Shandong Hi-tech Spring Material Technology Co., Ltd. (SZSE:301292) Stock Catapults 37% Though Its Price And Business Still Lag The Industry

Shandong Hi-tech Spring Material Technology Co., Ltd. (SZSE:301292) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

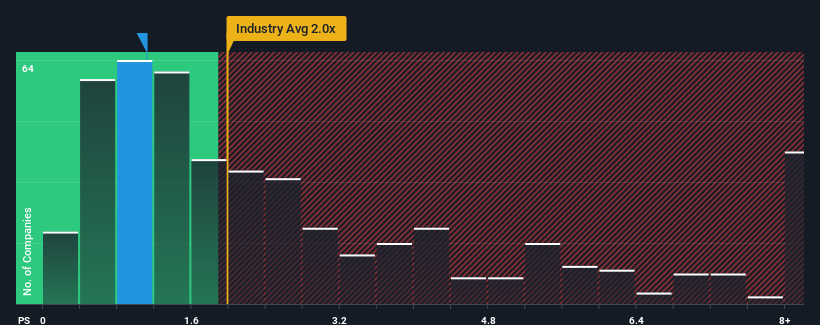

Although its price has surged higher, Shandong Hi-tech Spring Material Technology may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shandong Hi-tech Spring Material Technology

How Shandong Hi-tech Spring Material Technology Has Been Performing

Recent times have been advantageous for Shandong Hi-tech Spring Material Technology as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Shandong Hi-tech Spring Material Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Shandong Hi-tech Spring Material Technology?

In order to justify its P/S ratio, Shandong Hi-tech Spring Material Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 103% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 0.5% during the coming year according to the lone analyst following the company. That's not great when the rest of the industry is expected to grow by 25%.

With this in consideration, we find it intriguing that Shandong Hi-tech Spring Material Technology's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Shandong Hi-tech Spring Material Technology's P/S Mean For Investors?

Despite Shandong Hi-tech Spring Material Technology's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shandong Hi-tech Spring Material Technology's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Shandong Hi-tech Spring Material Technology has 4 warning signs (and 2 which make us uncomfortable) we think you should know about.

If these risks are making you reconsider your opinion on Shandong Hi-tech Spring Material Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301292

Shandong Hi-tech Spring Material Technology

Shandong Hi-tech Spring Material Technology Co., Ltd.

Low risk and slightly overvalued.

Market Insights

Community Narratives