3 Prominent Stocks Estimated To Be Priced 20.4% To 48.4% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have weighed on U.S. stocks and contributed to a mixed performance across major indices. While the S&P 500 has seen a pullback after previous gains, growth stocks have managed to outperform value counterparts amid these conditions. In such an environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for investors seeking value in a fluctuating market landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$19.03 | US$37.92 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.27 | US$168.24 | 49.9% |

| California Resources (NYSE:CRC) | US$52.32 | US$104.35 | 49.9% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.05 | HK$53.78 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2706.00 | ¥5411.18 | 50% |

| ChromaDex (NasdaqCM:CDXC) | US$3.58 | US$7.15 | 49.9% |

| Energy One (ASX:EOL) | A$5.53 | A$11.06 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

Let's dive into some prime choices out of the screener.

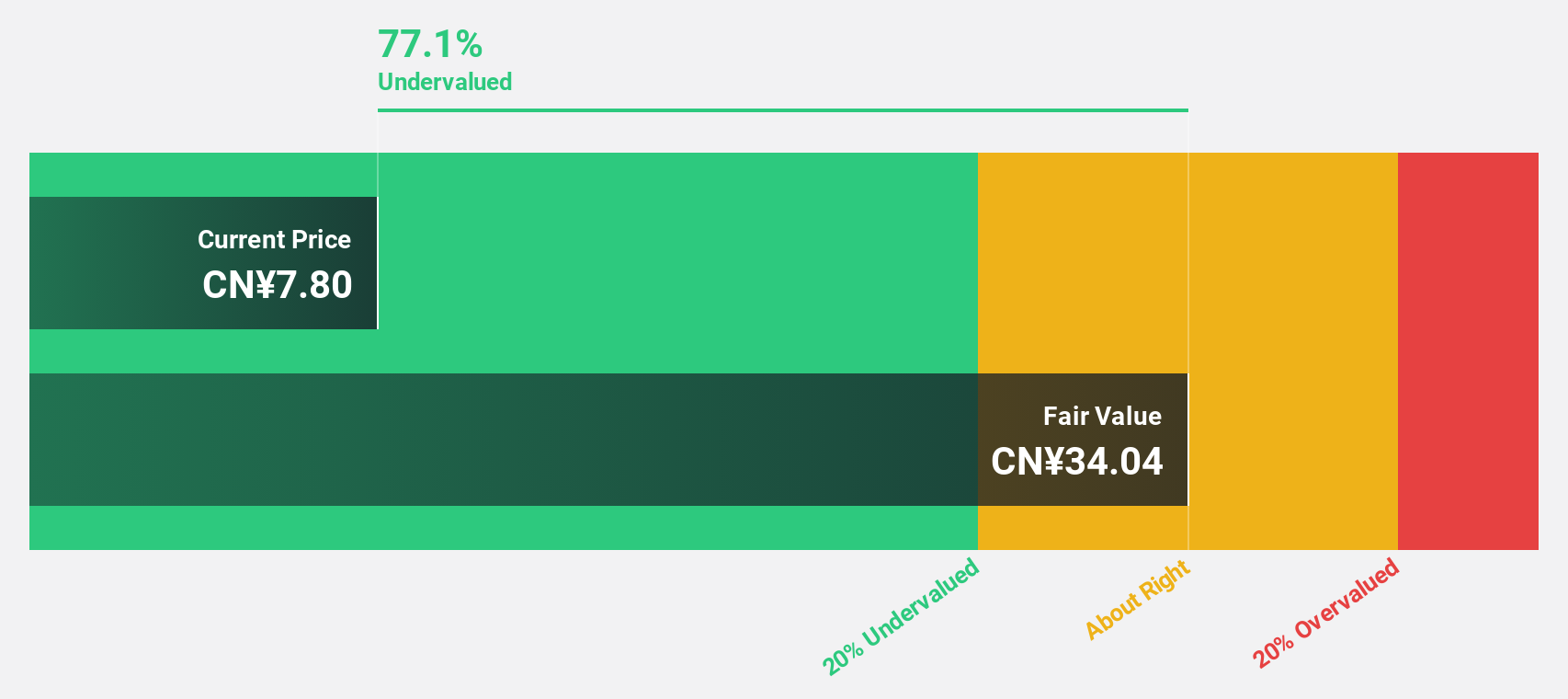

Hunan TV & Broadcast Intermediary (SZSE:000917)

Overview: Hunan TV & Broadcast Intermediary Co., Ltd. operates in the media industry, focusing on television broadcasting and related services, with a market cap of CN¥13.03 billion.

Operations: Hunan TV & Broadcast Intermediary Co., Ltd. generates its revenue primarily from television broadcasting and related services, with a market cap of CN¥13.03 billion.

Estimated Discount To Fair Value: 48.4%

Hunan TV & Broadcast Intermediary is trading at CNY 10.11, significantly below its estimated fair value of CNY 19.6, indicating it is highly undervalued based on cash flows. Despite recent declines in revenue and net income for the nine months ending September 2024, earnings are forecast to grow annually by over 35%, outpacing the Chinese market's expected growth of 25%. Revenue is also projected to increase at a rate of 15.4% per year.

- Our growth report here indicates Hunan TV & Broadcast Intermediary may be poised for an improving outlook.

- Dive into the specifics of Hunan TV & Broadcast Intermediary here with our thorough financial health report.

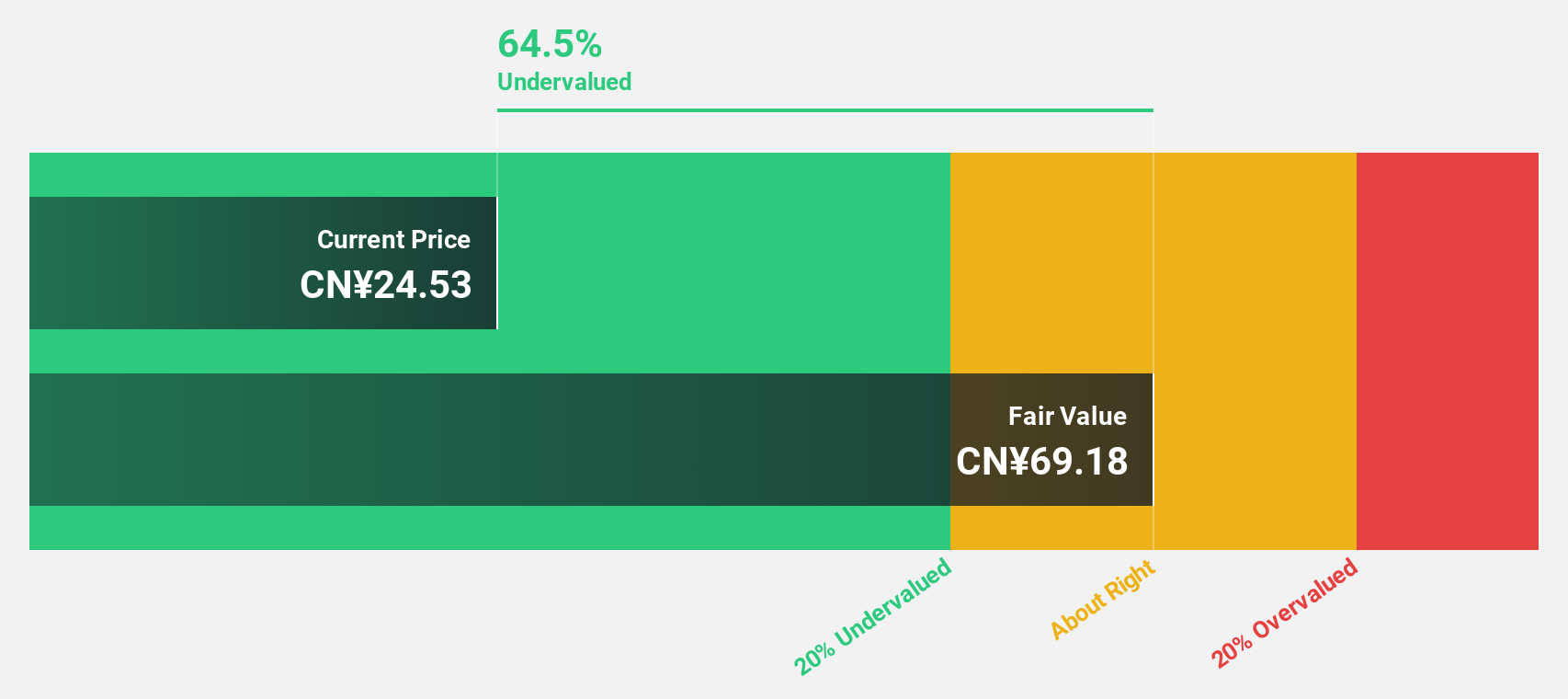

Hangzhou Oxygen Plant GroupLtd (SZSE:002430)

Overview: Hangzhou Oxygen Plant Group Co., Ltd. is a global manufacturer and seller of air separation equipment, petrochemical equipment, and other gas products, with a market cap of CN¥25.10 billion.

Operations: Revenue Segments (in millions of CN¥): Air separation equipment: 3,500; Petrochemical equipment: 2,100; Other gas products: 1,800.

Estimated Discount To Fair Value: 40.3%

Hangzhou Oxygen Plant Group Ltd. is trading at CNY 25.16, significantly below its estimated fair value of CNY 42.12, suggesting it is highly undervalued based on cash flows. Despite a drop in net income for the nine months ending September 2024, earnings are forecast to grow annually by approximately 27%, surpassing the Chinese market's expected growth of 25%. Revenue is also projected to rise at a rate of 15.4% per year.

- Upon reviewing our latest growth report, Hangzhou Oxygen Plant GroupLtd's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Hangzhou Oxygen Plant GroupLtd stock in this financial health report.

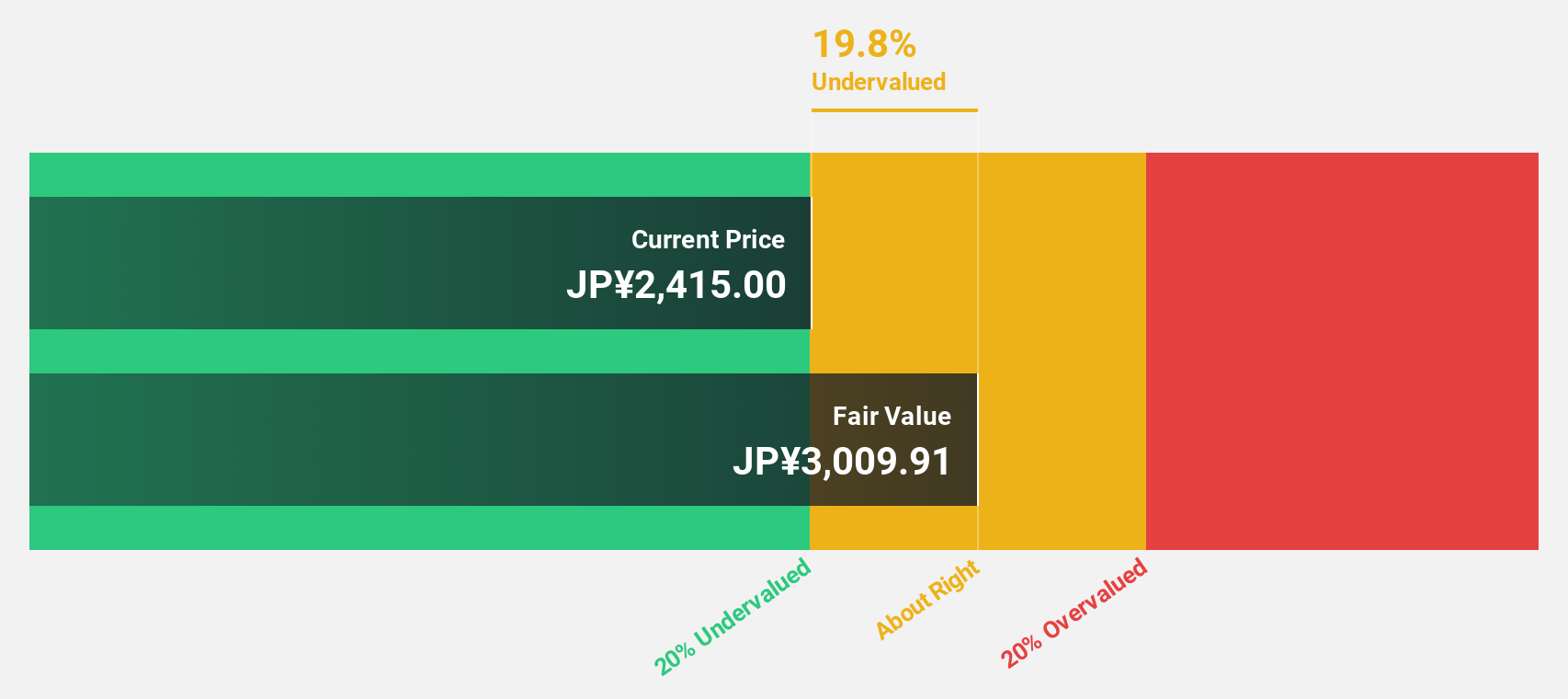

Shiseido Company (TSE:4911)

Overview: Shiseido Company, Limited is involved in the production and sale of cosmetics both in Japan and internationally, with a market cap of ¥1.35 trillion.

Operations: The company's revenue segments include the Japan Business at ¥279.41 billion, China Business at ¥253.08 billion, Travel Retail Business at ¥122.20 billion, Americas Business at ¥120.34 billion, EMEA Business at ¥134.42 billion, and Asia-Pacific Business at ¥76.29 billion.

Estimated Discount To Fair Value: 20.4%

Shiseido Company is trading at ¥3,360, over 20% below its estimated fair value of ¥4,220.97, indicating it is undervalued based on cash flows. Despite recent executive changes and a completed share buyback program worth ¥1.04 billion for performance-linked compensation, the company expects significant annual earnings growth of 35.8%, outpacing Japan's market average of 8.8%. However, profit margins have decreased from last year's levels.

- Insights from our recent growth report point to a promising forecast for Shiseido Company's business outlook.

- Click to explore a detailed breakdown of our findings in Shiseido Company's balance sheet health report.

Make It Happen

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 962 more companies for you to explore.Click here to unveil our expertly curated list of 965 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunan TV & Broadcast Intermediary might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000917

Hunan TV & Broadcast Intermediary

Hunan TV & Broadcast Intermediary Co., Ltd.

Excellent balance sheet with reasonable growth potential.