Earnings Tell The Story For Guangdong Modern High-tech Fiber Co., Ltd (SZSE:300876) As Its Stock Soars 41%

Those holding Guangdong Modern High-tech Fiber Co., Ltd (SZSE:300876) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

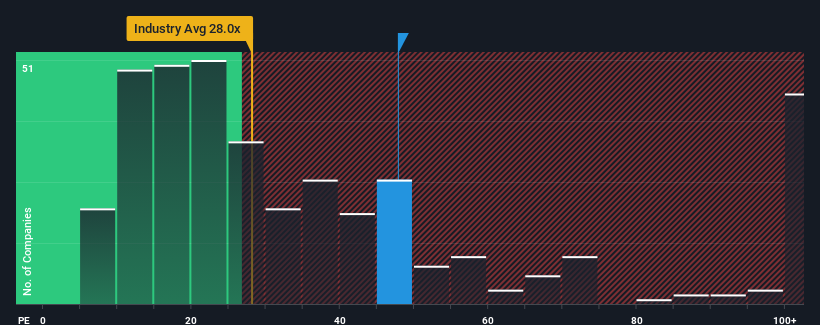

Since its price has surged higher, Guangdong Modern High-tech Fiber's price-to-earnings (or "P/E") ratio of 47.8x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Guangdong Modern High-tech Fiber as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Guangdong Modern High-tech Fiber

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Guangdong Modern High-tech Fiber's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. This means it has also seen a slide in earnings over the longer-term as EPS is down 68% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 140% as estimated by the one analyst watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we can see why Guangdong Modern High-tech Fiber is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Guangdong Modern High-tech Fiber's P/E?

Guangdong Modern High-tech Fiber's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Guangdong Modern High-tech Fiber's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with Guangdong Modern High-tech Fiber (including 1 which doesn't sit too well with us).

If these risks are making you reconsider your opinion on Guangdong Modern High-tech Fiber, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300876

Guangdong Modern High-tech Fiber

Guangdong Modern High-Tech Fiber Co., Ltd.

Very low with worrying balance sheet.

Market Insights

Community Narratives