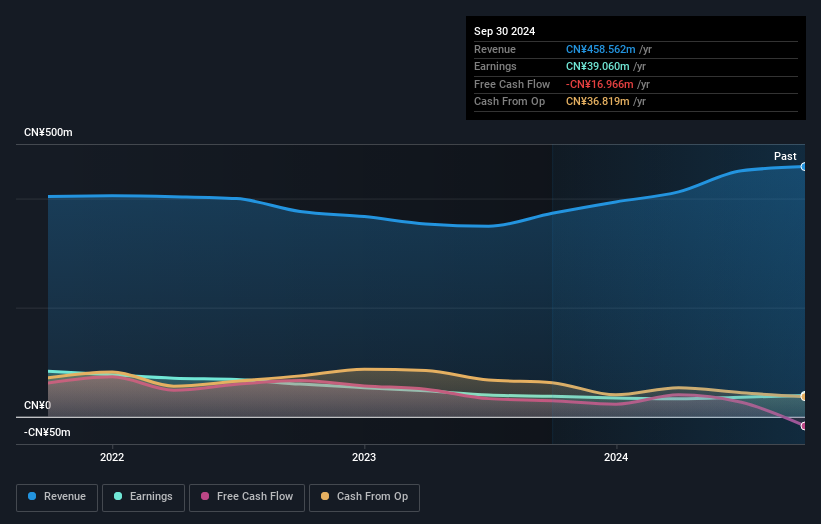

Overview: Fujian Yuanxiang New Materials Co., Ltd is involved in the research, development, production, and sale of silica both in China and internationally, with a market cap of CN¥2.10 billion.

Operations: Yuanxiang New Materials generates revenue primarily from its chemical products segment, reporting CN¥458.56 million in this category. The company's market cap stands at approximately CN¥2.10 billion.

Fujian Yuanxiang New Materials, a small player in the chemicals sector, has seen its earnings grow by 4.4% over the past year, outpacing the industry's -5.4%. Despite a volatile share price recently, it holds more cash than total debt and has reduced its debt-to-equity ratio from 41.4% to 2.5% over five years. However, free cash flow remains negative as of late 2024 with a levered free cash flow of -US$16.97 million and capital expenditure at US$53.79 million for the same period, indicating potential challenges in liquidity management despite high-quality earnings reported previously.

QNAP Systems (TPEX:7805)

Simply Wall St Value Rating: ★★★★★☆

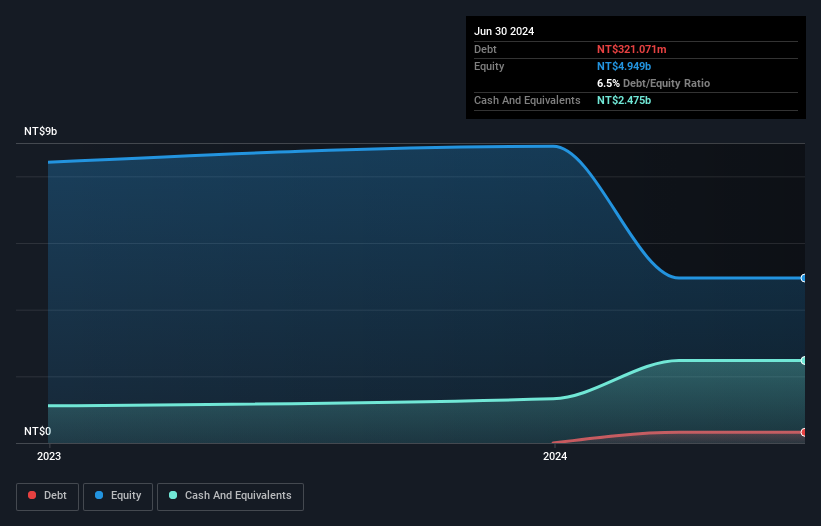

Overview: QNAP Systems, Inc. is a company that specializes in providing network appliances and has a market capitalization of NT$20.47 billion.

Operations: QNAP Systems generates revenue primarily from its computer peripherals segment, amounting to NT$5.87 billion.

QNAP Systems seems to be making waves with its innovative products and solid financial footing. Trading at 51% below its estimated fair value, it offers a compelling opportunity for investors. The company boasts high-quality earnings and has more cash than total debt, ensuring financial stability. Over the past year, earnings surged by 44%, outpacing the tech industry's average of 12.9%. Recently, QNAP introduced the TS-433eU NAS device, catering to small businesses with efficient storage solutions and enhanced data protection features like AES encryption and AI acceleration. These developments highlight QNAP's potential for continued growth in a competitive market.

- Dive into the specifics of QNAP Systems here with our thorough health report.

Gain insights into QNAP Systems' past trends and performance with our Past report.

Next Steps

- Access the full spectrum of 4733 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301300

Fujian Yuanxiang New MaterialsLtd

Engages in the research, development, production, and sale of silica in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives