- China

- /

- Hospitality

- /

- SZSE:000796

Three Undiscovered Asian Gems To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

Amidst heightened global trade tensions and economic uncertainty, Asian markets have been navigating a challenging landscape, with small-cap stocks experiencing significant volatility. Despite these headwinds, the region continues to offer intriguing investment opportunities for those seeking to diversify their portfolios. In this context, identifying stocks that demonstrate resilience and potential for growth can be key to enhancing an investment portfolio in today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Interactive Digital Technologies | 1.23% | 7.48% | 5.93% | ★★★★★★ |

| Ve Wong | 11.50% | 0.72% | 3.87% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| BBK Test Systems | NA | 8.57% | 12.90% | ★★★★★★ |

| Savior Lifetec | NA | -9.44% | -7.05% | ★★★★★★ |

| Creative & Innovative System | 0.65% | 57.93% | 84.89% | ★★★★★★ |

| TOMONY Holdings | 48.81% | 7.66% | 14.89% | ★★★★★☆ |

| CTCI Advanced Systems | 28.82% | 23.23% | 27.69% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Aeolus Tyre | 35.14% | 0.01% | 17.84% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Caissa Tosun DevelopmentLtd (SZSE:000796)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caissa Tosun Development Co., Ltd. operates in the travel and tourism sector both within China and internationally, with a market capitalization of CN¥6.40 billion.

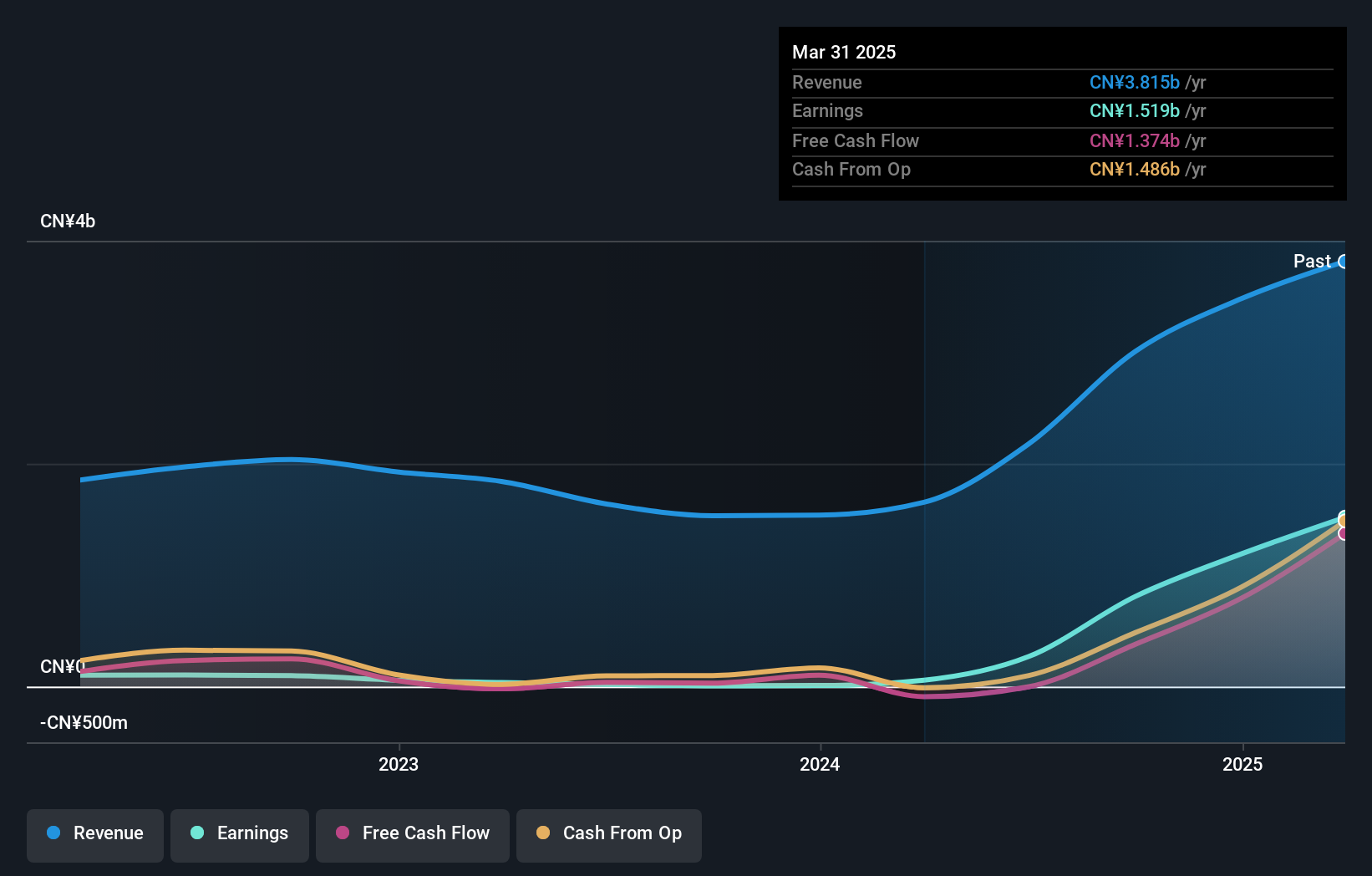

Operations: Caissa Tosun generates revenue primarily from its travel and tourism operations. The company's net profit margin is 5.23%.

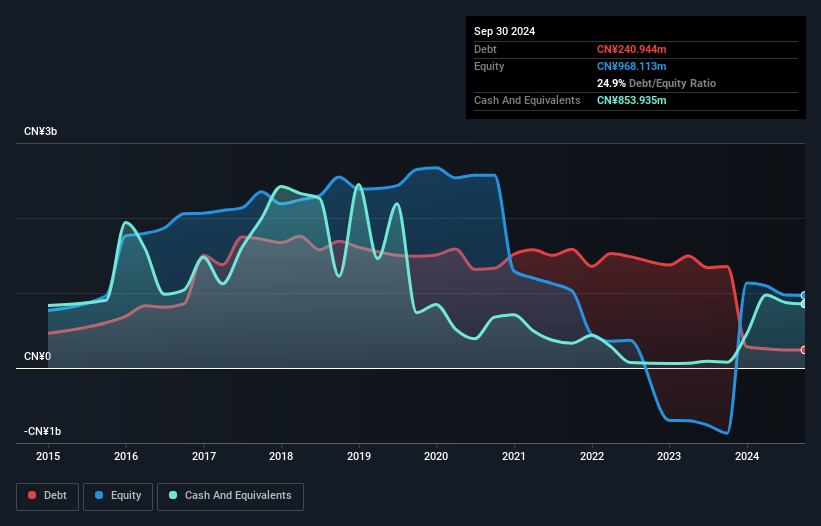

Caissa Tosun Development, a promising player in the hospitality sector, is trading at 82.7% below its estimated fair value, offering potential upside for investors. Recently turning profitable, it now outpaces industry growth rates despite the sector's -10.2% trend. The company's debt-to-equity ratio has improved significantly from 56.3% to 24.9% over five years, reflecting stronger financial health with more cash than total debt on hand. However, while revenue is expected to grow by 36.51%, earnings are projected to decrease sharply by an average of 95.6% annually over the next three years, posing a challenge for sustained profitability.

Tibet GaoZheng Explosive (SZSE:002827)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tibet GaoZheng Explosive Co., Ltd. is a company that produces and sells civil explosives in China, with a market capitalization of CN¥7.05 billion.

Operations: Tibet GaoZheng Explosive generates revenue primarily from the production and sale of civil explosives. The company's net profit margin shows notable fluctuations, reflecting the variability in its cost structure and market conditions.

Tibet GaoZheng Explosive, a small player in the chemicals sector, showcases robust earnings growth of 30% last year, outpacing the industry average. Despite its debt to equity ratio climbing from 19.1% to 95% over five years, its interest payments are comfortably covered at 9.8 times by EBIT. However, free cash flow remains negative, indicating potential liquidity challenges ahead. The company recently approved a cash dividend of CNY 0.70 per share for A shares, reflecting confidence in its profitability despite financial headwinds. Earnings are projected to grow at an impressive rate of nearly 47%, suggesting promising future prospects amidst current fiscal pressures.

- Navigate through the intricacies of Tibet GaoZheng Explosive with our comprehensive health report here.

Learn about Tibet GaoZheng Explosive's historical performance.

Jiangsu Zhengdan Chemical Industry (SZSE:300641)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhengdan Chemical Industry Co., Ltd. operates in the petrochemical sector and has a market capitalization of approximately CN¥14.44 billion.

Operations: The primary revenue stream for Jiangsu Zhengdan Chemical Industry comes from its operations in the petrochemical industry, generating approximately CN¥3.01 billion.

Zhengdan Chemical has demonstrated remarkable earnings growth, skyrocketing by 8,941% over the past year, significantly outpacing the chemicals industry average of -4.1%. This impressive performance is complemented by a reduction in its debt to equity ratio from 19% to 7.2% over five years, indicating prudent financial management. With a price-to-earnings ratio of 17.9x well below the CN market average of 32.8x, it appears undervalued relative to peers. The company also boasts high-quality non-cash earnings and positive free cash flow, suggesting robust operational efficiency and potential for sustained profitability in the competitive chemical sector.

Taking Advantage

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2556 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000796

Caissa Tosun DevelopmentLtd

Engages in travel and tourism related businesses in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives