- China

- /

- Metals and Mining

- /

- SZSE:002478

Here's Why Jiangsu Changbao SteeltubeLtd (SZSE:002478) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Jiangsu Changbao Steeltube Co.,Ltd (SZSE:002478) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Jiangsu Changbao SteeltubeLtd

What Is Jiangsu Changbao SteeltubeLtd's Debt?

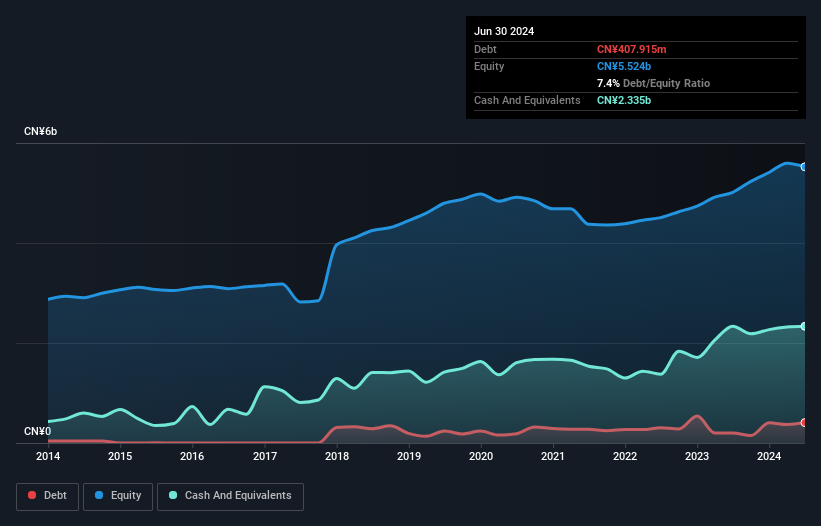

The image below, which you can click on for greater detail, shows that at June 2024 Jiangsu Changbao SteeltubeLtd had debt of CN¥407.9m, up from CN¥200.0m in one year. However, its balance sheet shows it holds CN¥2.33b in cash, so it actually has CN¥1.93b net cash.

A Look At Jiangsu Changbao SteeltubeLtd's Liabilities

Zooming in on the latest balance sheet data, we can see that Jiangsu Changbao SteeltubeLtd had liabilities of CN¥2.42b due within 12 months and liabilities of CN¥76.5m due beyond that. On the other hand, it had cash of CN¥2.33b and CN¥1.63b worth of receivables due within a year. So it actually has CN¥1.47b more liquid assets than total liabilities.

This surplus liquidity suggests that Jiangsu Changbao SteeltubeLtd's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Jiangsu Changbao SteeltubeLtd has more cash than debt is arguably a good indication that it can manage its debt safely.

But the bad news is that Jiangsu Changbao SteeltubeLtd has seen its EBIT plunge 11% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Jiangsu Changbao SteeltubeLtd's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Jiangsu Changbao SteeltubeLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, Jiangsu Changbao SteeltubeLtd recorded free cash flow of 37% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Jiangsu Changbao SteeltubeLtd has net cash of CN¥1.93b, as well as more liquid assets than liabilities. So we don't have any problem with Jiangsu Changbao SteeltubeLtd's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Jiangsu Changbao SteeltubeLtd (of which 1 is a bit concerning!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002478

Jiangsu Changbao SteeltubeLtd

Manufactures and sells steel tubes in the People’s Republic of China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives