- China

- /

- Metals and Mining

- /

- SZSE:300428

Investors Aren't Entirely Convinced By Lizhong Sitong Light Alloys Group Co., Ltd.'s (SZSE:300428) Earnings

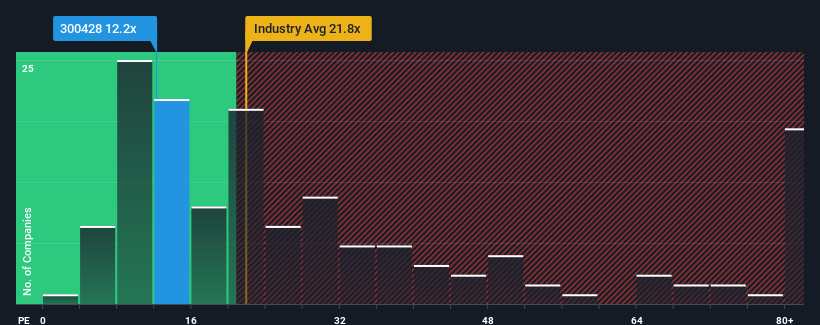

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 27x, you may consider Lizhong Sitong Light Alloys Group Co., Ltd. (SZSE:300428) as a highly attractive investment with its 12.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Lizhong Sitong Light Alloys Group as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Lizhong Sitong Light Alloys Group

How Is Lizhong Sitong Light Alloys Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Lizhong Sitong Light Alloys Group's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 57%. As a result, it also grew EPS by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the six analysts watching the company. With the market predicted to deliver 19% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that Lizhong Sitong Light Alloys Group is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Lizhong Sitong Light Alloys Group's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Lizhong Sitong Light Alloys Group currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Lizhong Sitong Light Alloys Group (of which 1 doesn't sit too well with us!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300428

Lizhong Sitong Light Alloys Group

Lizhong Sitong Light Alloys Group Co., Ltd.

Proven track record and fair value.