- China

- /

- Electronic Equipment and Components

- /

- SZSE:002402

Asian Growth Leaders With High Insider Stakes

Reviewed by Simply Wall St

As global markets grapple with uncertainties, including trade policy and economic growth concerns, Asia remains a focal point for investors seeking opportunities in regions showing resilience. In this context, companies with high insider ownership often stand out as they may align management's interests with those of shareholders, potentially fostering long-term growth and stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 27.3% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Samyang Foods (KOSE:A003230) | 11.6% | 30.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 44.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Siam Cement (SET:SCC)

Simply Wall St Growth Rating: ★★★★☆☆

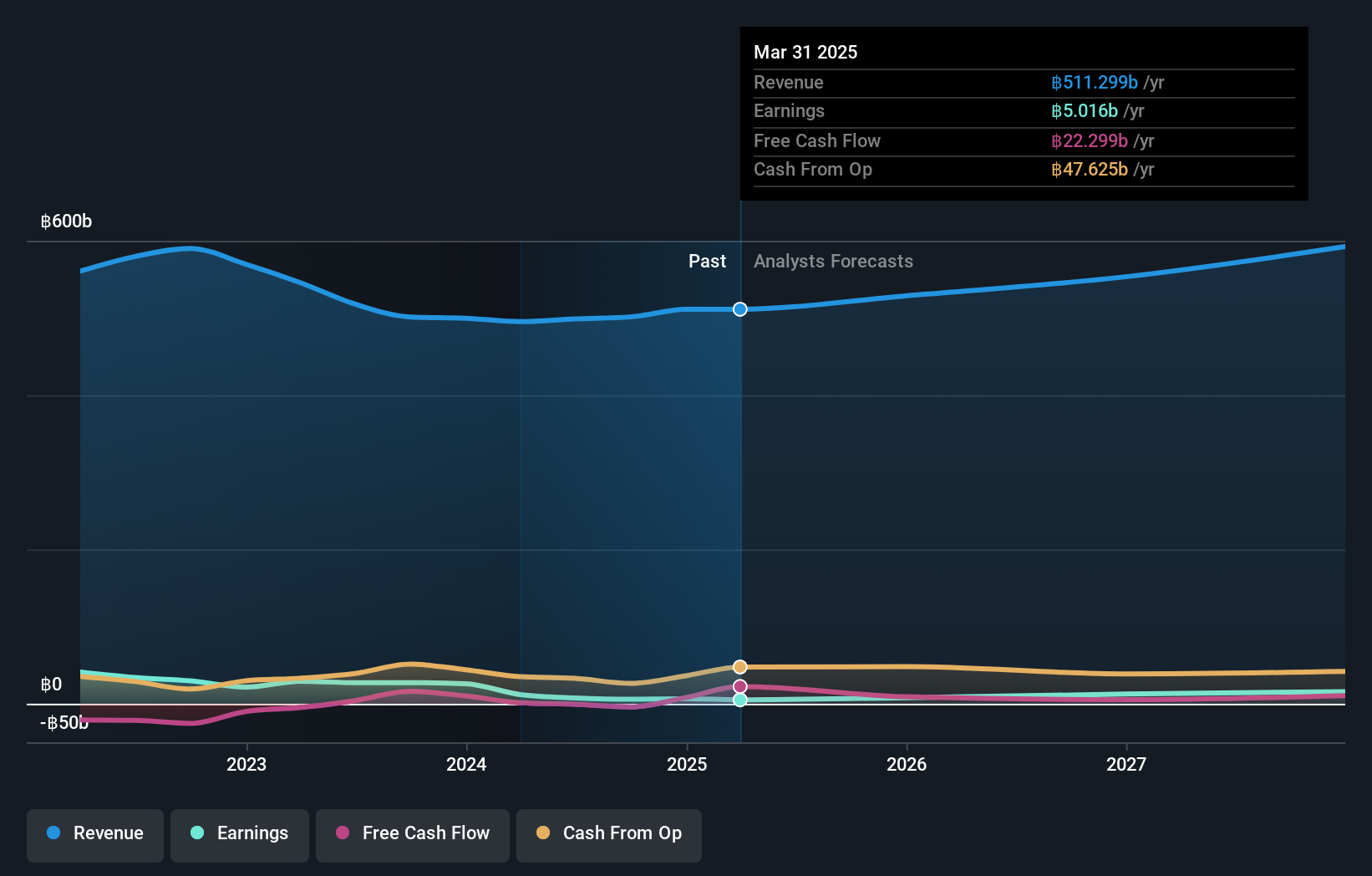

Overview: The Siam Cement Public Company Limited, with a market cap of THB203.40 billion, operates in the cement and building materials, chemicals, and packaging sectors both in Thailand and internationally.

Operations: The company's revenue segments in millions of THB are comprised of SCG Chemicals (SCGC) at 210.30 billion, SCG Smart Living Business and SCG Distribution and Retail Business at 140.17 billion, SCGP at 132.78 billion, SCG Cement and Green Solutions Business at 81.89 billion, and SCG Decor (SCGD) at 25.56 billion.

Insider Ownership: 33.6%

Earnings Growth Forecast: 32.2% p.a.

Siam Cement is poised for significant earnings growth, with forecasts indicating a 32.2% annual increase over the next three years, outpacing the Thai market's 12.9%. However, its Return on Equity is projected to be low at 4.2%, and profit margins have declined from last year. Recently, Siam Cement issued THB 15 billion in debentures at a fixed rate of 3.20% per annum to refinance existing debt, reflecting strategic financial maneuvers amid fluctuating earnings performance.

- Dive into the specifics of Siam Cement here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Siam Cement shares in the market.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co. Ltd, along with its subsidiaries, engages in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally with a market cap of approximately CN¥21.39 billion.

Operations: Shenzhen H&T Intelligent Control Co. Ltd's revenue is derived from the research, development, manufacturing, sales, and marketing of intelligent controller products both domestically and internationally.

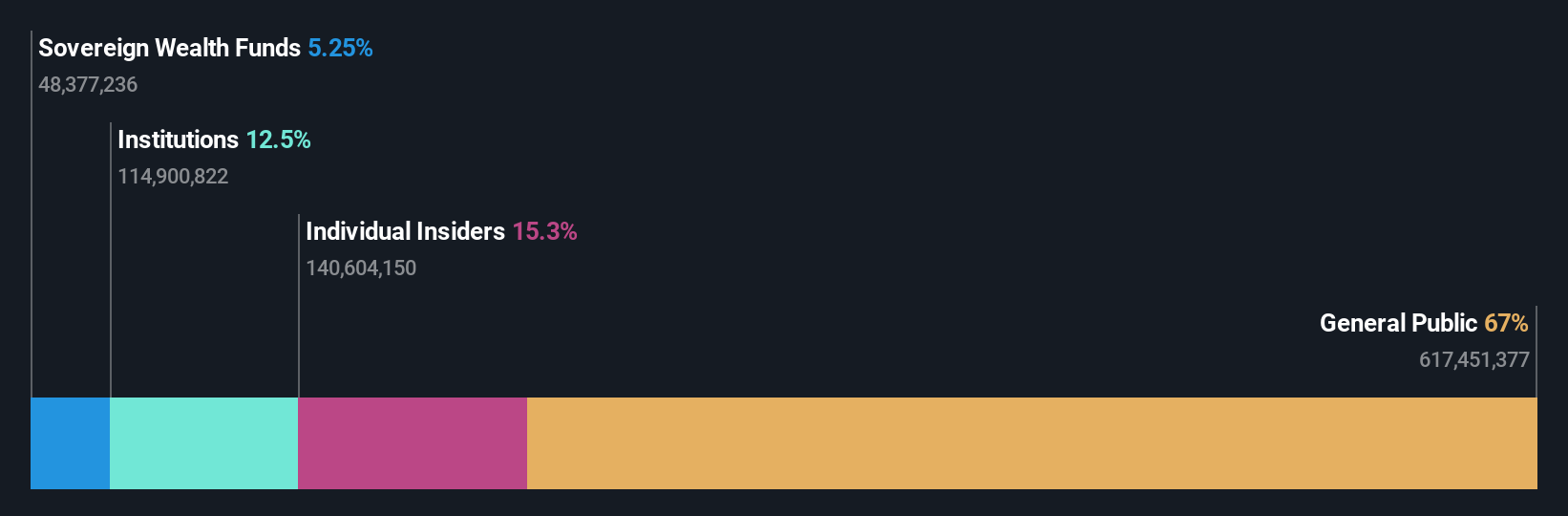

Insider Ownership: 16.2%

Earnings Growth Forecast: 36.9% p.a.

Shenzhen H&T Intelligent Control Ltd. is positioned for robust growth, with earnings expected to increase by 36.9% annually, surpassing the Chinese market's average. Revenue is forecasted to grow at 22.2% per year, exceeding market expectations. Despite this growth trajectory, profit margins have decreased from last year and the Return on Equity is projected to be modest in three years. The company recently held a meeting to discuss repurchasing restricted stocks and amending its capital structure.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen H&T Intelligent ControlLtd.

- The valuation report we've compiled suggests that Shenzhen H&T Intelligent ControlLtd's current price could be inflated.

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ganfeng Lithium Group Co., Ltd. is a manufacturer and seller of lithium products operating in Mainland China, South Korea, Europe, the rest of Asia, North America, and internationally with a market cap of CN¥68.27 billion.

Operations: Revenue segments for Ganfeng Lithium Group include lithium compounds and derivatives (CN¥14.25 billion), lithium metal (CN¥2.17 billion), and battery products (CN¥3.89 billion).

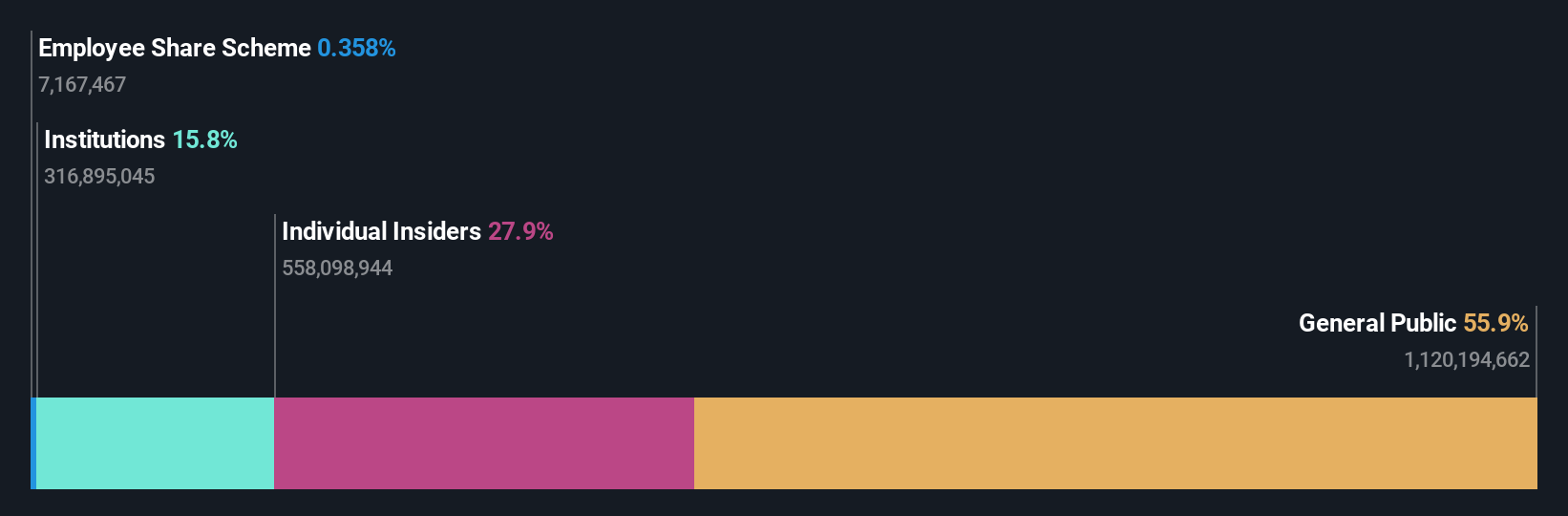

Insider Ownership: 27.8%

Earnings Growth Forecast: 66.6% p.a.

Ganfeng Lithium Group is expected to transition to profitability within three years, with earnings projected to grow at 66.58% annually, surpassing market averages. However, the company's recent guidance indicates a significant net loss for 2024 due to lithium price fluctuations and asset impairments. Despite these challenges, revenue growth is forecasted at 13.5% annually, outpacing the CN market slightly. Recent shareholder meetings focused on financial assistance and guarantees highlight ongoing strategic adjustments amidst volatile conditions.

- Unlock comprehensive insights into our analysis of Ganfeng Lithium Group stock in this growth report.

- Our expertly prepared valuation report Ganfeng Lithium Group implies its share price may be too high.

Key Takeaways

- Navigate through the entire inventory of 642 Fast Growing Asian Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Shenzhen H&T Intelligent ControlLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002402

Shenzhen H&T Intelligent ControlLtd

Researches and develops, manufactures, sells, and markets intelligent controller products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives