- China

- /

- Construction

- /

- SZSE:002586

Global Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape marked by trade uncertainties and mixed performances across major stock indices. Amid these conditions, smaller-cap indexes have shown resilience, suggesting that investors might find opportunities in less prominent sectors. Penny stocks, often representing smaller or newer companies, continue to intrigue investors with their potential for growth and value when backed by strong financials. In this context, we explore several penny stocks that stand out for their financial strength and offer compelling opportunities for those seeking under-the-radar investments poised for success.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.865 | MYR1.35B | ✅ 5 ⚠️ 2 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.32 | MYR890.29M | ✅ 4 ⚠️ 3 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.03 | HK$649.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.67 | £353.78M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,631 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd is involved in the research, development, production, and sales of chemical fibers, textile materials, and rubber and plastic products both in China and internationally with a market cap of CN¥5.08 billion.

Operations: The company's revenue is primarily derived from Chemical Fiber Manufacturing (CN¥3.17 billion), Other Textile Industry (CN¥2.07 billion), Rubber and Plastic Products Industry (CN¥605.34 million), and Hotel Services (CN¥2.04 million).

Market Cap: CN¥5.08B

Zhejiang Hailide New Material Co., Ltd has shown stable weekly volatility at 6% over the past year, with earnings growing by 17.6% last year, surpassing its five-year average of 2.5%. The company's debt is well covered by operating cash flow and interest payments are adequately managed with a coverage of 14.7 times EBIT. Despite a low return on equity at 10.5%, the stock trades at a favorable price-to-earnings ratio of 12.4x compared to the CN market's average of 35.7x, suggesting good relative value among peers and industry standards.

- Unlock comprehensive insights into our analysis of Zhejiang Hailide New MaterialLtd stock in this financial health report.

- Learn about Zhejiang Hailide New MaterialLtd's future growth trajectory here.

Shanghai Shunho New Materials TechnologyLtd (SZSE:002565)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Shunho New Materials Technology Co., Ltd. operates in the new materials sector, focusing on innovative material solutions, with a market cap of CN¥3.23 billion.

Operations: Shanghai Shunho New Materials Technology Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥3.23B

