- Taiwan

- /

- Auto Components

- /

- TWSE:6605

Global Dividend Stocks Spotlight Featuring Three Top Picks

Reviewed by Simply Wall St

As global markets navigate the turbulence of U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are increasingly seeking stability through dividend stocks. In such uncertain times, these stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth potential with risk mitigation.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.29% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.19% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.88% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| NCD (TSE:4783) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| Daicel (TSE:4202) | 4.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.77% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.39% | ★★★★★★ |

Click here to see the full list of 1381 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

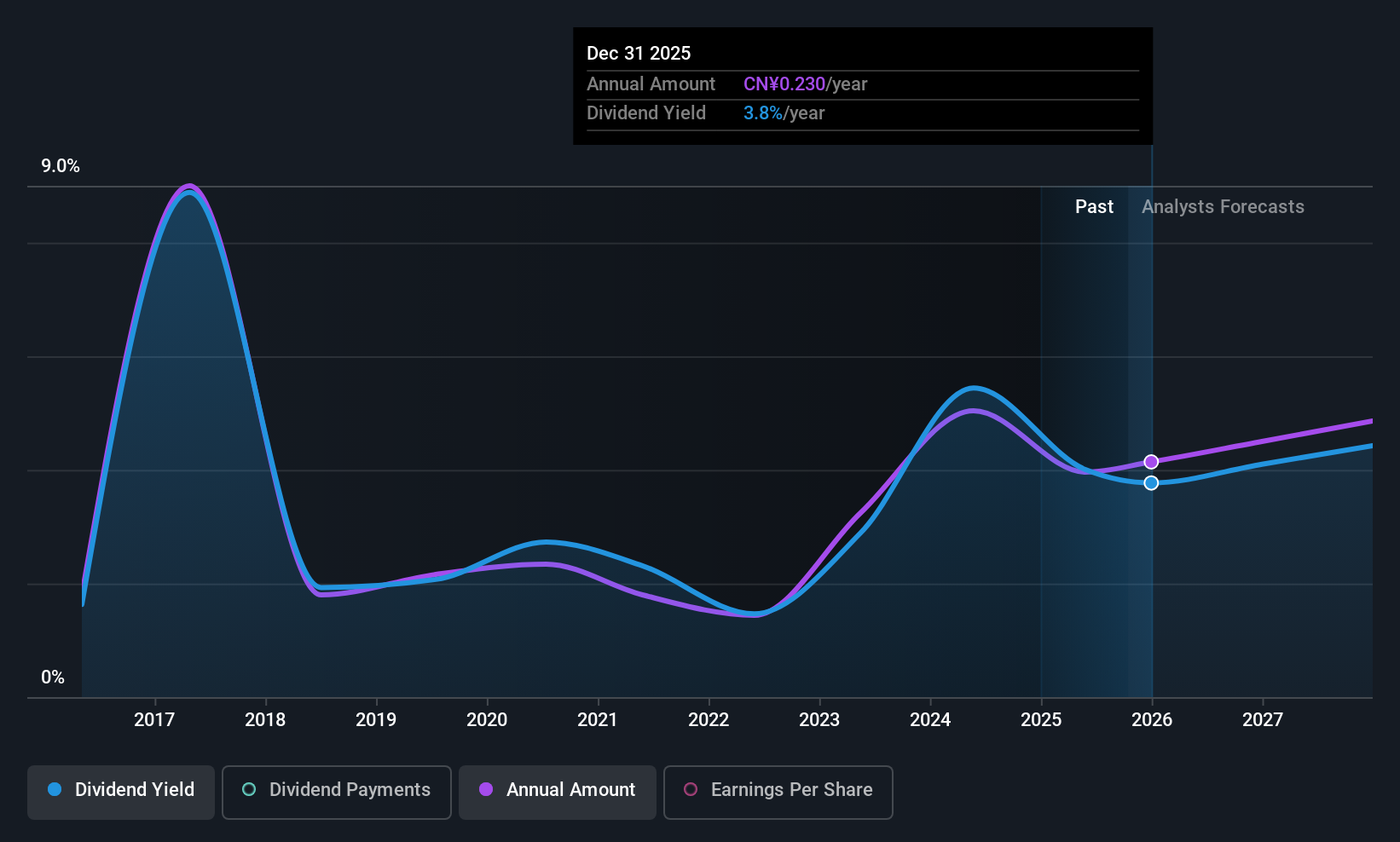

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DeHua TB New Decoration Material Co., Ltd specializes in the production and sale of environmentally friendly furniture panels both in China and internationally, with a market cap of CN¥9.24 billion.

Operations: DeHua TB New Decoration Material Co., Ltd generates revenue primarily from its Decorative Material Business, contributing CN¥7.11 billion, and its Custom Home Business, which adds CN¥1.75 billion.

Dividend Yield: 5.6%

DeHua TB New Decoration Material Ltd. offers a dividend yield of 5.67%, placing it in the top 25% of CN market payers, though its dividend history is volatile and unreliable. Despite this, dividends are covered by earnings (79.9% payout ratio) and cash flows (59.4%). The stock trades at significant value below fair estimates, but investors should consider the unstable dividend track record when evaluating its long-term reliability as a dividend investment.

- Unlock comprehensive insights into our analysis of DeHua TB New Decoration MaterialLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that DeHua TB New Decoration MaterialLtd is trading behind its estimated value.

Jiangsu Changbao SteeltubeLtd (SZSE:002478)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Changbao Steeltube Co., Ltd manufactures and sells steel tubes both in the People’s Republic of China and internationally, with a market cap of CN¥5.39 billion.

Operations: The company's revenue primarily comes from the production and sales of seamless steel pipes, amounting to CN¥5.70 billion.

Dividend Yield: 3.6%

Jiangsu Changbao Steeltube Ltd. offers a dividend yield in the top 25% of the CN market at 3.6%, with dividends well covered by earnings (35.3% payout ratio) and cash flows (37.2%). Despite a volatile dividend history, payments have grown over the past decade. The stock trades at a favorable price-to-earnings ratio of 9.7x, below the CN market average, though recent earnings reported lower net income compared to last year amid ongoing company governance adjustments.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu Changbao SteeltubeLtd.

- Upon reviewing our latest valuation report, Jiangsu Changbao SteeltubeLtd's share price might be too pessimistic.

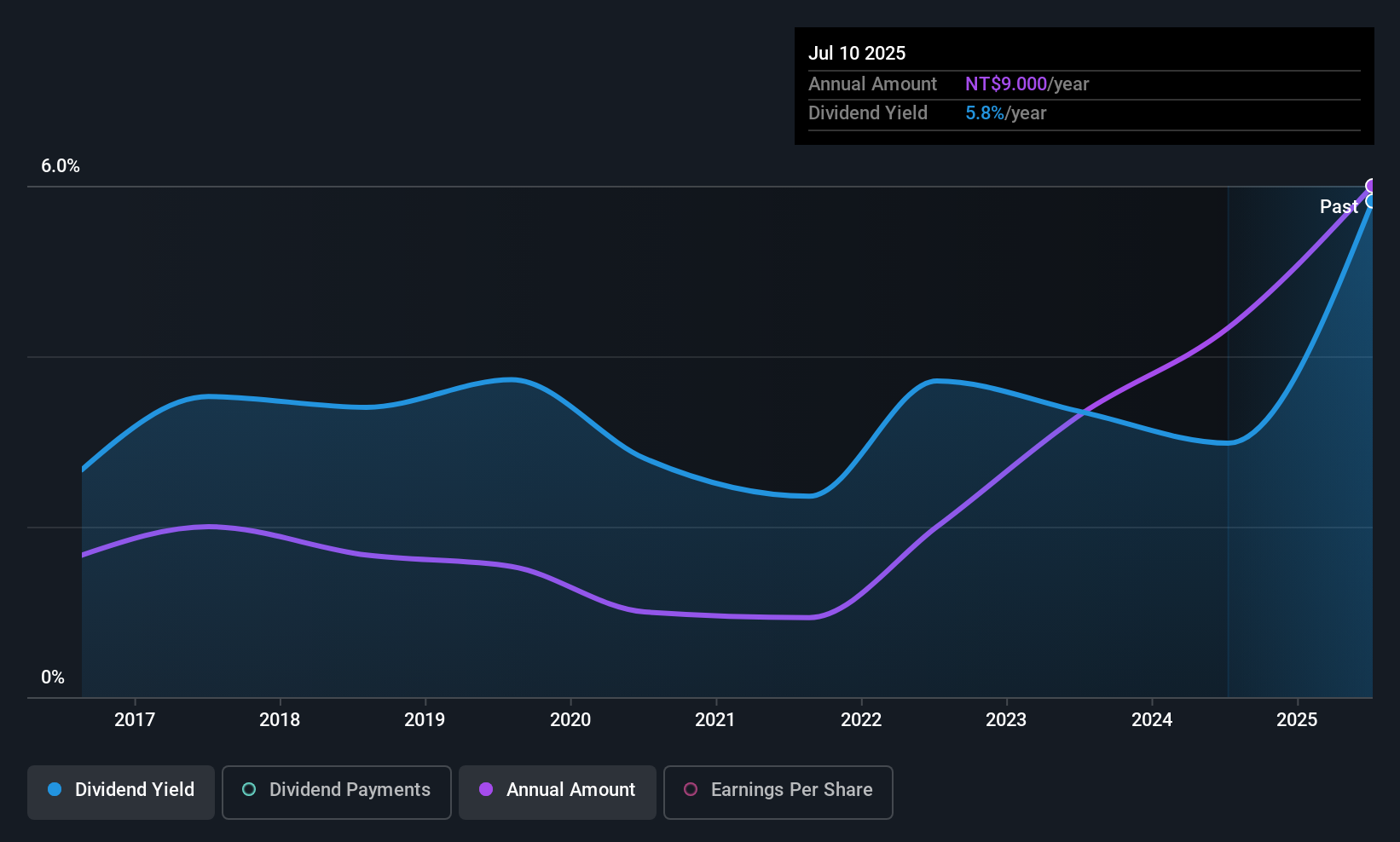

Depo Auto Parts Industrial (TWSE:6605)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Depo Auto Parts Industrial Co., Ltd. manufactures and sells automotive and related lighting products, with a market cap of NT$21.22 billion.

Operations: Depo Auto Parts Industrial Co., Ltd.'s revenue is primarily derived from the research and development, manufacturing, and sales of various automotive lamps, totaling NT$20.18 billion.

Dividend Yield: 6.8%

Depo Auto Parts Industrial's dividend yield of 6.79% ranks in the top 25% of the TW market, with dividends well covered by earnings (63.3% payout ratio) and cash flows (33.2%). Despite a history of volatility, dividends have grown over the past decade. However, recent earnings showed a decline in net income to TWD 72.94 million for Q2 2025 from TWD 812.62 million a year ago, reflecting challenges that could impact future payouts.

- Click here to discover the nuances of Depo Auto Parts Industrial with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Depo Auto Parts Industrial's current price could be quite moderate.

Next Steps

- Unlock our comprehensive list of 1381 Top Global Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6605

Depo Auto Parts Industrial

Manufactures and sells automotive and other related lighting products.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives