Sichuan Yahua Industrial Group (SZSE:002497 shareholders incur further losses as stock declines 4.8% this week, taking three-year losses to 56%

It is doubtless a positive to see that the Sichuan Yahua Industrial Group Co., Ltd. (SZSE:002497) share price has gained some 31% in the last three months. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 57%. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Sichuan Yahua Industrial Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

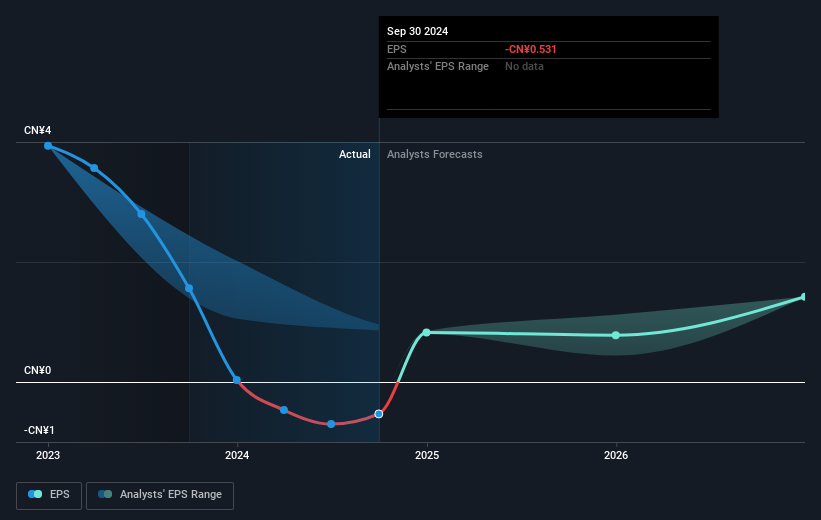

Sichuan Yahua Industrial Group saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Sichuan Yahua Industrial Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Sichuan Yahua Industrial Group shareholders are down 0.9% for the year (even including dividends), but the market itself is up 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Sichuan Yahua Industrial Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Sichuan Yahua Industrial Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002497

Sichuan Yahua Industrial Group

Research, produces, and sells civil explosive, and blasting services in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives