3 Asian Companies That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate fluctuating economic indicators, Asian stock markets have shown resilience with modest gains, particularly in China and Japan. In this environment of mixed signals and cautious optimism, identifying undervalued stocks can offer investors potential opportunities for growth by focusing on companies whose intrinsic value may not be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SpiderPlus (TSE:4192) | ¥502.00 | ¥994.80 | 49.5% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1180.00 | ¥2323.25 | 49.2% |

| Shenzhen Envicool Technology (SZSE:002837) | CN¥31.63 | CN¥62.34 | 49.3% |

| Lucky Harvest (SZSE:002965) | CN¥35.24 | CN¥69.28 | 49.1% |

| Livero (TSE:9245) | ¥1747.00 | ¥3431.97 | 49.1% |

| Hugel (KOSDAQ:A145020) | ₩351500.00 | ₩699950.46 | 49.8% |

| HL Holdings (KOSE:A060980) | ₩41300.00 | ₩81367.57 | 49.2% |

| HDC Hyundai Development (KOSE:A294870) | ₩23300.00 | ₩45966.93 | 49.3% |

| Dive (TSE:151A) | ¥955.00 | ¥1867.69 | 48.9% |

| cottaLTD (TSE:3359) | ¥435.00 | ¥856.73 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang Leapmotor Technology (SEHK:9863)

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles in Mainland China and internationally, with a market cap of HK$81.76 billion.

Operations: The company generates revenue of CN¥32.16 billion from the production, research and development, and sales of new energy vehicles.

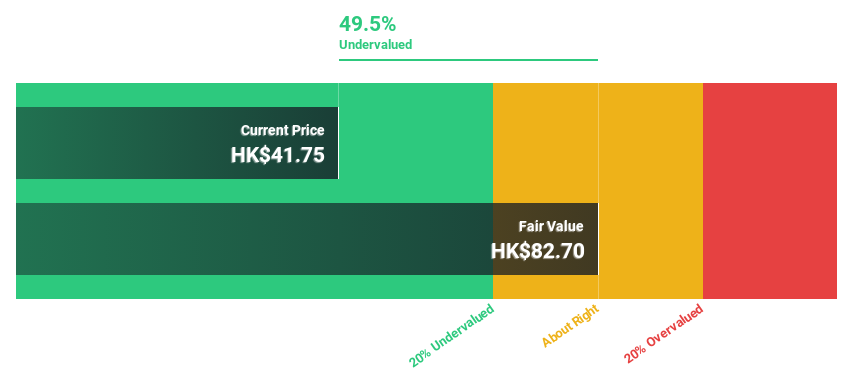

Estimated Discount To Fair Value: 45.2%

Zhejiang Leapmotor Technology is trading at HK$61.15, significantly below its estimated fair value of HK$111.5, suggesting it may be undervalued based on cash flows. The company's revenue is forecast to grow 28.3% annually, outpacing the Hong Kong market average of 8%. Despite recent board changes and amendments to its Articles of Association, Leapmotor's earnings are projected to grow 61% per year, with profitability expected within three years and a high return on equity forecasted at 26.3%.

- Our expertly prepared growth report on Zhejiang Leapmotor Technology implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Leapmotor Technology.

PropNex (SGX:OYY)

Overview: PropNex Limited is an investment holding company that offers real estate services in Singapore, with a market cap of SGD1.04 billion.

Operations: The company's revenue is primarily derived from Agency Services at SGD591.61 million, Project Marketing Services at SGD185.57 million, Training Services at SGD3.48 million, and Administrative Support Services at SGD2.29 million.

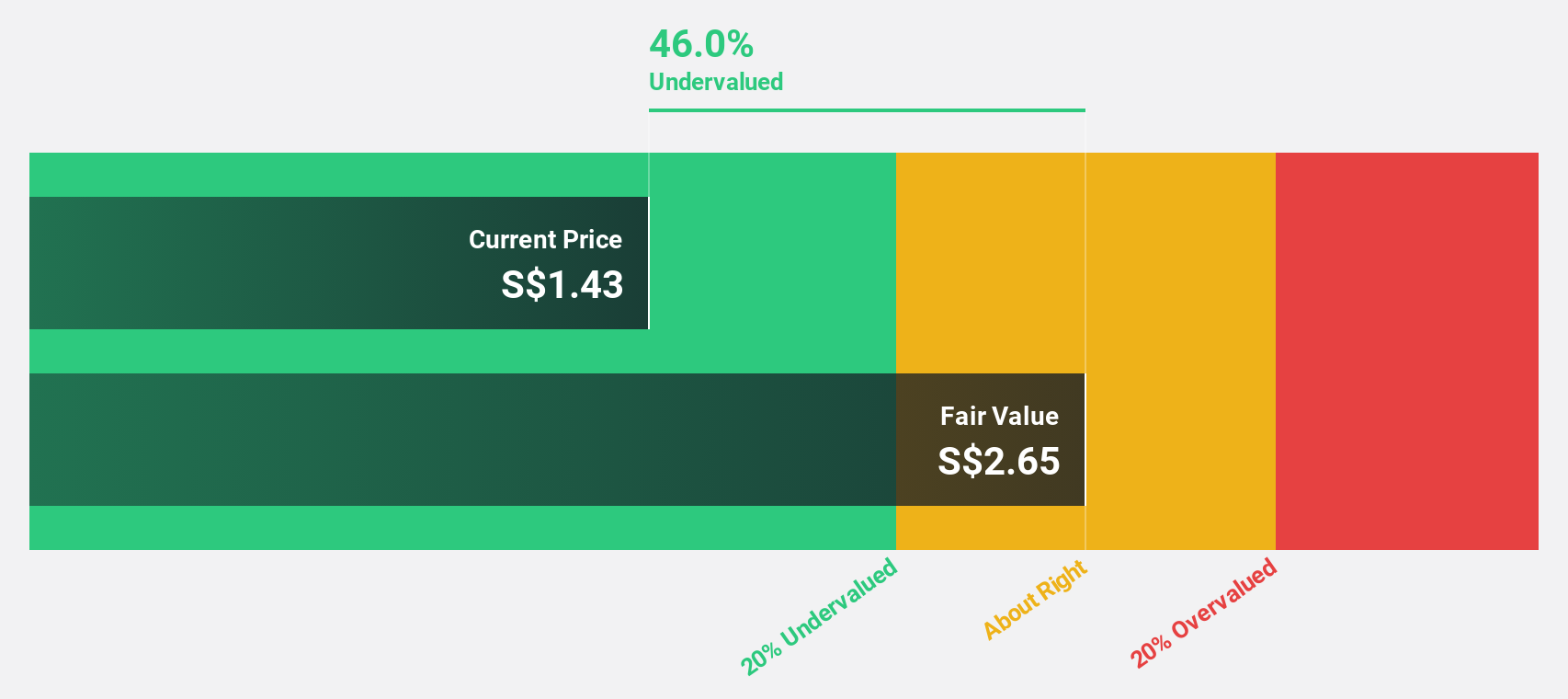

Estimated Discount To Fair Value: 46.6%

PropNex is trading at S$1.41, considerably below its estimated fair value of S$2.64, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow 11.05% annually, exceeding the Singapore market's average growth rate of 7.4%. However, its dividend yield of 3.72% isn't well supported by earnings or free cash flows. Recent leadership changes see Mr Kelvin Fong as CEO, which may influence strategic direction and competitive positioning in the real estate sector.

- Our comprehensive growth report raises the possibility that PropNex is poised for substantial financial growth.

- Click here to discover the nuances of PropNex with our detailed financial health report.

Zhejiang Jiemei Electronic And Technology (SZSE:002859)

Overview: Zhejiang Jiemei Electronic And Technology Co., Ltd. is involved in the research, development, production, and sales of consumable materials for electronic components both in China and internationally, with a market cap of CN¥9.16 billion.

Operations: The company generates revenue of CN¥1.80 billion from its operations in the electronic information industry.

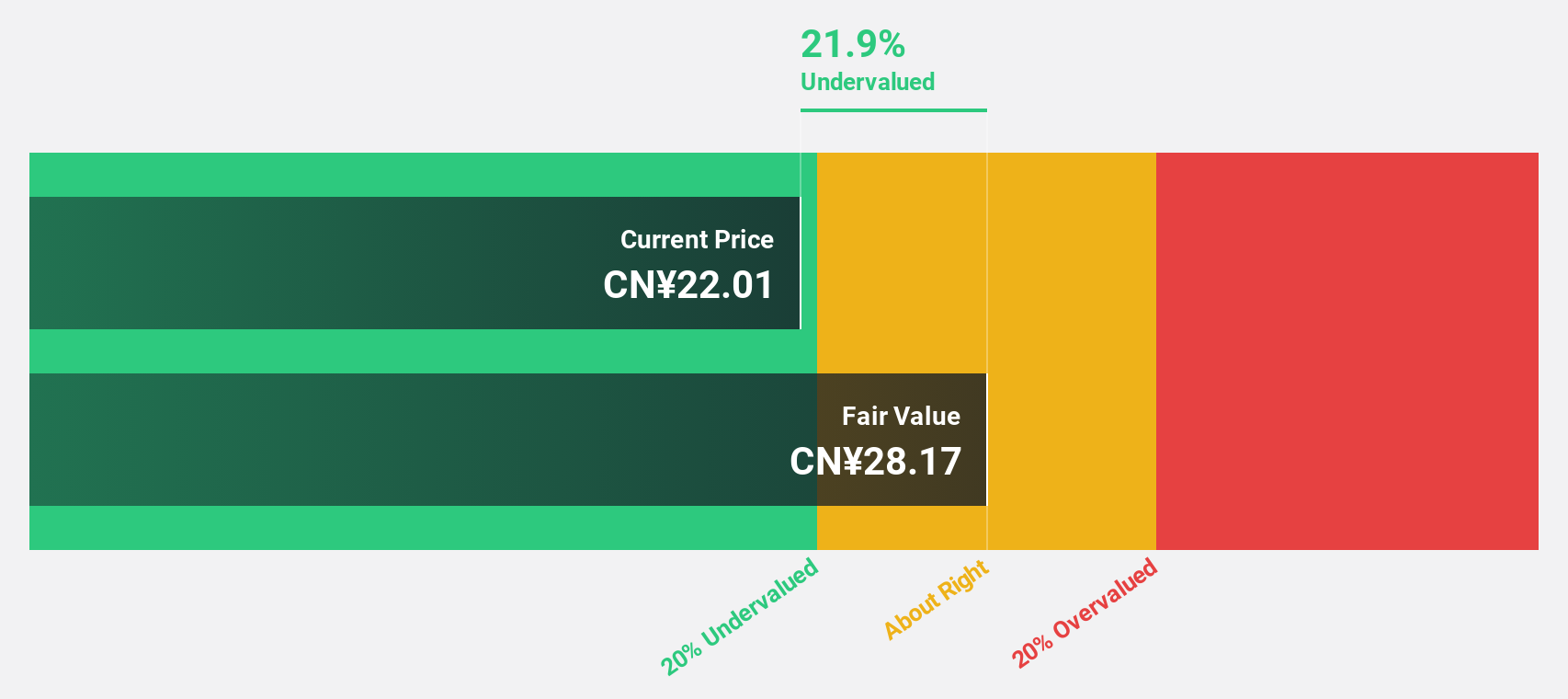

Estimated Discount To Fair Value: 23.8%

Zhejiang Jiemei Electronic And Technology is trading at CN¥21.5, below its fair value estimate of CN¥28.22, suggesting undervaluation based on cash flows. Despite a recent dividend decrease and lower profit margins compared to last year, the company's revenue is expected to grow 21.5% annually, outpacing the Chinese market's growth rate of 12.4%. However, debt coverage by operating cash flow remains inadequate and dividends are not well-supported by free cash flows.

- According our earnings growth report, there's an indication that Zhejiang Jiemei Electronic And Technology might be ready to expand.

- Take a closer look at Zhejiang Jiemei Electronic And Technology's balance sheet health here in our report.

Next Steps

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 257 more companies for you to explore.Click here to unveil our expertly curated list of 260 Undervalued Asian Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiemei Electronic And Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002859

Zhejiang Jiemei Electronic And Technology

Engages in the research and development, production, and sales of consumable materials for electronic components in China and internationally.

Reasonable growth potential with low risk.

Market Insights

Community Narratives