Shanghai Hajime Advanced Material Technology Co., Ltd.'s (SZSE:301000) 26% Share Price Plunge Could Signal Some Risk

The Shanghai Hajime Advanced Material Technology Co., Ltd. (SZSE:301000) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 69%, which is great even in a bull market.

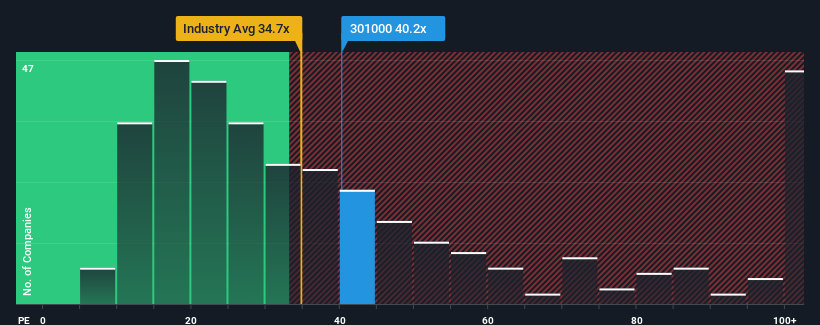

In spite of the heavy fall in price, Shanghai Hajime Advanced Material Technology may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 40.2x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been pleasing for Shanghai Hajime Advanced Material Technology as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Shanghai Hajime Advanced Material Technology

How Is Shanghai Hajime Advanced Material Technology's Growth Trending?

Shanghai Hajime Advanced Material Technology's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 56% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 3.9% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 34% during the coming year according to the one analyst following the company. Meanwhile, the rest of the market is forecast to expand by 38%, which is noticeably more attractive.

In light of this, it's alarming that Shanghai Hajime Advanced Material Technology's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Shanghai Hajime Advanced Material Technology's P/E hasn't come down all the way after its stock plunged. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Shanghai Hajime Advanced Material Technology's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Shanghai Hajime Advanced Material Technology is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Shanghai Hajime Advanced Material Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301000

Shanghai Hajime Advanced Material Technology

Shanghai Hajime Advanced Material Technology Co., Ltd.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)