Viva Goods And 2 Other Promising Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

As global markets show mixed signals, with the S&P 500 advancing and small-cap indices like the Russell 2000 outperforming, investors are keenly observing shifts in economic indicators such as consumer spending and industrial output. In this context, penny stocks—often representing smaller or newer companies—remain a relevant area for potential growth opportunities. Despite their somewhat outdated label, these stocks can offer significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.59 | MYR2.93B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.75 | MYR129.91M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.30 | CN¥2.11B | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £183.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.235 | £307.76M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.45 | MYR2.5B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,807 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Viva Goods (SEHK:933)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Viva Goods Company Limited is an investment holding company that supplies apparel and footwear across various regions including the United Kingdom, Republic of Ireland, America, China, Asia, Europe, the Middle East, and Africa with a market capitalization of approximately HK$5.45 billion.

Operations: The company's revenue is primarily derived from its Multi-Brand Apparel and Footwear segment, generating HK$10.35 billion, complemented by HK$530.03 million from the Sports Experience segment.

Market Cap: HK$5.45B

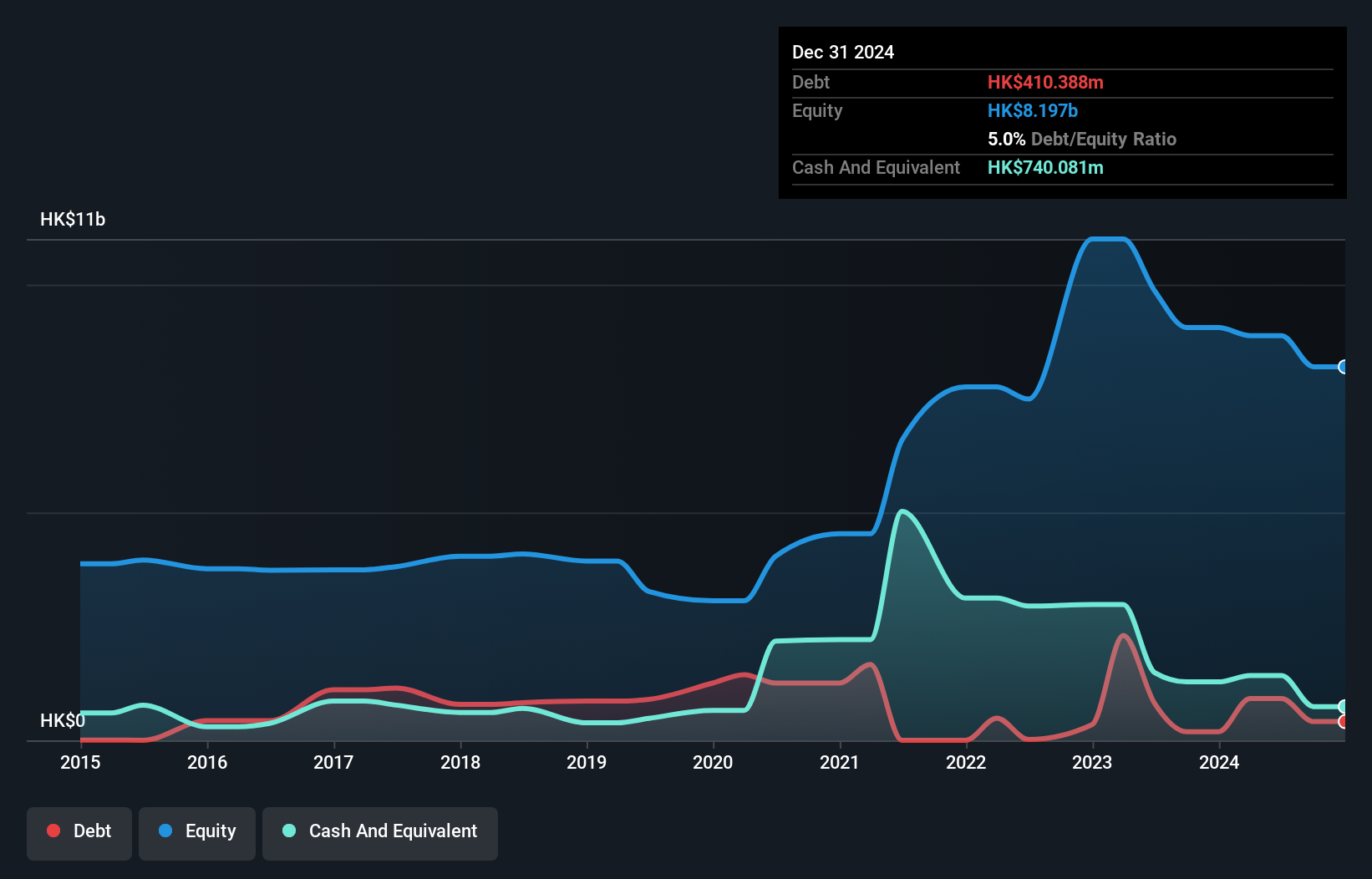

Viva Goods Company Limited, with a market cap of HK$5.45 billion, reported half-year sales of HK$5.1 billion and net income of HK$112.81 million, indicating a decline from the previous year. Despite being unprofitable with losses increasing over five years at 11.5% annually, the company has reduced its debt-to-equity ratio significantly from 27.5% to 10.3%. Its seasoned management and board have maintained stability without shareholder dilution over the past year, while short-term assets comfortably cover both short and long-term liabilities, offering some financial resilience amidst challenges in profitability growth.

- Click to explore a detailed breakdown of our findings in Viva Goods' financial health report.

- Understand Viva Goods' track record by examining our performance history report.

Hubei Mailyard ShareLtd (SHSE:600107)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hubei Mailyard Share Co., Ltd, along with its subsidiaries, is involved in the manufacturing, processing, and sale of clothes, apparel, textiles, and accessories both in China and internationally; it has a market cap of CN¥1.77 billion.

Operations: Hubei Mailyard Share Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥1.77B

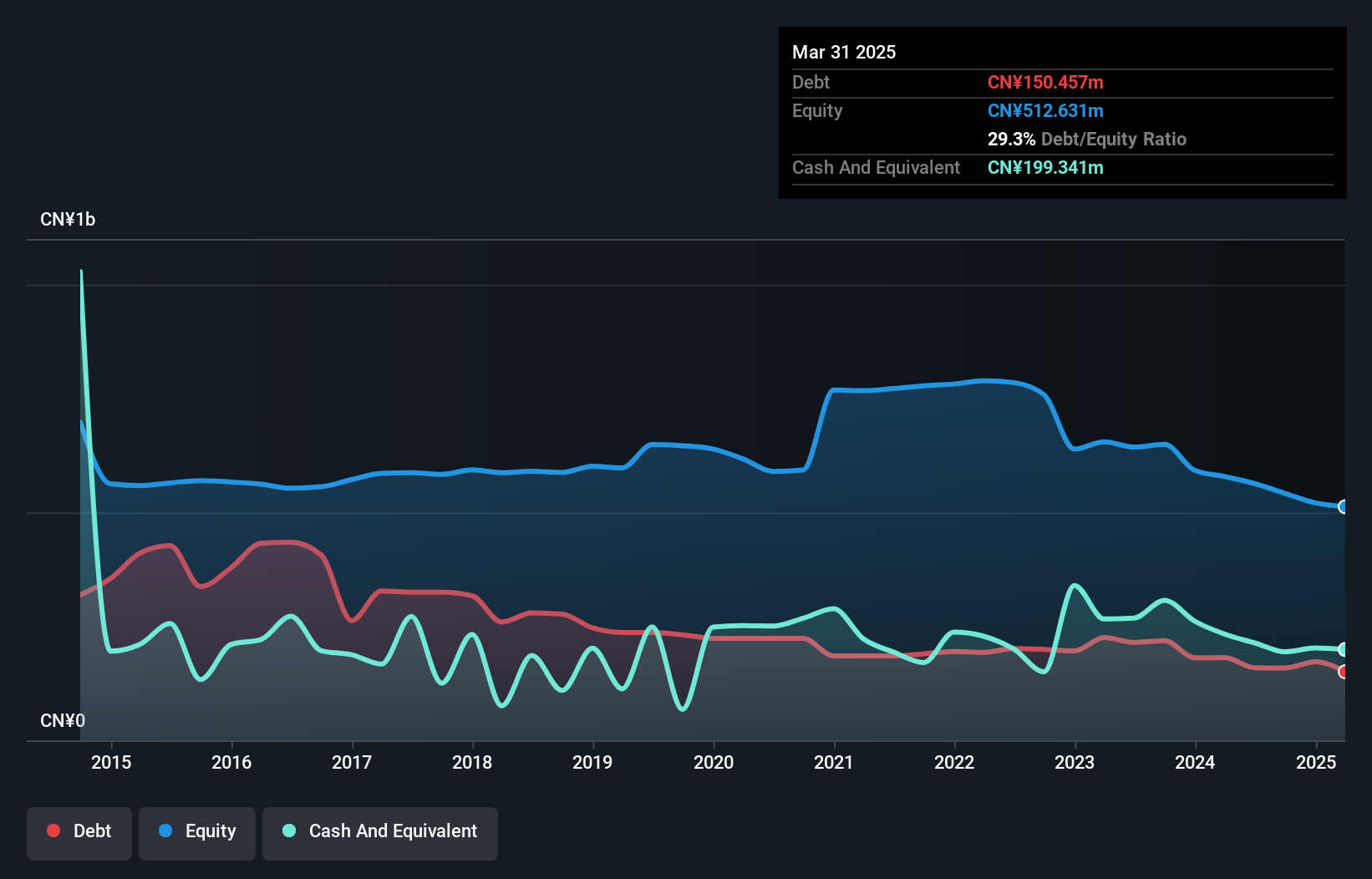

Hubei Mailyard Share Co., Ltd, with a market cap of CN¥1.77 billion, reported half-year revenue of CN¥204.74 million, down from CN¥220.26 million the previous year, alongside a net loss increase to CN¥27.48 million. Despite unprofitability and declining earnings over five years at 45.9% annually, the company has reduced its debt-to-equity ratio from 36.5% to 28.2%. While short-term assets exceed both short and long-term liabilities and cash surpasses total debt, high volatility persists in its share price amidst an inexperienced board and negative operating cash flow coverage for debt obligations.

- Get an in-depth perspective on Hubei Mailyard ShareLtd's performance by reading our balance sheet health report here.

- Learn about Hubei Mailyard ShareLtd's historical performance here.

Shandong Longquan Pipe IndustryLtd (SZSE:002671)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Longquan Pipe Industry Co., Ltd produces and sells prestressed concrete cylinder pipes in China, with a market cap of CN¥2.53 billion.

Operations: The company generates revenue from the Metal Pipe Fittings Business Division, contributing CN¥200.25 million, and the PCCP and Other Pipeline Business Segments, which bring in CN¥817.65 million.

Market Cap: CN¥2.53B

Shandong Longquan Pipe Industry Co., Ltd, with a market cap of CN¥2.53 billion, reported half-year revenue of CN¥419.04 million, down from CN¥489.8 million the previous year, yet net income rose significantly to CN¥16.53 million from CN¥2.65 million. The company's short-term assets comfortably cover both short and long-term liabilities, although its operating cash flow does not adequately cover debt levels at 6.3%. Despite low return on equity at 2.5%, interest payments are well-covered by EBIT at 3.5 times coverage, and shareholders have not faced significant dilution recently amidst stable weekly volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Shandong Longquan Pipe IndustryLtd.

- Gain insights into Shandong Longquan Pipe IndustryLtd's past trends and performance with our report on the company's historical track record.

Next Steps

- Reveal the 5,807 hidden gems among our Penny Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:933

Viva Goods

An investment holding company, provides apparel and footwear in the United Kingdom, the Republic of Ireland, America, the People’s Republic of China, Asia, Europe, the Middle East, and Africa.

Excellent balance sheet and good value.