- China

- /

- Communications

- /

- SZSE:300167

Global Penny Stocks With Strong Potential: 3 Picks Under US$600M Market Cap

Reviewed by Simply Wall St

Global markets have experienced a significant boost, driven by a temporary pause in U.S.-China tariffs and cooling inflation rates, which has led to rallies across major indices. Amidst these developments, investors are increasingly exploring diverse opportunities beyond traditional large-cap stocks. Penny stocks—often smaller or newer companies—offer an intriguing mix of affordability and growth potential. Despite being considered outdated by some, these stocks can present valuable opportunities when backed by strong financials and solid fundamentals. In this article, we explore three penny stocks that stand out for their financial strength and potential in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.13 | SGD8.38B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 2 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.98 | MYR1.53B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.365 | MYR1.06B | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2.14B | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.88 | £437.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.90 | A$669.09M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,646 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sichuan Shengda Forestry Industry (SZSE:002259)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sichuan Shengda Forestry Industry Co., Ltd is involved in the production and sale of liquefied natural gas (LNG) in China, with a market cap of CN¥2.89 billion.

Operations: The company generates revenue from its gas business, amounting to CN¥811.35 million.

Market Cap: CN¥2.89B

Sichuan Shengda Forestry Industry Co., Ltd, with a market cap of CN¥2.89 billion, has shown financial improvement by becoming profitable over the past year. The company reported net income of CN¥12 million for 2024, compared to a net loss previously. Despite this progress, it faces challenges such as short-term liabilities exceeding its assets and recent auditor concerns about its ability to continue as a going concern. The company is debt-free and experienced stable weekly volatility but was impacted by a significant one-off loss recently, affecting its earnings quality.

- Dive into the specifics of Sichuan Shengda Forestry Industry here with our thorough balance sheet health report.

- Gain insights into Sichuan Shengda Forestry Industry's historical outcomes by reviewing our past performance report.

Shanghai Shunho New Materials TechnologyLtd (SZSE:002565)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Shunho New Materials Technology Co., Ltd. operates in the materials technology sector with a market capitalization of CN¥4.17 billion.

Operations: Shanghai Shunho New Materials Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.17B

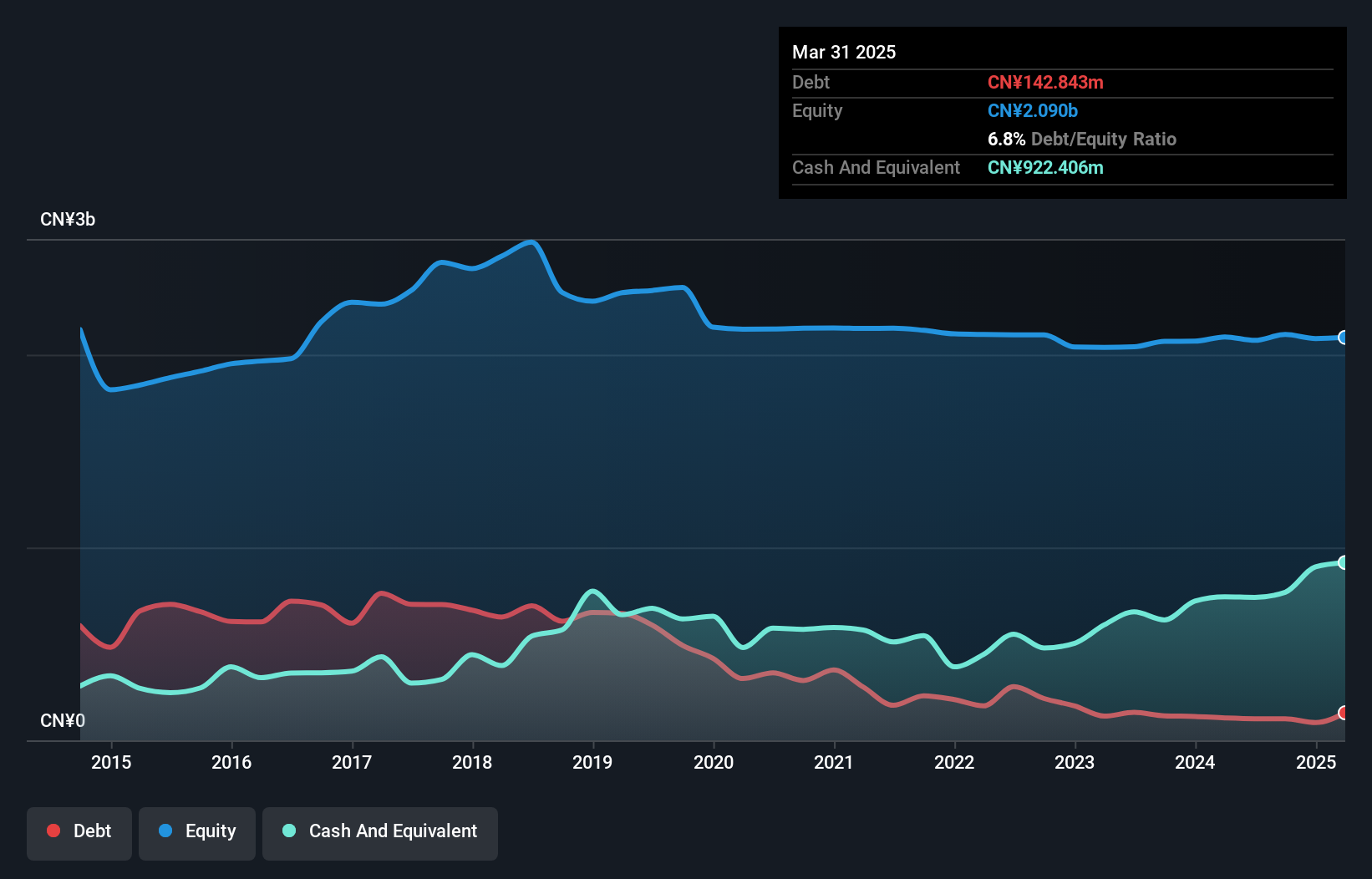

Shanghai Shunho New Materials Technology Co., Ltd. has a market cap of CN¥4.17 billion and operates with a solid financial structure, as its short-term assets significantly exceed both short- and long-term liabilities. The company recently completed a share buyback program worth CN¥100 million, enhancing shareholder value through repurchases for employee stock ownership plans or equity incentives. Despite reporting lower sales of CN¥325.13 million for Q1 2025 compared to the previous year, it maintains high-quality earnings and has reduced its debt-to-equity ratio over five years while trading significantly below estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of Shanghai Shunho New Materials TechnologyLtd.

- Evaluate Shanghai Shunho New Materials TechnologyLtd's historical performance by accessing our past performance report.

Shenzhen DivisionLtd (SZSE:300167)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Division Co., Ltd. focuses on the research, development, and sale of smart video and IoT core technology products and solutions mainly in China, with a market cap of approximately CN¥1.35 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥440.82 million.

