- China

- /

- Auto Components

- /

- SZSE:002662

3 Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets face pressure from rising U.S. Treasury yields and tepid economic growth, investors are seeking stable returns amidst uncertainty. In such an environment, dividend stocks can offer a reliable income stream, making them a valuable addition to any portfolio looking for steady performance despite market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.13% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.44% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.97% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.79% | ★★★★★☆ |

Click here to see the full list of 2029 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

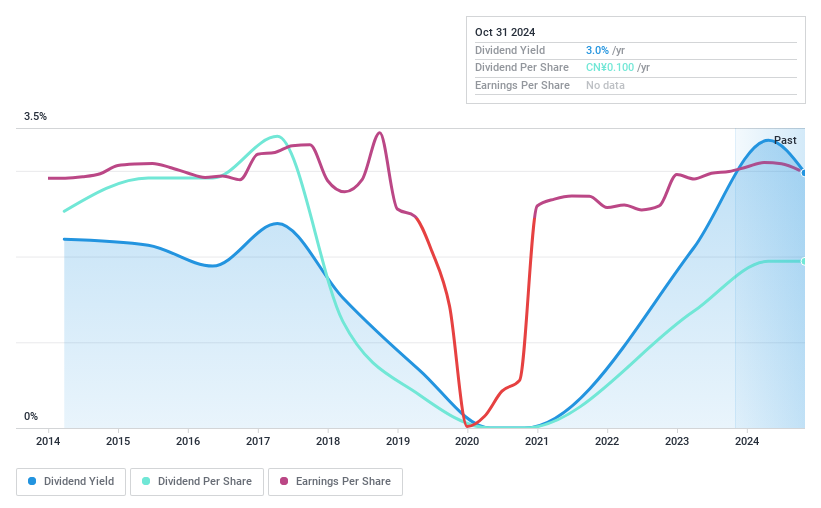

Qingdao East Steel Tower StockLtd (SZSE:002545)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Qingdao East Steel Tower Stock Co. Ltd, with a market cap of CN¥8.38 billion, manufactures and markets steel structure products in the People's Republic of China.

Operations: Qingdao East Steel Tower Stock Co. Ltd generates its revenue through the manufacturing and marketing of steel structure products within China.

Dividend Yield: 4.3%

Qingdao East Steel Tower offers a dividend yield of 4.3%, placing it in the top 25% of CN market dividend payers, with dividends well-covered by earnings and cash flows at payout ratios of 63.1% and 40%, respectively. Despite trading at a favorable price-to-earnings ratio compared to the market, its dividend history has been volatile over the past decade, indicating some unreliability despite recent growth in payments.

- Take a closer look at Qingdao East Steel Tower StockLtd's potential here in our dividend report.

- Our expertly prepared valuation report Qingdao East Steel Tower StockLtd implies its share price may be lower than expected.

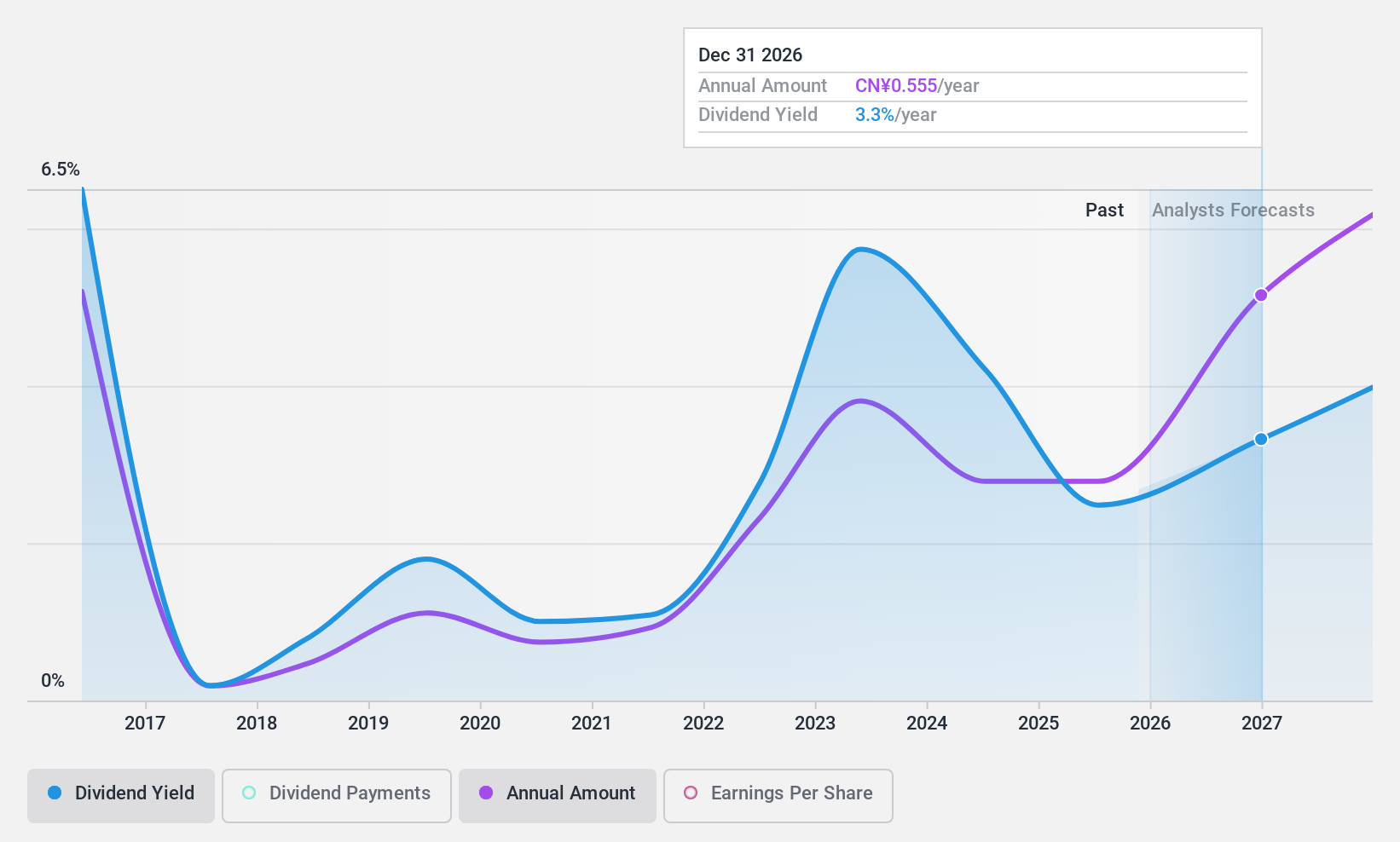

Beijing WKW Automotive PartsLtd (SZSE:002662)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing WKW Automotive Parts Co., Ltd. manufactures and sells automotive interior and exterior trim systems in China, with a market cap of CN¥4.89 billion.

Operations: Beijing WKW Automotive Parts Co., Ltd. generates revenue through the production and sale of automotive interior and exterior trim systems in China.

Dividend Yield: 3%

Beijing WKW Automotive Parts Ltd. trades at a significant discount to its fair value, but its dividend reliability is questionable due to a volatile payout history over the past decade. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 31.3% and 52.6%, respectively. The current yield of 2.98% ranks in the top 25% of CN market payers, although dividend growth has been inconsistent historically.

- Click here to discover the nuances of Beijing WKW Automotive PartsLtd with our detailed analytical dividend report.

- The analysis detailed in our Beijing WKW Automotive PartsLtd valuation report hints at an deflated share price compared to its estimated value.

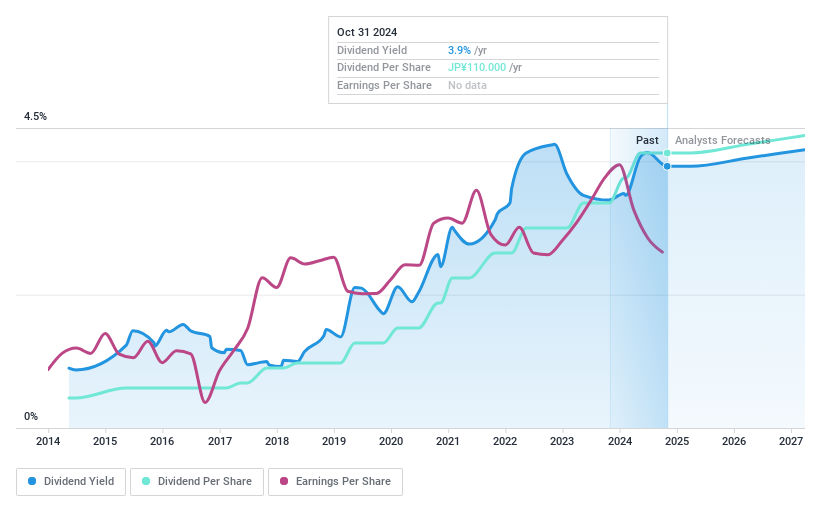

Yokogawa Bridge Holdings (TSE:5911)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yokogawa Bridge Holdings Corp. specializes in constructing steel bridge projects both in Japan and internationally, with a market cap of ¥112.72 billion.

Operations: Yokogawa Bridge Holdings Corp. generates revenue primarily from its steel bridge construction projects in both domestic and international markets.

Dividend Yield: 3.9%

Yokogawa Bridge Holdings offers a stable dividend history with consistent growth over the past decade. Despite trading at 58% below estimated fair value, its dividends are not supported by free cash flow, raising sustainability concerns. The payout ratio of 40.5% indicates earnings coverage, but cash flow issues persist. A recent share buyback program aims to enhance shareholder returns and capital efficiency, although revised earnings guidance reflects challenges in profit growth and production volumes.

- Get an in-depth perspective on Yokogawa Bridge Holdings' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Yokogawa Bridge Holdings' share price might be too pessimistic.

Make It Happen

- Embark on your investment journey to our 2029 Top Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing WKW Automotive PartsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002662

Beijing WKW Automotive PartsLtd

Manufactures and sells automotive interior and exterior trim systems in China.

Flawless balance sheet, good value and pays a dividend.