Huafon Microfibre (Shanghai) Co., Ltd.'s (SZSE:300180) Low P/S No Reason For Excitement

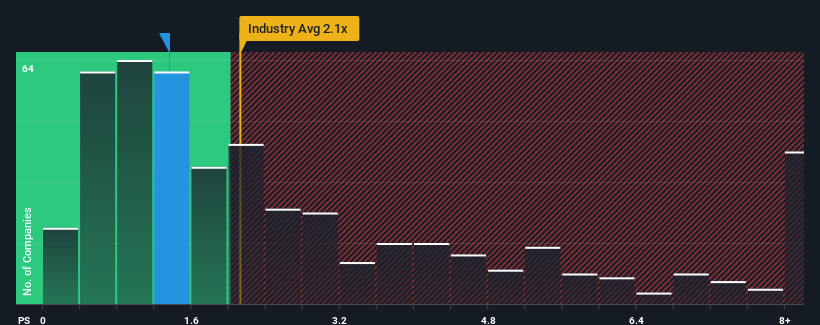

Huafon Microfibre (Shanghai) Co., Ltd.'s (SZSE:300180) price-to-sales (or "P/S") ratio of 1.4x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.1x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Huafon Microfibre (Shanghai)

How Huafon Microfibre (Shanghai) Has Been Performing

As an illustration, revenue has deteriorated at Huafon Microfibre (Shanghai) over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Huafon Microfibre (Shanghai)'s earnings, revenue and cash flow.How Is Huafon Microfibre (Shanghai)'s Revenue Growth Trending?

In order to justify its P/S ratio, Huafon Microfibre (Shanghai) would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.4%. Even so, admirably revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 23% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Huafon Microfibre (Shanghai) is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Huafon Microfibre (Shanghai)'s P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Huafon Microfibre (Shanghai) confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You always need to take note of risks, for example - Huafon Microfibre (Shanghai) has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Huafon Microfibre (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300180

Huafon Microfibre (Shanghai)

Develops, manufactures, and sells microfiber materials in China and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives