Phoenix Group Leads The Pack With 2 More Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been on a positive trajectory, with U.S. stock indexes nearing record highs and growth stocks outperforming value shares. Amidst this backdrop, the concept of penny stocks remains relevant, offering investors potential opportunities for growth at lower price points. Though often associated with smaller or newer companies, these stocks can be attractive when they demonstrate strong financial fundamentals and balance sheet strength.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$45.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.56B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.875 | £469.93M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £150.13M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.07 | £305.33M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

Click here to see the full list of 5,684 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Phoenix Group Plc, along with its subsidiaries, offers crypto and cloud mining services across the United Arab Emirates, Oman, CIS, Canada, the United States, and other international markets with a market cap of AED6.47 billion.

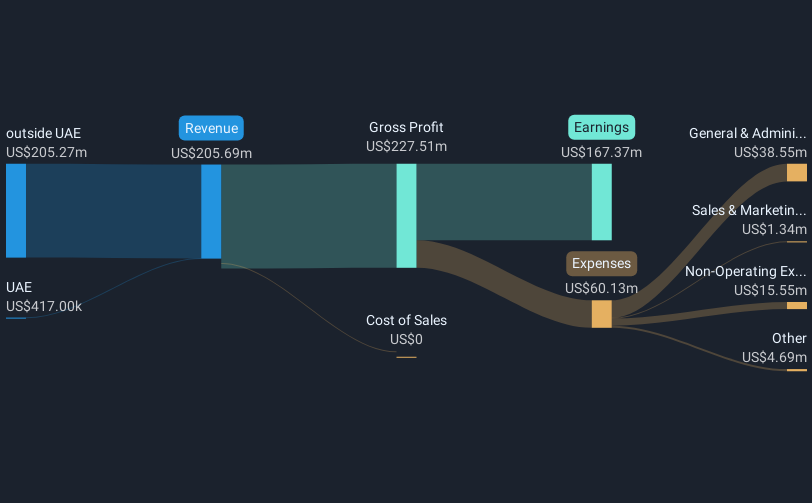

Operations: The company generates revenue from its data processing segment, amounting to $205.69 million.

Market Cap: AED6.47B

Phoenix Group Plc recently reported a decline in revenue to US$205.69 million for 2024, down from US$288.19 million the previous year, with net income also decreasing to US$167.37 million. Despite negative earnings growth and a decline in revenue, the company's strategic expansion with a new 50MW mining facility in North Dakota enhances its digital asset infrastructure capabilities significantly. The company maintains strong liquidity with short-term assets exceeding liabilities and has a satisfactory net debt to equity ratio of 2%. Leadership changes include Munaf Ali's appointment as CEO, aiming to leverage his expertise for future growth opportunities in cryptocurrency markets.

- Unlock comprehensive insights into our analysis of Phoenix Group stock in this financial health report.

- Gain insights into Phoenix Group's historical outcomes by reviewing our past performance report.

Qinghai Spring Medicinal Resources Technology (SHSE:600381)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Spring Medicinal Resources Technology Co., Ltd. operates in the medicinal resources sector and has a market cap of CN¥2.14 billion.

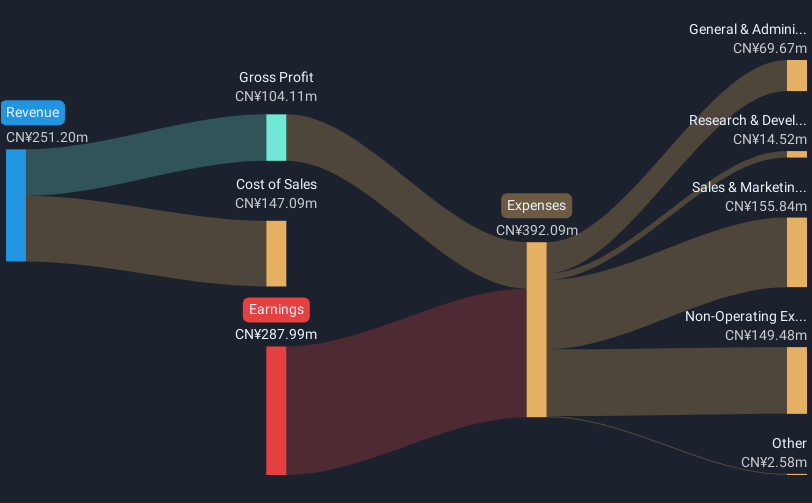

Operations: Qinghai Spring Medicinal Resources Technology Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥2.14B

Qinghai Spring Medicinal Resources Technology, with a market cap of CN¥2.14 billion, operates without debt and maintains strong liquidity as its short-term assets of CN¥616.4 million surpass both short-term and long-term liabilities. Despite trading at 56.9% below estimated fair value, the company remains pre-revenue and unprofitable, with earnings declining by 22.4% annually over the past five years. The board is experienced with an average tenure of 3.7 years, yet management tenure data is insufficient to assess experience levels fully. Recent events include a special shareholders meeting scheduled for December 2024 in Xining, Qinghai China.

- Jump into the full analysis health report here for a deeper understanding of Qinghai Spring Medicinal Resources Technology.

- Learn about Qinghai Spring Medicinal Resources Technology's historical performance here.

Era (SZSE:002641)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Era Co., Ltd. engages in the research, development, production, and sale of plastic pipe products in China and has a market capitalization of CN¥5.30 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥5.3B

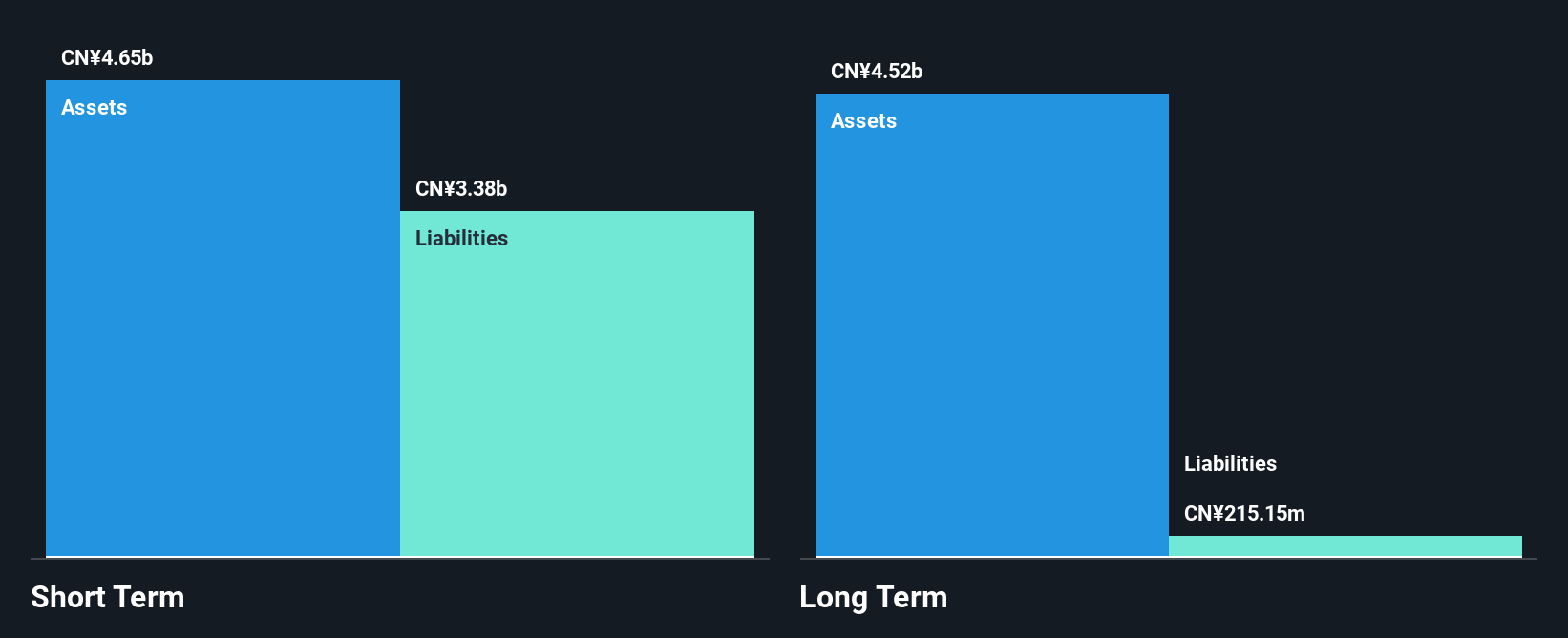

Era Co., Ltd., with a market capitalization of CN¥5.30 billion, has not diluted shareholders over the past year and maintains a stable weekly volatility of 5%. Despite negative earnings growth of -20.2% last year, its board is experienced with an average tenure of 4.5 years. The company's Return on Equity is low at 4.2%, but it holds more cash than total debt and covers interest payments effectively. Short-term assets (CN¥4 billion) exceed both short-term and long-term liabilities, indicating strong liquidity, while debt to equity has improved significantly over five years from 7.1% to 2.7%.

- Click to explore a detailed breakdown of our findings in Era's financial health report.

- Learn about Era's future growth trajectory here.

Next Steps

- Discover the full array of 5,684 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Era might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002641

Era

Research, develops, produces, and sells plastic pipe products in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives