Shanghai Baolijia Chemical Co., Ltd. (SZSE:301037) Not Doing Enough For Some Investors As Its Shares Slump 26%

To the annoyance of some shareholders, Shanghai Baolijia Chemical Co., Ltd. (SZSE:301037) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

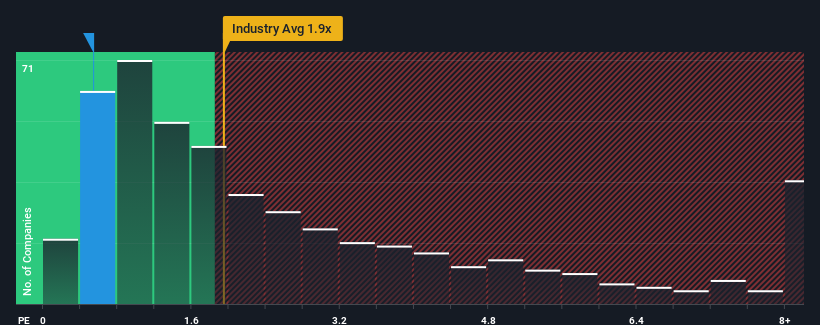

Although its price has dipped substantially, Shanghai Baolijia Chemical's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Shanghai Baolijia Chemical

What Does Shanghai Baolijia Chemical's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Shanghai Baolijia Chemical over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shanghai Baolijia Chemical's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Shanghai Baolijia Chemical?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shanghai Baolijia Chemical's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Shanghai Baolijia Chemical's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From Shanghai Baolijia Chemical's P/S?

The southerly movements of Shanghai Baolijia Chemical's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Shanghai Baolijia Chemical revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for Shanghai Baolijia Chemical (2 are a bit unpleasant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301037

Shanghai Baolijia Chemical

Researches, develops, produces, and sells emulsions in the People’s Republic of China and internationally.

Slightly overvalued very low.

Market Insights

Community Narratives