Three Undiscovered Gems To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have shown notable movement, with the Russell 2000 Index leading gains despite remaining slightly below its record high. Amidst these dynamic market conditions, identifying promising small-cap stocks can offer investors opportunities to diversify and potentially enhance their portfolios, especially when focusing on companies poised for growth in a shifting economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Kappa Create | 83.86% | 0.22% | 14.37% | ★★★★★☆ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.53% | 16.85% | 21.57% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Inkeverse Group (SEHK:3700)

Simply Wall St Value Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People’s Republic of China, with a market capitalization of HK$2.21 billion.

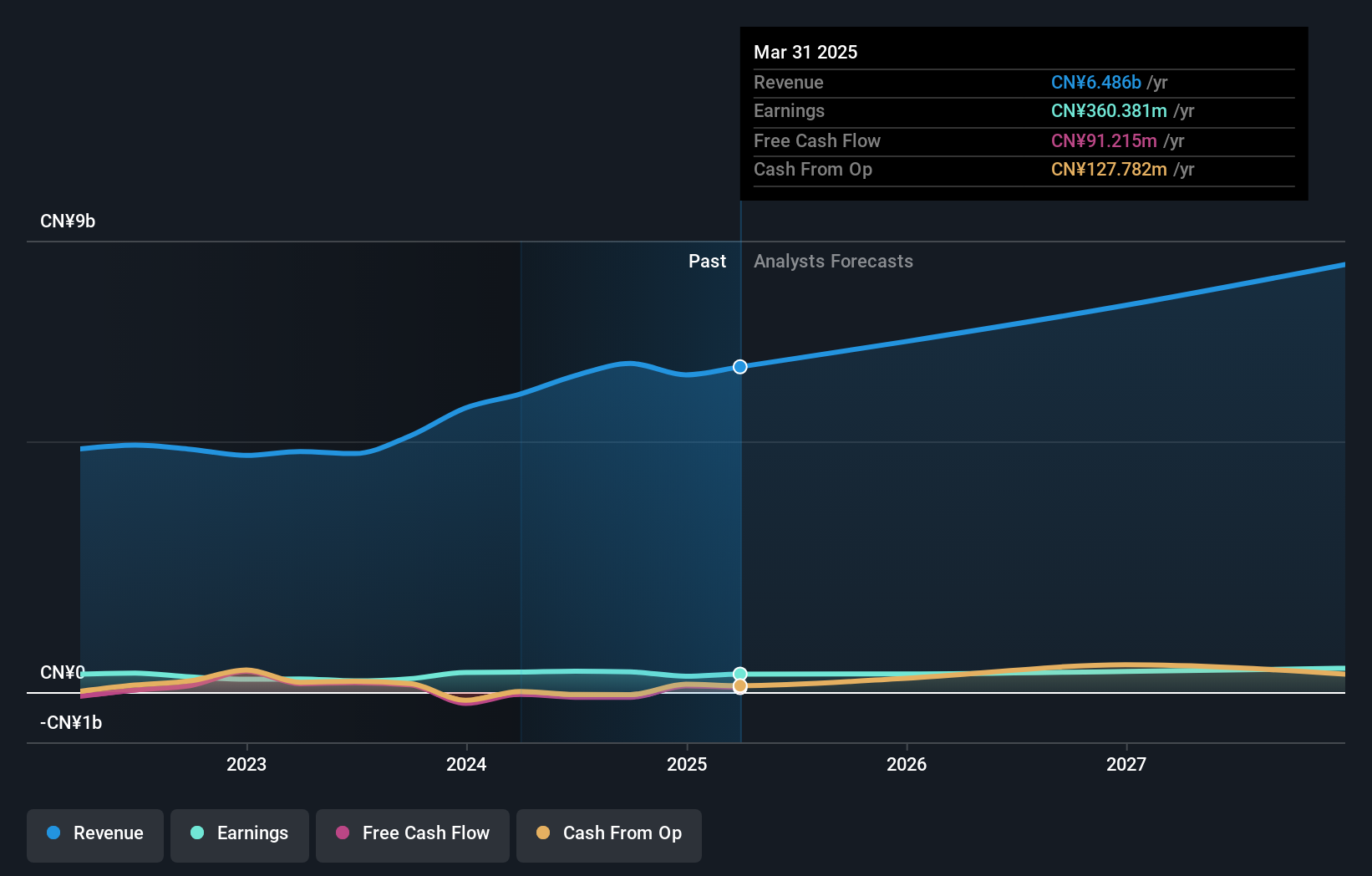

Operations: Inkeverse Group generates revenue primarily through its live streaming business, which reported CN¥7.25 billion in revenue. The company's financial performance is influenced by its ability to manage costs associated with operating these platforms.

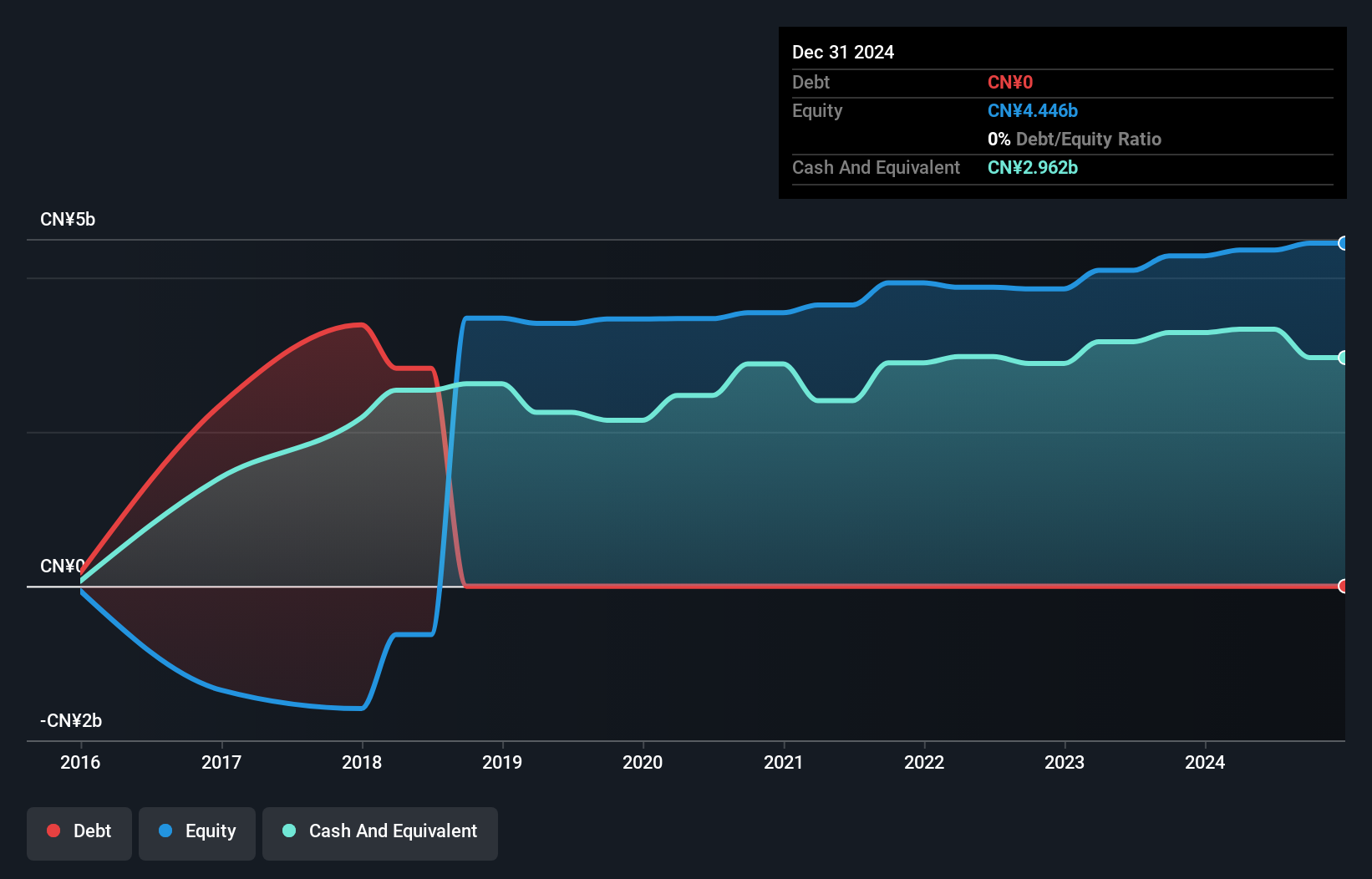

Inkeverse Group, a relatively smaller player in the market, showcases impressive earnings growth of 136.1% over the past year, outpacing the Interactive Media and Services industry which saw a 22.8% drop. With a price-to-earnings ratio of 7.7x compared to Hong Kong's market average of 10x, it seems undervalued. Despite reporting sales of CNY 3.53 billion for the first half of 2024, net income fell to CNY 120.6 million from CNY 190.35 million last year—pointing to potential operational challenges or increased expenses impacting profitability despite positive free cash flow and debt-free status enhancing financial stability.

- Unlock comprehensive insights into our analysis of Inkeverse Group stock in this health report.

Review our historical performance report to gain insights into Inkeverse Group's's past performance.

Beijing Lier High-temperature MaterialsLtd (SZSE:002392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Lier High-temperature Materials Co., Ltd. specializes in the production of high-temperature resistant materials and has a market cap of CN¥4.74 billion.

Operations: Beijing Lier generates revenue primarily from the sale of high-temperature resistant materials. The company has a market capitalization of CN¥4.74 billion, reflecting its financial standing in the industry.

Beijing Lier High-temperature Materials is making waves with its robust financial performance, reporting a net income of CNY 309.81 million for the nine months ended September 2024, up from CNY 300.64 million a year prior. This company has seen earnings growth of 51.5% over the past year, outpacing the broader Metals and Mining industry which shrank by -3%. With a price-to-earnings ratio of just 12.8x compared to the CN market's average of 36.3x, it trades at an attractive valuation. Additionally, recent buybacks totaling CNY 13.46 million underscore management's confidence in its trajectory.

Kiyo Bank (TSE:8370)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kiyo Bank, Ltd. is a Japanese financial institution offering a range of banking products and services to individuals, corporates, and businesses, with a market cap of ¥120.46 billion.

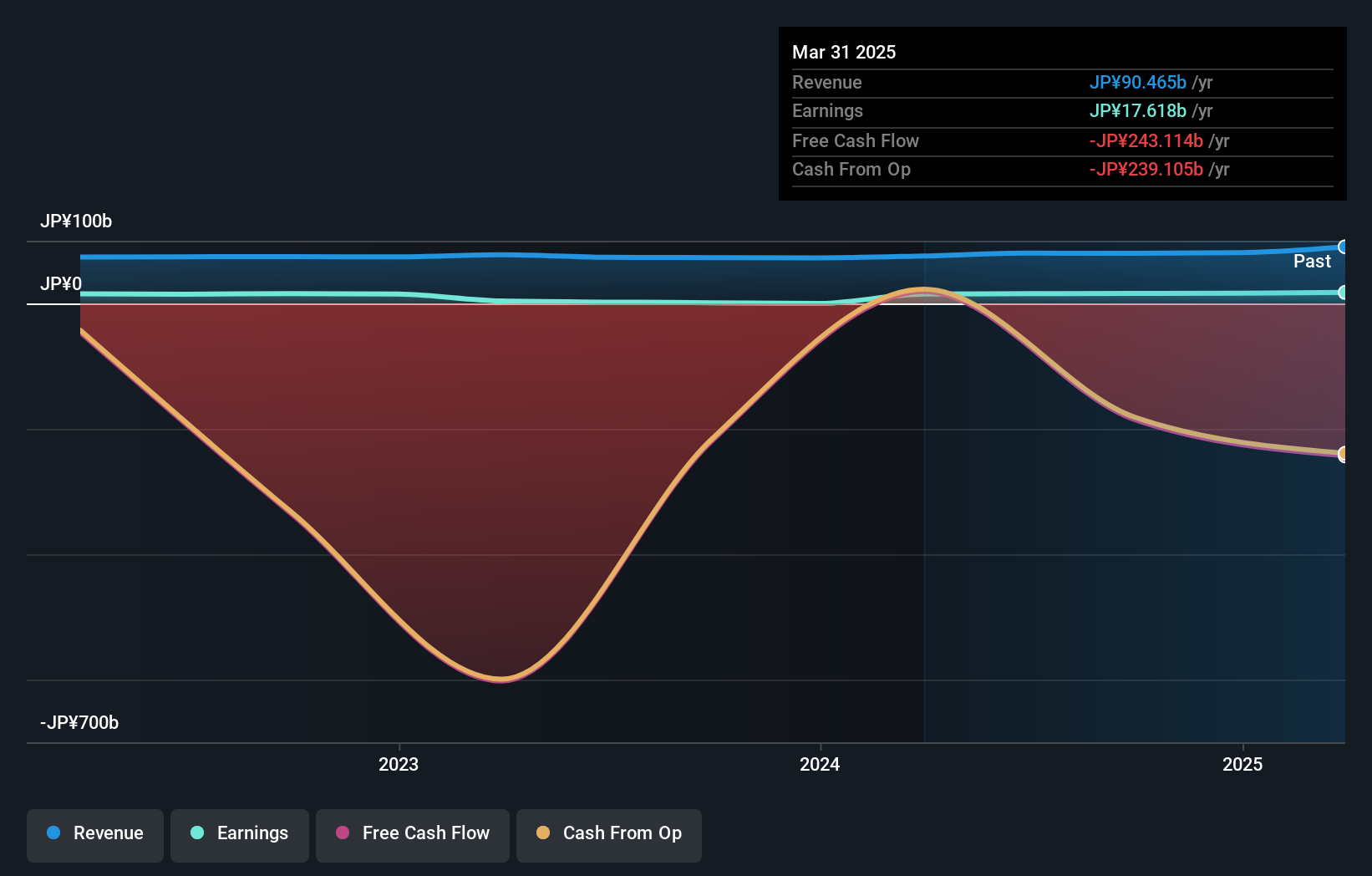

Operations: Kiyo Bank generates revenue primarily from its banking segment, which accounts for ¥72.39 billion. The company's market cap is approximately ¥120.46 billion.

With total assets of ¥5,925.8 billion and equity at ¥232.3 billion, Kiyo Bank stands out with its robust financial footing. The bank's reliance on low-risk funding sources is evident with 84% of liabilities covered by customer deposits, minimizing external borrowing risks. Despite a modest net interest margin of 0.9%, earnings have surged by an impressive 619% over the past year, outperforming the industry average significantly. However, it grapples with an insufficient allowance for bad loans at 1.6% of total loans but has completed a notable share repurchase program worth ¥2,999 million covering 2.54% shares recently.

- Navigate through the intricacies of Kiyo Bank with our comprehensive health report here.

Evaluate Kiyo Bank's historical performance by accessing our past performance report.

Next Steps

- Investigate our full lineup of 4673 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiyo Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8370

Kiyo Bank

Provides various banking products and services to individual and corporate customers in Japan.

Established dividend payer and good value.

Market Insights

Community Narratives