Jahen Household Products (SZSE:300955) Has Affirmed Its Dividend Of CN¥0.35

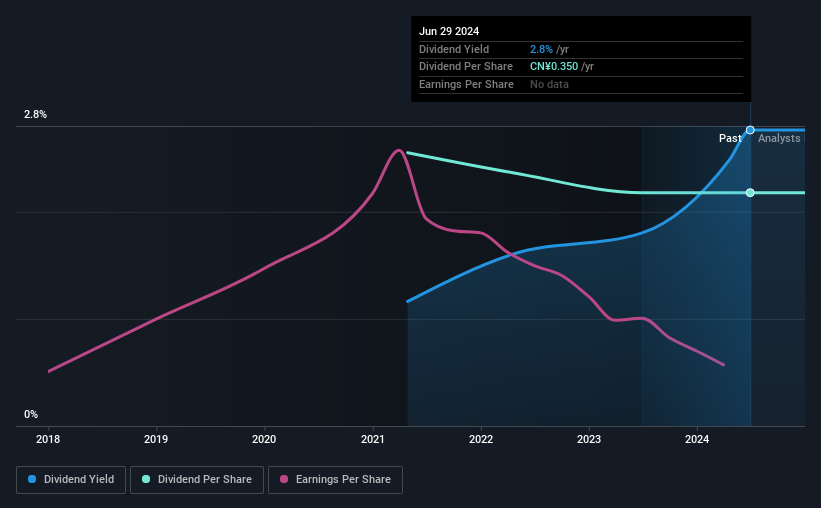

Jahen Household Products Co., Ltd.'s (SZSE:300955) investors are due to receive a payment of CN¥0.35 per share on 5th of July. This means the dividend yield will be fairly typical at 2.8%.

Check out our latest analysis for Jahen Household Products

Jahen Household Products' Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

The next year is set to see EPS grow by 78.1%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 58% which would be quite comfortable going to take the dividend forward.

Jahen Household Products Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The annual payment during the last 3 years was CN¥0.41 in 2021, and the most recent fiscal year payment was CN¥0.35. The dividend has shrunk at around 5.1% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. Jahen Household Products' earnings per share has shrunk at 11% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Jahen Household Products' Dividend Doesn't Look Great

Overall, while some might be pleased that the dividend wasn't cut, we think this may help Jahen Household Products make more consistent payments in the future. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Jahen Household Products (1 makes us a bit uncomfortable!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300955

Jahen Household Products

Designs, develops, and manufactures of chemical products and plastic packaging containers in China and internationally.

High growth potential and slightly overvalued.

Market Insights

Community Narratives