Market Cap: CN¥1.35B

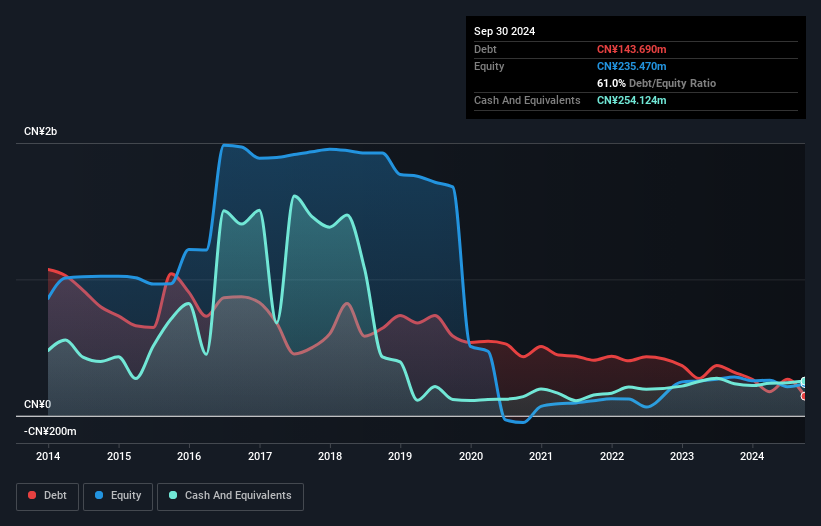

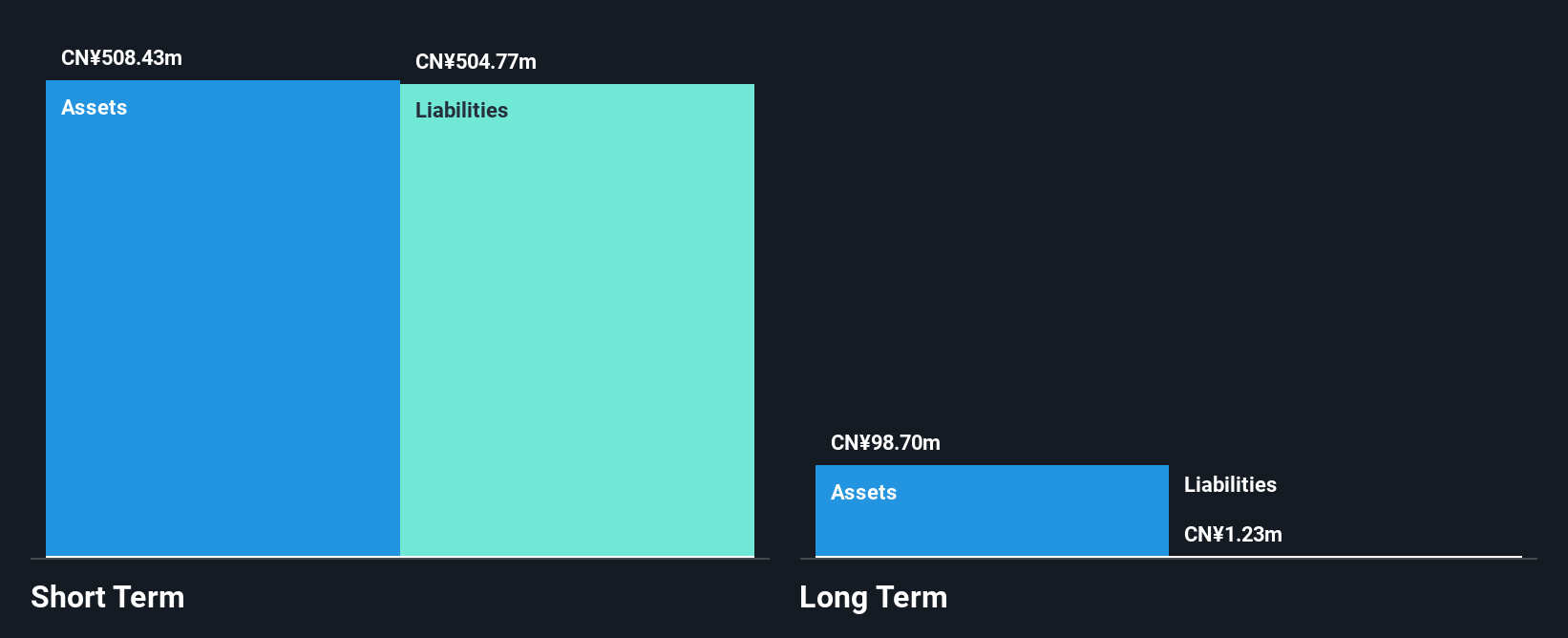

Shenzhen Division Co., Ltd. exhibits a mixed financial outlook with short-term assets surpassing liabilities, providing a stable cash runway for over three years. Despite this, the company remains unprofitable with increasing losses over the past five years and a negative return on equity of 1.92%. Recent earnings show improved revenue at CN¥132.18 million for Q1 2025 but still report net losses of CN¥1.29 million, down from CN¥8.99 million last year. Additionally, auditors have raised concerns about the company's ability to continue as a going concern, highlighting potential risks for investors in this volatile penny stock environment.

- Click here to discover the nuances of Shenzhen DivisionLtd with our detailed analytical financial health report.

- Explore historical data to track Shenzhen DivisionLtd's performance over time in our past results report.

Key Takeaways

- Explore the 5,646 names from our Global Penny Stocks screener here.

- Ready For A Different Approach? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shenzhen DivisionLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300167

Shenzhen DivisionLtd

Engages in the research and development, and sale of smart video and IoT core technology products and solutions primarily in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives