- China

- /

- Metals and Mining

- /

- SZSE:002996

Chongqing Shunbo Aluminum Co.,Ltd. (SZSE:002996) Stock Rockets 30% But Many Are Still Ignoring The Company

Chongqing Shunbo Aluminum Co.,Ltd. (SZSE:002996) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

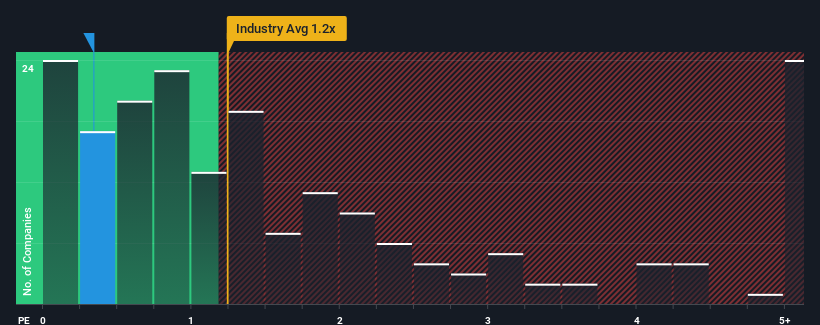

Even after such a large jump in price, considering around half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider Chongqing Shunbo AluminumLtd as an solid investment opportunity with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Chongqing Shunbo AluminumLtd

How Has Chongqing Shunbo AluminumLtd Performed Recently?

While the industry has experienced revenue growth lately, Chongqing Shunbo AluminumLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Chongqing Shunbo AluminumLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Chongqing Shunbo AluminumLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.9%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 145% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 65% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this information, we find it odd that Chongqing Shunbo AluminumLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Chongqing Shunbo AluminumLtd's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Chongqing Shunbo AluminumLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Chongqing Shunbo AluminumLtd (1 is concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002996

Chongqing Shunbo AluminumLtd

Engages in the production and sale of recycled aluminum alloy ingots in China.

Slight risk with acceptable track record.

Market Insights

Community Narratives