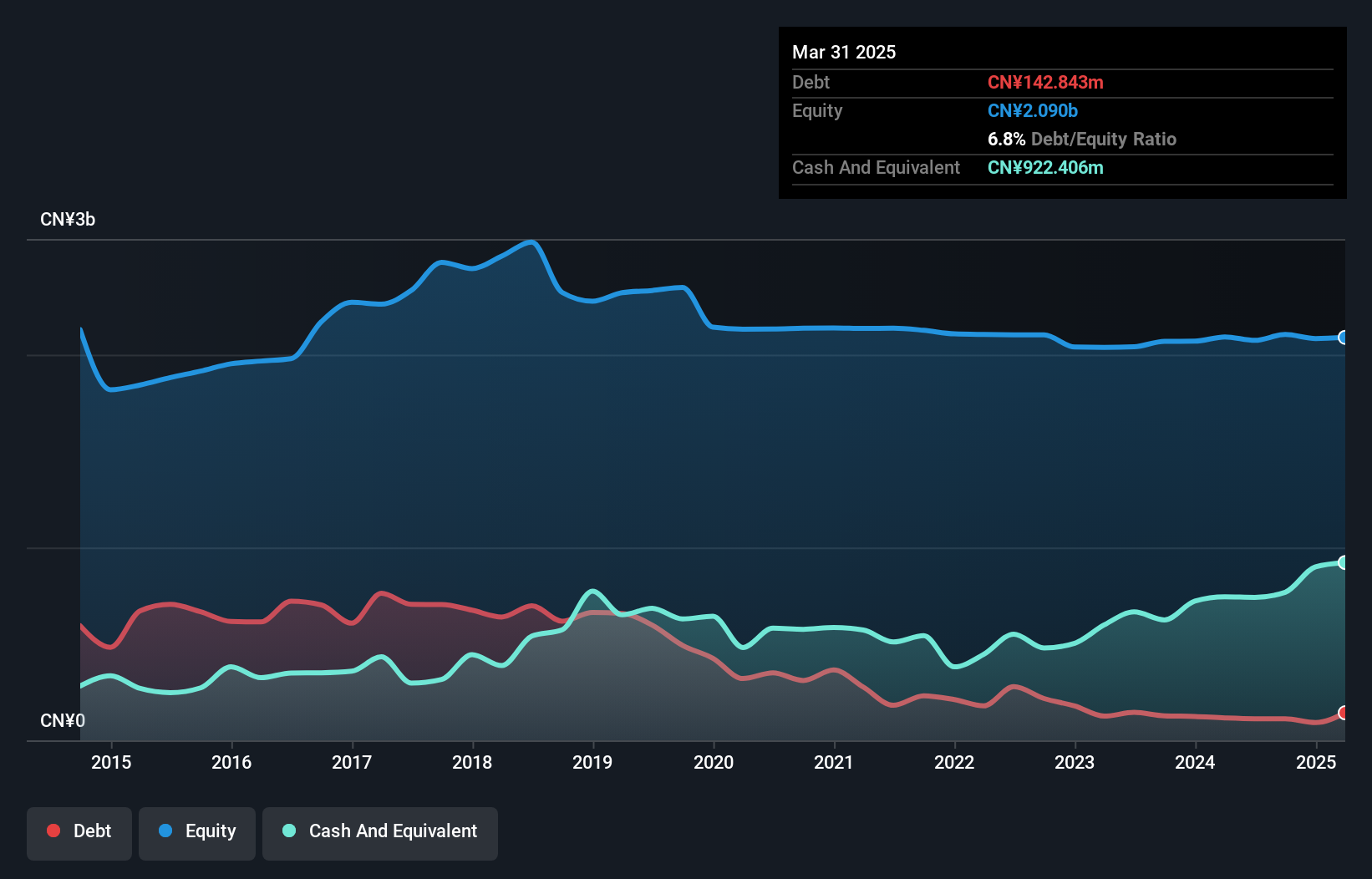

Shanghai Shunho New Materials Technology Co., Ltd. has recently initiated a share buyback program, planning to repurchase CN¥100 million worth of shares, which suggests confidence in its valuation and potential for shareholder value enhancement. The company has become profitable this year, with earnings growth accelerating significantly over the past five years. Its short-term assets comfortably cover both short and long-term liabilities, indicating strong liquidity management. However, the return on equity remains low at 4%, and while debt levels are well managed with cash exceeding total debt, the dividend track record is unstable.

- Jump into the full analysis health report here for a deeper understanding of Shanghai Shunho New Materials TechnologyLtd.

- Examine Shanghai Shunho New Materials TechnologyLtd's past performance report to understand how it has performed in prior years.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry and has a market cap of approximately CN¥3.28 billion.

Operations: The company generates revenue primarily from its operations in China, totaling CN¥2.23 billion.

Market Cap: CN¥3.28B

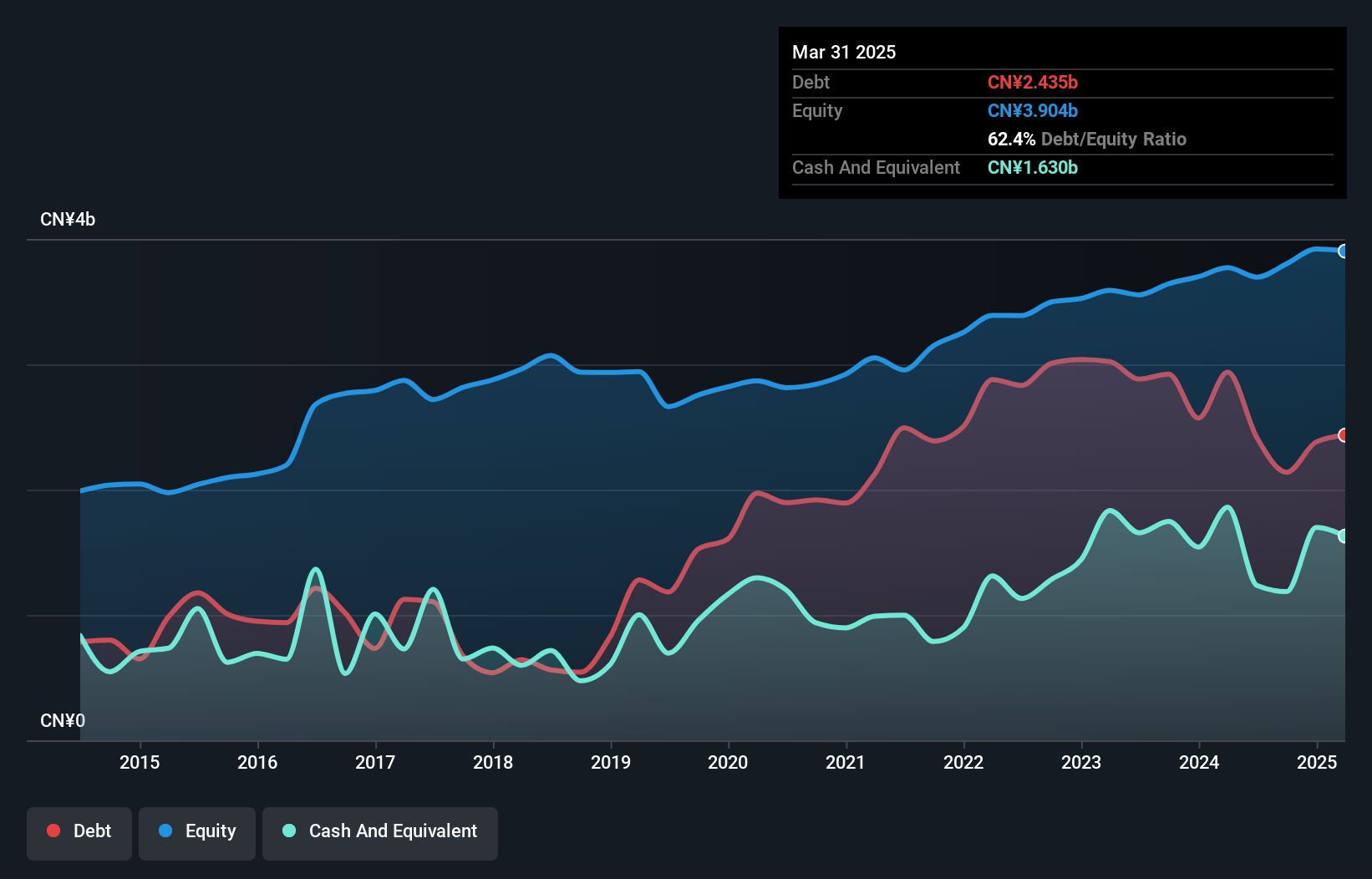

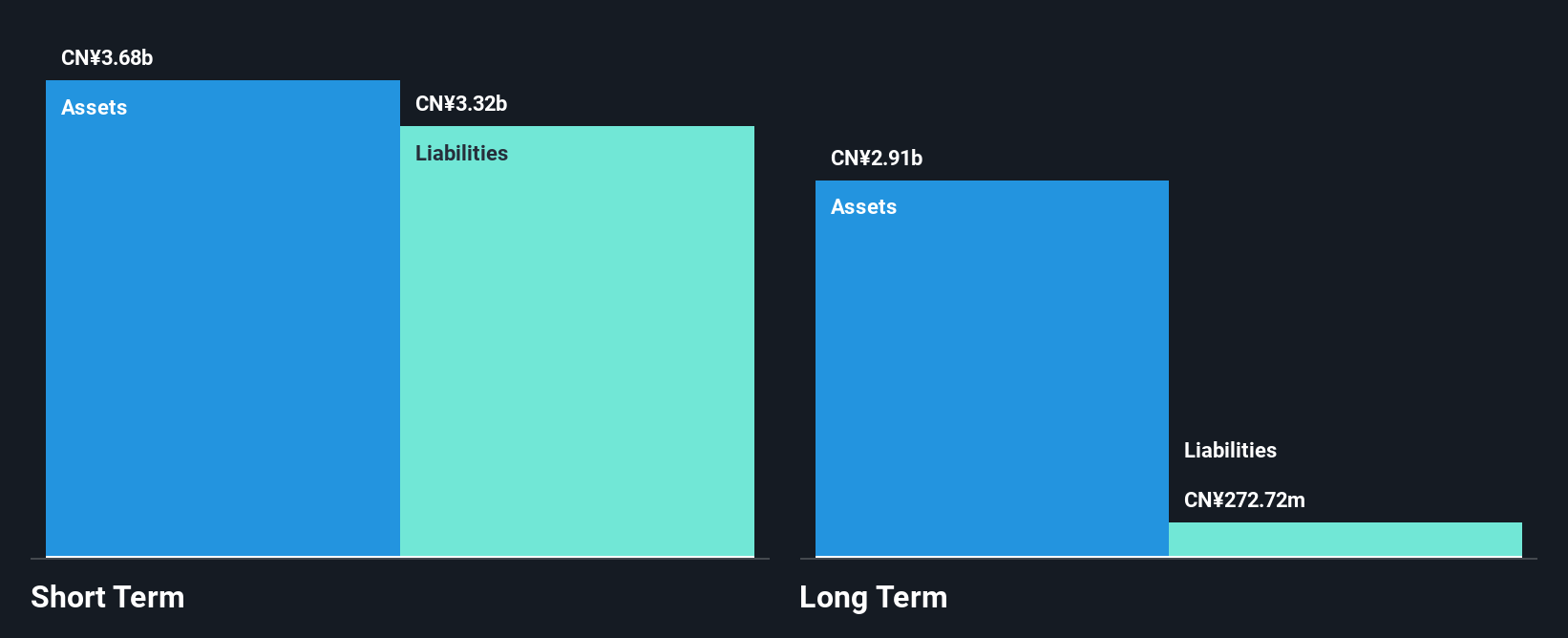

Zhejiang Reclaim Construction Group has a market cap of CN¥3.28 billion and generates CN¥2.23 billion in revenue, primarily from its Chinese operations. The company maintains more cash than total debt, with a reduced debt to equity ratio over five years, indicating improved financial health. Although currently unprofitable with negative return on equity, it has narrowed losses by 38.1% annually over the past five years and boasts an experienced board with an average tenure of 3.2 years. Despite stable weekly volatility and no significant shareholder dilution recently, short-term liabilities match short-term assets at CN¥3.9 billion each.

- Click to explore a detailed breakdown of our findings in Zhejiang Reclaim Construction Group's financial health report.

- Learn about Zhejiang Reclaim Construction Group's historical performance here.

Taking Advantage

- Navigate through the entire inventory of 5,631 Global Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Reclaim Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002586

Zhejiang Reclaim Construction Group

Zhejiang Reclaim Construction Group Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives