Discovering Opportunities: 3 Penny Stocks With Market Caps Under US$2B

Reviewed by Simply Wall St

As the global markets navigate a mixed landscape of rising treasury yields and declining consumer confidence, investors are increasingly looking for opportunities beyond the traditional large-cap stocks. Penny stocks, though often associated with speculative trading, can present unique growth potential when backed by strong financials and sound fundamentals. In this article, we explore three penny stocks that stand out as promising options for those seeking to tap into smaller companies with potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$42.73B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,813 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanJi E-Commerce Co., LTD operates in China, offering brand authorization, retail, and mobile Internet marketing services, with a market cap of CN¥10.37 billion.

Operations: The company generates revenue of CN¥3.03 billion from its operations in China.

Market Cap: CN¥10.37B

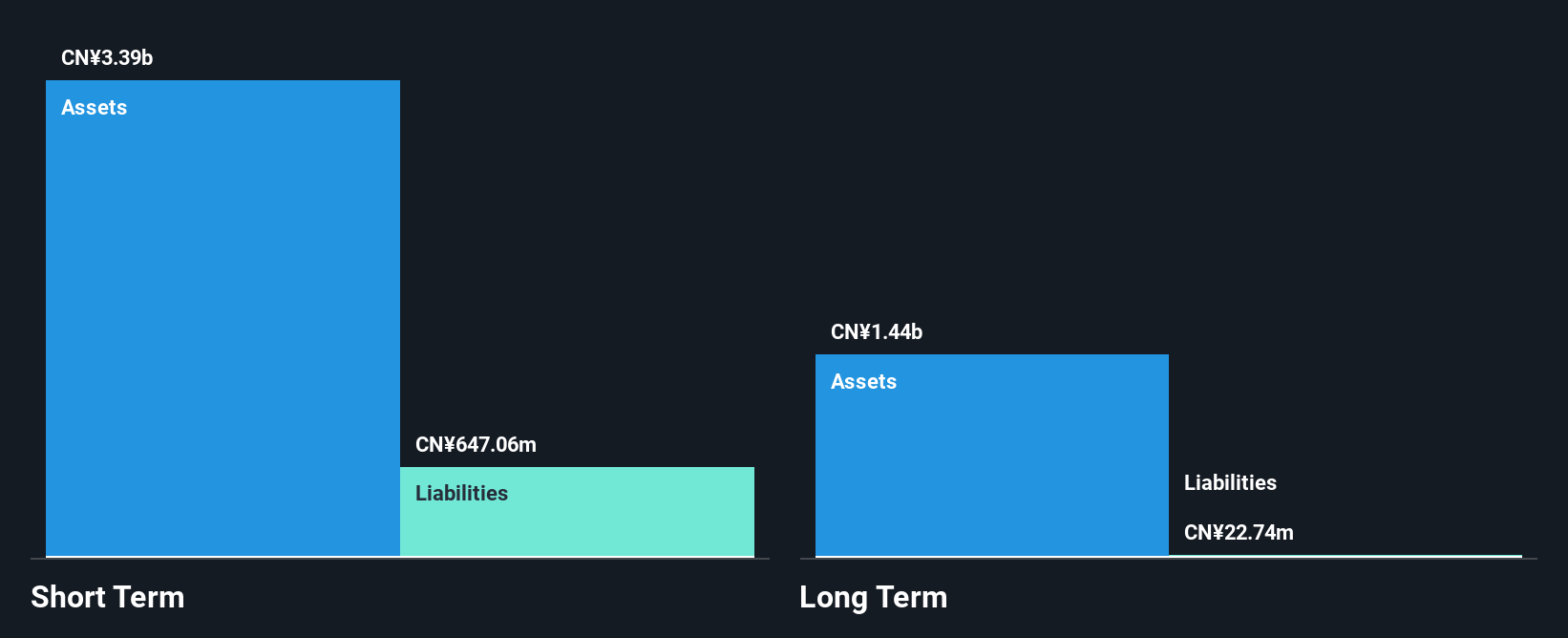

NanJi E-Commerce has recently reported increased sales of CN¥2.41 billion for the nine months ending September 2024, up from CN¥2.07 billion the previous year, yet net income declined to CN¥54.23 million from CN¥83.28 million. Despite becoming profitable in the last year and having no debt, its earnings have been impacted by a large one-off gain of CN¥45.7 million and remain volatile with a low return on equity at 1.7%. The company's short-term assets significantly cover both short-term and long-term liabilities, but its dividend remains poorly covered by earnings or free cash flows.

- Dive into the specifics of NanJi E-Commerce here with our thorough balance sheet health report.

- Evaluate NanJi E-Commerce's historical performance by accessing our past performance report.

Puyang Refractories Group (SZSE:002225)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Puyang Refractories Group Co., Ltd. operates in the research, development, production, and sales of shaped, unshaped, and functional refractory products both in China and internationally with a market cap of CN¥4.93 billion.

Operations: No specific revenue segments are reported for Puyang Refractories Group Co., Ltd.

Market Cap: CN¥4.93B

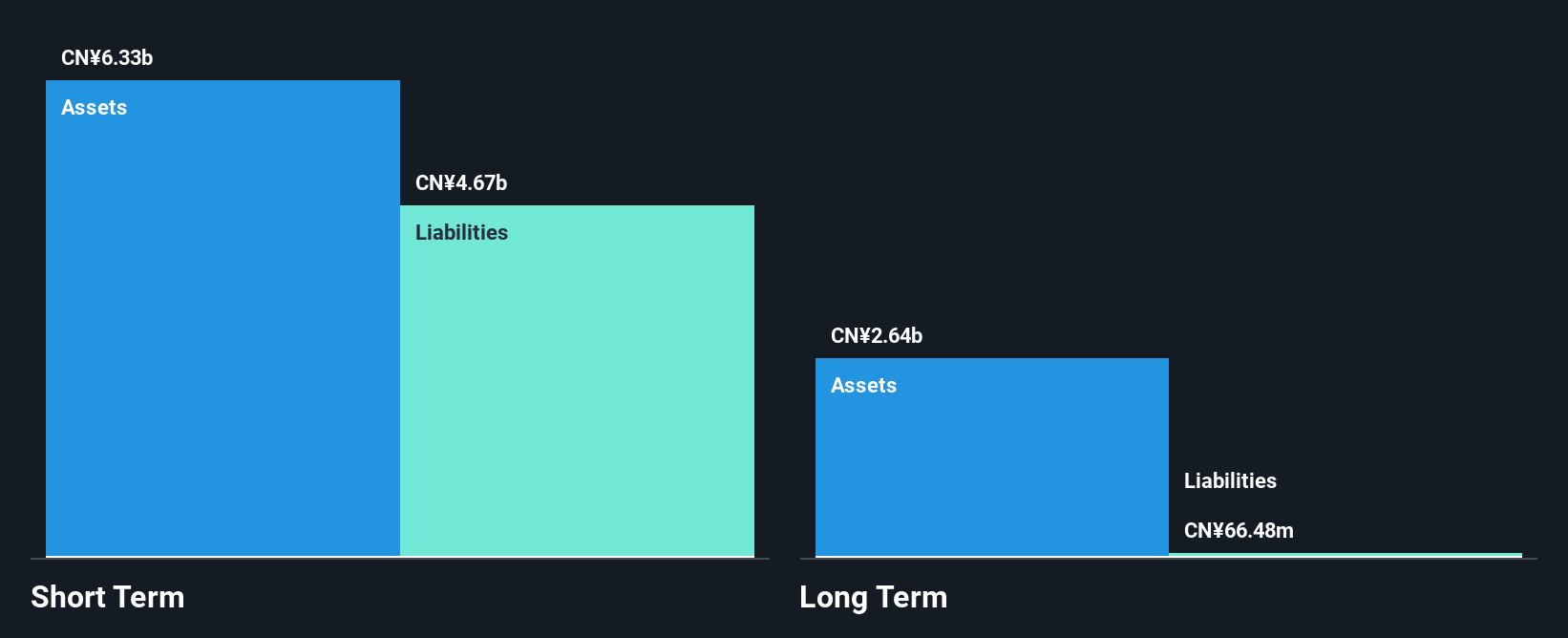

Puyang Refractories Group's financial health presents a mixed picture, with short-term assets of CN¥5.5 billion comfortably covering both short and long-term liabilities, but a high net debt to equity ratio of 54.7% raises concerns about leverage. The company's revenue for the first nine months of 2024 was CN¥4 billion, slightly down from the previous year, while net income declined to CN¥122.9 million from CN¥207.65 million. Earnings have been negatively impacted by declining profit margins and negative growth over the past year, though operating cash flow adequately covers debt obligations at 27.6%.

- Click here and access our complete financial health analysis report to understand the dynamics of Puyang Refractories Group.

- Gain insights into Puyang Refractories Group's outlook and expected performance with our report on the company's earnings estimates.

Shenzhen Hemei GroupLTD (SZSE:002356)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shenzhen Hemei Group Co., LTD. operates in the sale of clothing and accessories both within China and internationally, with a market capitalization of CN¥4.31 billion.

Operations: No specific revenue segments have been reported for Shenzhen Hemei Group Co., LTD.

Market Cap: CN¥4.31B

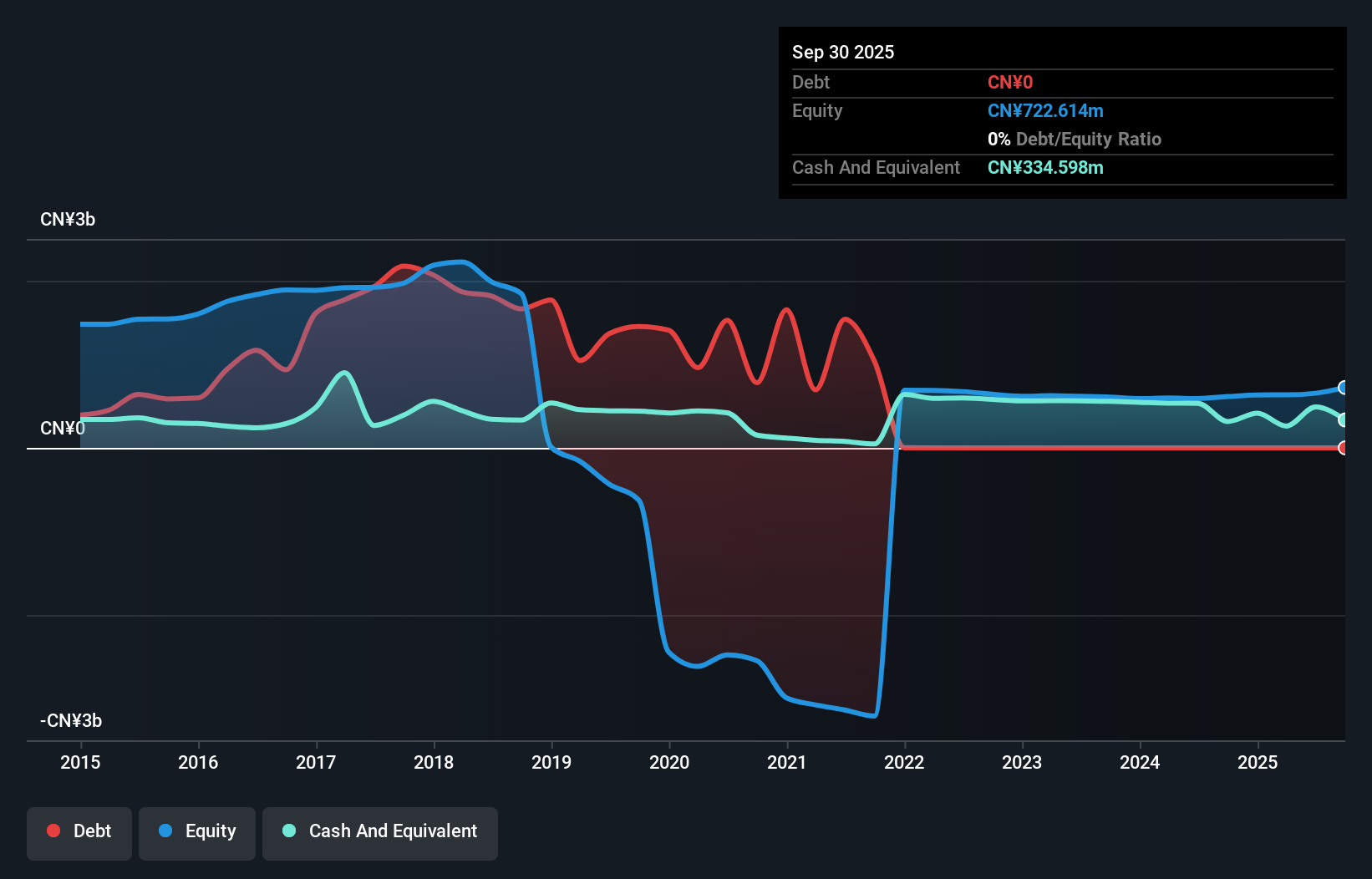

Shenzhen Hemei Group Co., LTD. demonstrates a complex financial landscape typical of many penny stocks, with short-term assets of CN¥649.8 million comfortably covering both short and long-term liabilities, indicating sound liquidity management. Despite being debt-free, the company remains unprofitable with a negative return on equity of -12.22% and reported a net loss of CN¥31.89 million for the first nine months of 2024. Recent strategic activities include an acquisition by Beijing Yuan Program Asset Management Co., Ltd., which acquired a 5% stake in November 2024, potentially signaling investor confidence amidst ongoing challenges in profitability and board experience.

- Unlock comprehensive insights into our analysis of Shenzhen Hemei GroupLTD stock in this financial health report.

- Gain insights into Shenzhen Hemei GroupLTD's past trends and performance with our report on the company's historical track record.

Where To Now?

- Explore the 5,813 names from our Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand authorization, retail, and mobile Internet marketing services in China.

Flawless balance sheet slight.