- China

- /

- Electrical

- /

- SHSE:688717

Undiscovered Gems In Asia Featuring 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape characterized by fluctuating economic indicators and shifting investor sentiment, small-cap stocks in Asia present intriguing opportunities amid broader market dynamics. With the Russell 2000 Index outperforming the S&P 500 due to expectations of lower interest rates, investors may find value in exploring smaller companies that are well-positioned to benefit from regional economic trends and sector-specific growth drivers.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tibet Weixinkang Medicine | NA | 11.26% | 29.37% | ★★★★★★ |

| Shantou Institute of Ultrasonic Instrument | NA | 13.88% | 15.72% | ★★★★★★ |

| Suzhou Sepax Technologies | 0.05% | 31.21% | 31.16% | ★★★★★★ |

| Minmetals Development | 62.90% | -1.49% | -17.98% | ★★★★★★ |

| Sublime China Information | NA | 4.98% | 6.30% | ★★★★★★ |

| Guangdong Delian Group | 27.55% | 3.84% | -37.65% | ★★★★★☆ |

| Tibet TourismLtd | 27.08% | 10.59% | 26.47% | ★★★★★☆ |

| Henan Yuguang Gold&LeadLtd | 173.66% | 14.81% | 20.21% | ★★★★☆☆ |

| Qingdao Daneng Environmental Protection Equipment | 58.81% | 35.07% | 27.11% | ★★★★☆☆ |

| Shenzhen Leaguer | 62.41% | 0.65% | -18.79% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

ValueMax Group (SGX:T6I)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ValueMax Group Limited is an investment holding company involved in pawnbroking, moneylending, retailing of jewelry and watches, and gold trading primarily in Singapore, with a market capitalization of SGD983.79 million.

Operations: ValueMax Group derives its revenue primarily from the retail and trading of jewelry and gold, contributing SGD374.23 million, followed by pawnbroking at SGD85.76 million, and moneylending at SGD66.87 million.

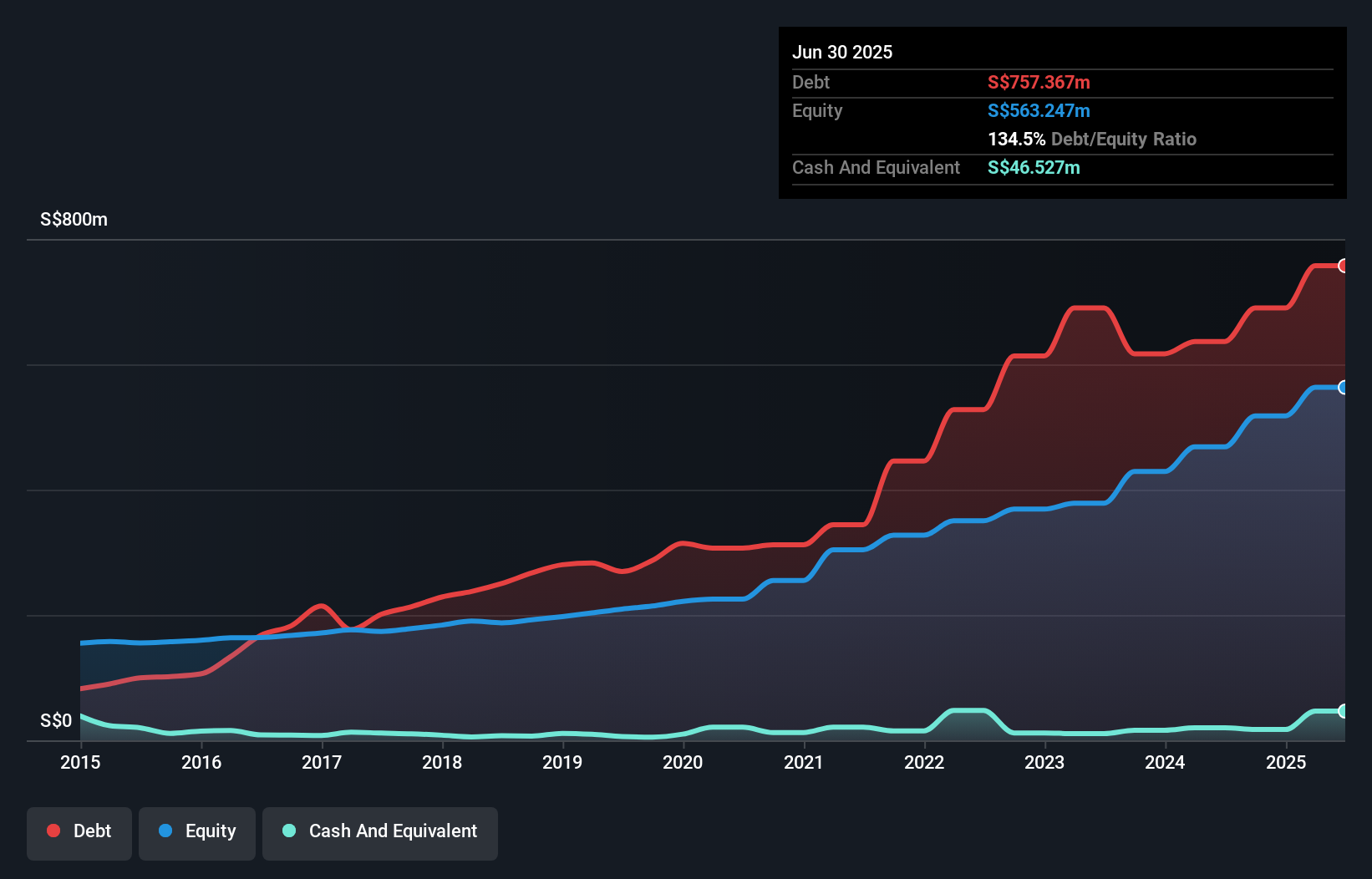

ValueMax Group, a notable player in the Consumer Finance sector, has demonstrated impressive earnings growth of 51% over the past year, outpacing the industry average of 10.7%. The company's debt to equity ratio has slightly improved from 136.2% to 134.5% over five years, though its net debt to equity remains high at 126.2%. Despite this leverage concern, ValueMax's earnings quality is robust and interest payments are well covered by EBIT at a multiple of 13.7x. Recent financials show sales reached S$268 million for H1 2025 with net income rising to S$48 million compared to last year's figures.

- Click here to discover the nuances of ValueMax Group with our detailed analytical health report.

Evaluate ValueMax Group's historical performance by accessing our past performance report.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Value Rating: ★★★★★★

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. specializes in the development and production of solar power equipment, with a market cap of CN¥13.73 billion.

Operations: SolaX Power Network Technology generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥3.30 billion.

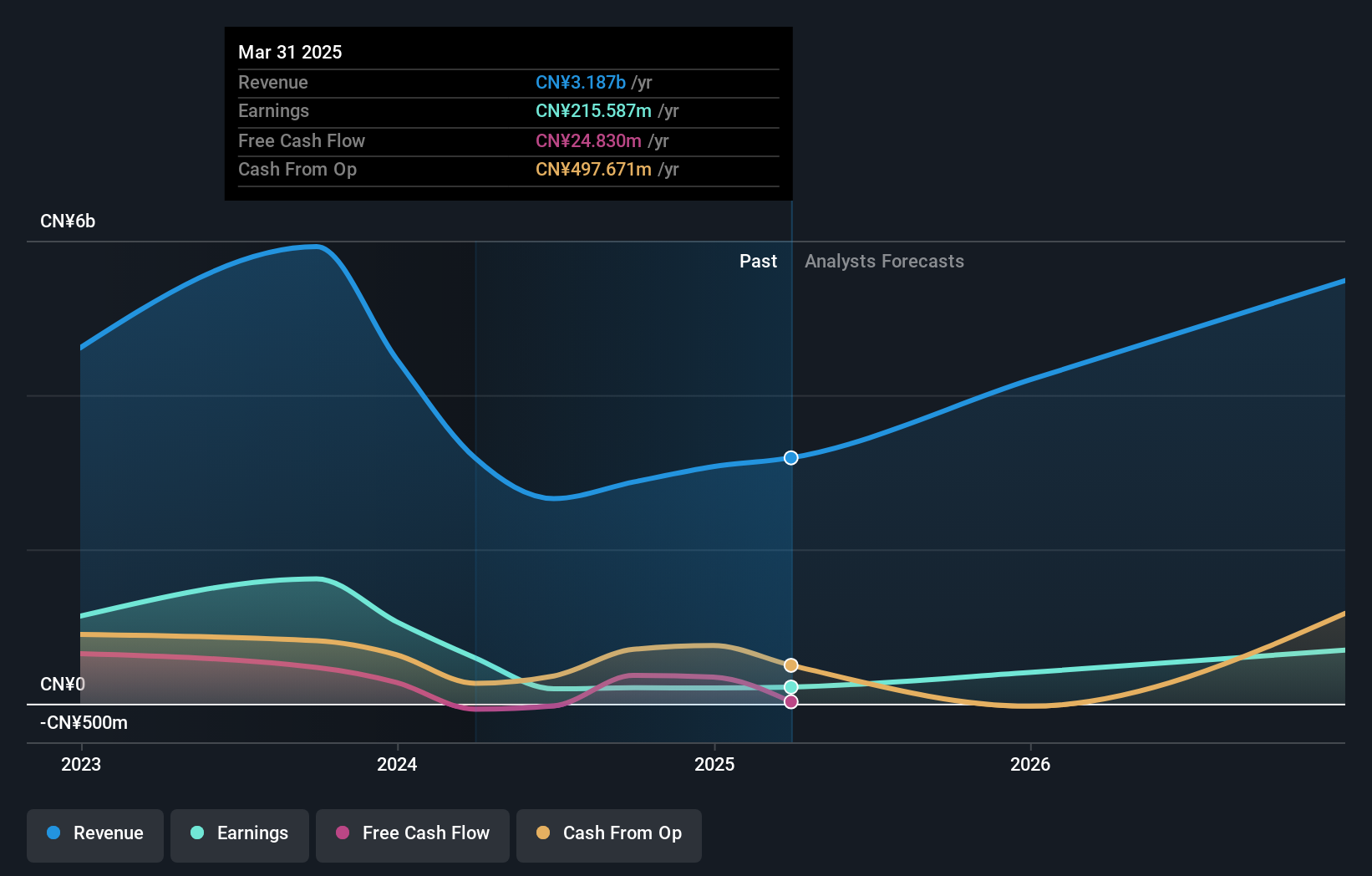

SolaX Power Network Technology, a nimble player in the energy sector, has seen its earnings grow by 26% over the past year, outpacing the electrical industry's -0.2%. The company is debt-free now compared to five years ago when it had a hefty debt-to-equity ratio of 784.2%. Recent financials show a net income of CNY 141.78 million for H1 2025, up from CNY 103.01 million last year, with basic earnings per share rising to CNY 0.89 from CNY 0.64. A new partnership with Solerus Energy expands its U.S. presence and showcases innovative energy storage solutions that promise versatility and high performance.

- Navigate through the intricacies of SolaX Power Network Technology (Zhejiang) with our comprehensive health report here.

Understand SolaX Power Network Technology (Zhejiang)'s track record by examining our Past report.

Longkou Union Chemical (SZSE:301209)

Simply Wall St Value Rating: ★★★★★★

Overview: Longkou Union Chemical Co., Ltd. specializes in the production and sale of organic pigments both within China and internationally, with a market cap of CN¥13.10 billion.

Operations: Longkou Union Chemical generates revenue primarily through the production and sale of organic pigments. The company's financial performance is highlighted by a net profit margin that has shown notable trends over recent periods.

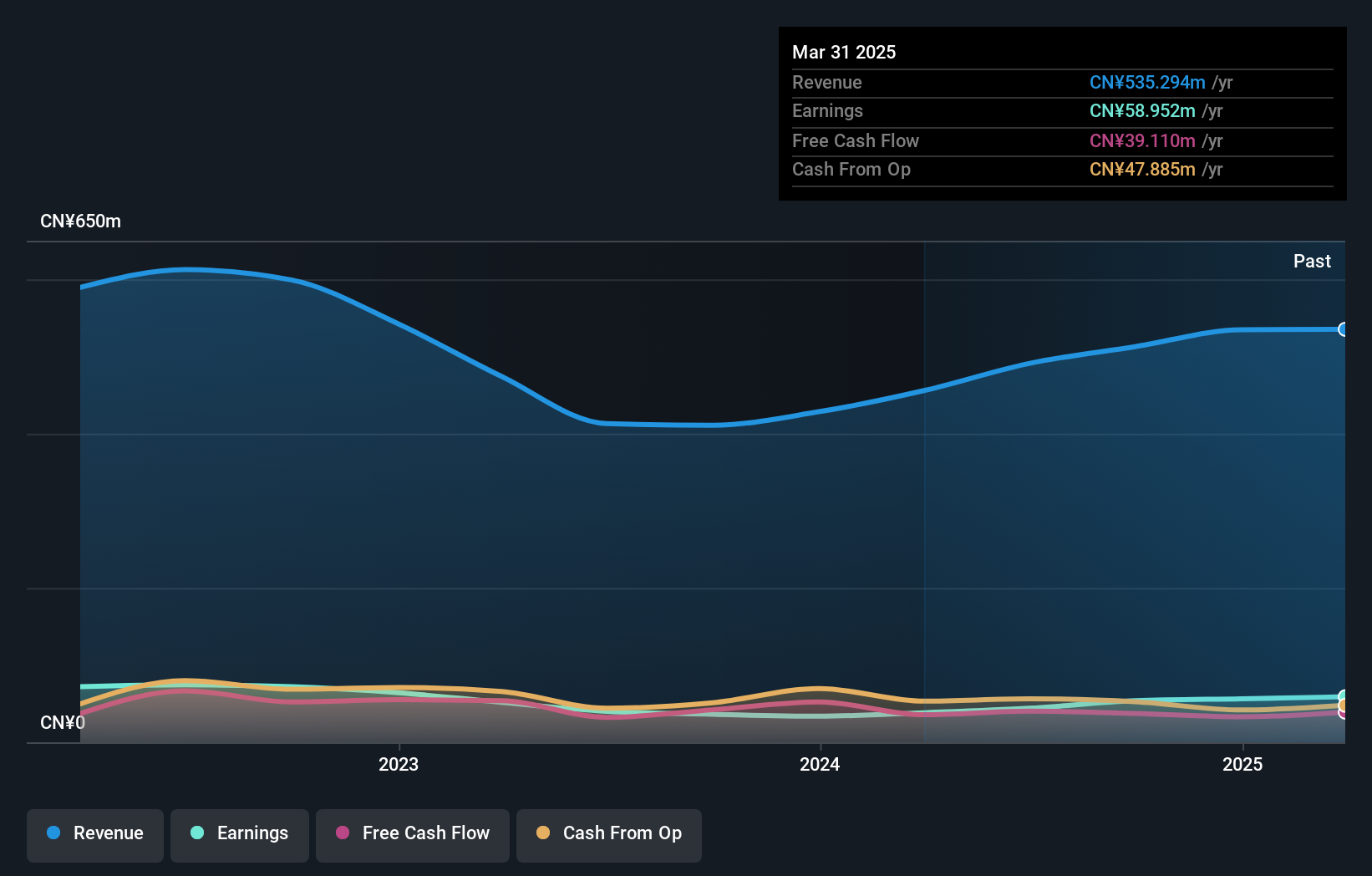

Union Chemical, a small player in the chemicals sector, has shown impressive earnings growth of 41.7% over the past year, outpacing the industry average of 1.6%. Despite a volatile share price recently, it remains financially sound with a debt-to-equity ratio improvement from 23.8% to 4.7% over five years and more cash than total debt. For the first half of 2025, Union Chemical reported net income of CNY 33.76 million on sales of CNY 269.4 million, reflecting solid performance compared to last year’s figures and indicating high-quality earnings potential amidst recent governance amendments approved at their EGM in September.

- Click to explore a detailed breakdown of our findings in Longkou Union Chemical's health report.

Explore historical data to track Longkou Union Chemical's performance over time in our Past section.

Make It Happen

- Get an in-depth perspective on all 2383 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688717

SolaX Power Network Technology (Zhejiang)

SolaX Power Network Technology (Zhejiang) Co., Ltd.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives