- China

- /

- Auto Components

- /

- SHSE:605228

Uncovering None And 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week, small-cap stocks have seen mixed performance with the Russell 2000 Index showing modest gains amid broader economic uncertainties like declining consumer confidence and manufacturing orders in the U.S. Despite these challenges, identifying promising small-cap companies can be crucial for investors seeking growth opportunities, as such stocks often possess unique advantages like innovation potential and market agility that can thrive even in volatile conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| AuMas Resources Berhad | NA | 14.09% | 57.21% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vietnam Container Shipping | 47.45% | 7.52% | -7.54% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Shanghai Sinotec (SHSE:603121)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Sinotec Co., Ltd. focuses on the development, production, and sale of auto parts in China with a market capitalization of CN¥3.73 billion.

Operations: Sinotec generates revenue primarily through the sale of auto parts, with a focus on production efficiency. The company has experienced variations in its net profit margin, reflecting changes in operational costs and pricing strategies.

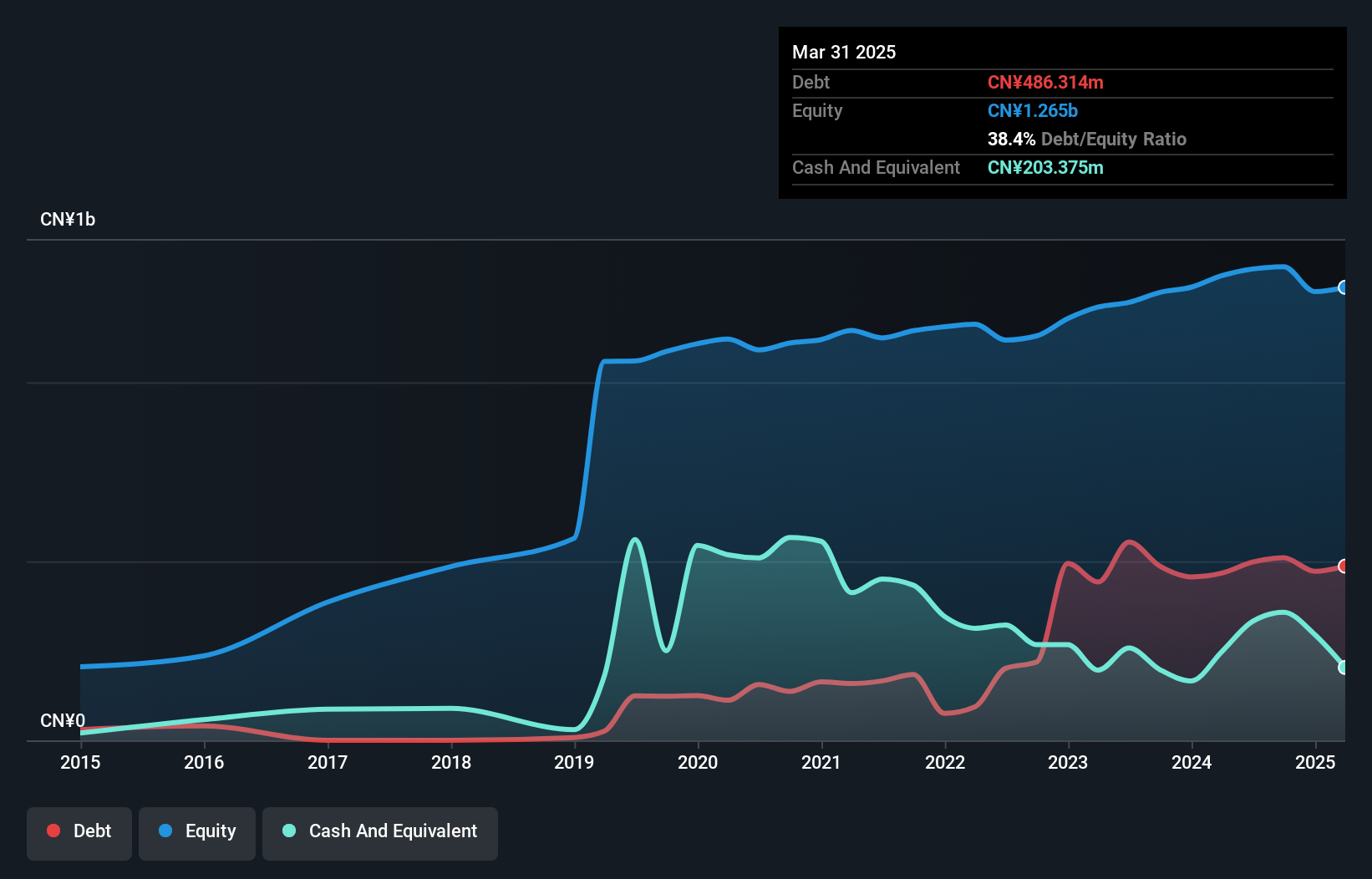

Shanghai Sinotec, a smaller player in the auto components sector, has shown robust earnings growth of 17.4% over the past year, outpacing industry averages. The company boasts high-quality earnings and trades at 26.9% below its estimated fair value, suggesting potential undervaluation. However, its debt to equity ratio has climbed from 11.4% to 38.5% over five years, indicating increased leverage. Recent reports show sales for the first nine months of 2024 reached CNY 941.87 million (about US$129 million), with net income at CNY 71.24 million (about US$9 million), down from CNY 96.53 million a year earlier due to rising costs or other factors impacting margins.

Shentong Technology Group (SHSE:605228)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shentong Technology Group Co., Ltd is engaged in the development, manufacturing, and sale of automotive parts in China with a market capitalization of CN¥4.53 billion.

Operations: The primary revenue stream for Shentong Technology Group comes from the sales of auto parts and molds, generating CN¥1.55 billion.

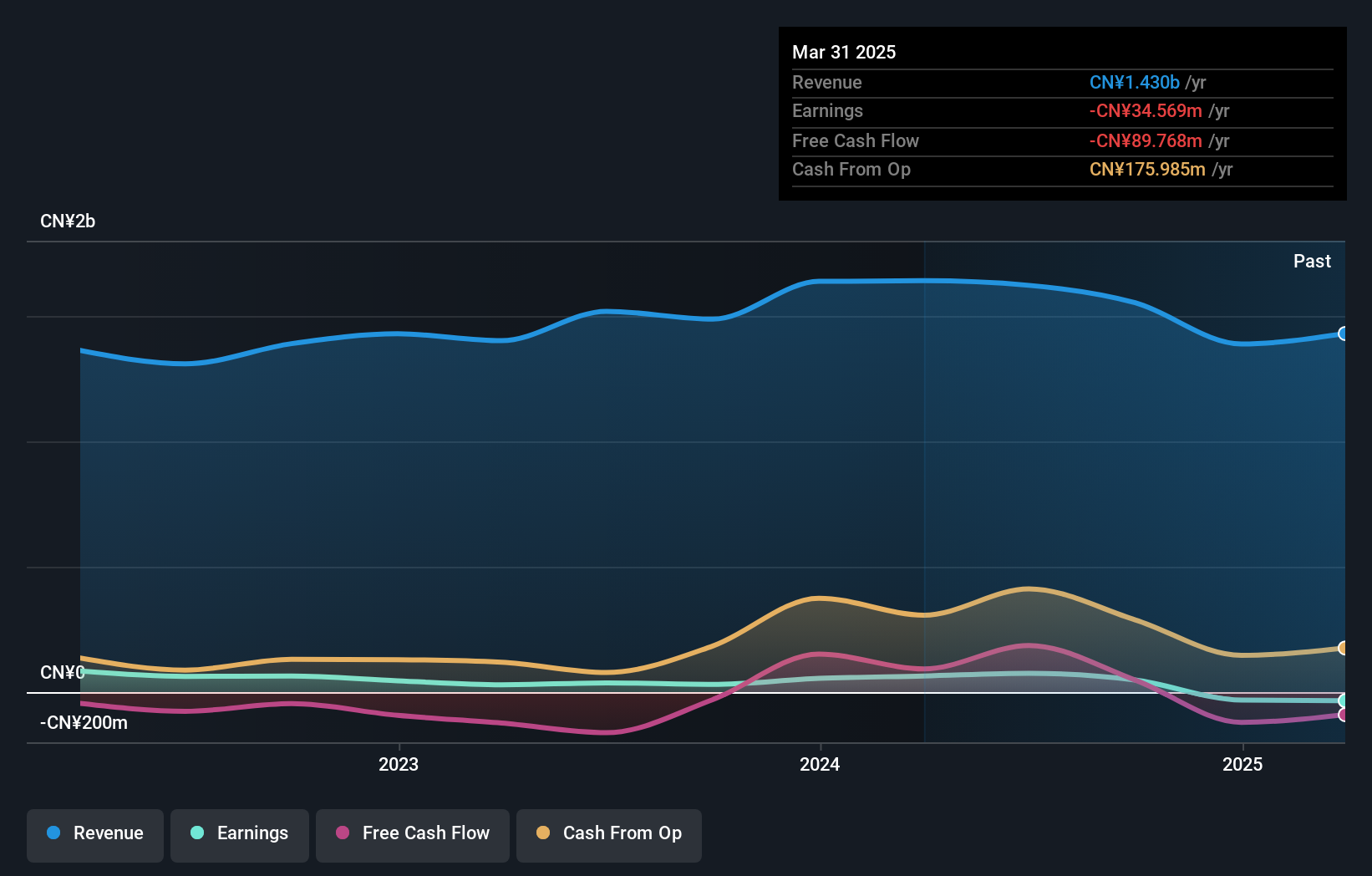

Shentong Technology Group, operating in the auto components sector, showcases a mixed performance. Its earnings have grown by 56.9% over the past year, significantly outpacing the industry's 10.5% growth rate. Despite this positive trend, Shentong's revenue for the nine months ending September 2024 was CNY 966.92 million, down from CNY 1.05 billion a year ago. Net income also saw a decrease to CNY 16.56 million from CNY 22.84 million previously reported for the same period last year. The company has been proactive with its capital management, repurchasing approximately 6.59 million shares worth CNY 52.94 million in recent buyback activities completed by December 2024.

- Click here and access our complete health analysis report to understand the dynamics of Shentong Technology Group.

Understand Shentong Technology Group's track record by examining our Past report.

Focus Lightings Tech (SZSE:300708)

Simply Wall St Value Rating: ★★★★★★

Overview: Focus Lightings Tech Co., Ltd. is involved in the research, development, production, and sale of compound optoelectronic semiconductor materials both in China and internationally, with a market cap of CN¥8.04 billion.

Operations: Focus Lightings Tech generates revenue primarily from the sale of compound optoelectronic semiconductor materials. The company's financial performance includes a market cap of CN¥8.04 billion, and its cost structure significantly impacts profitability metrics.

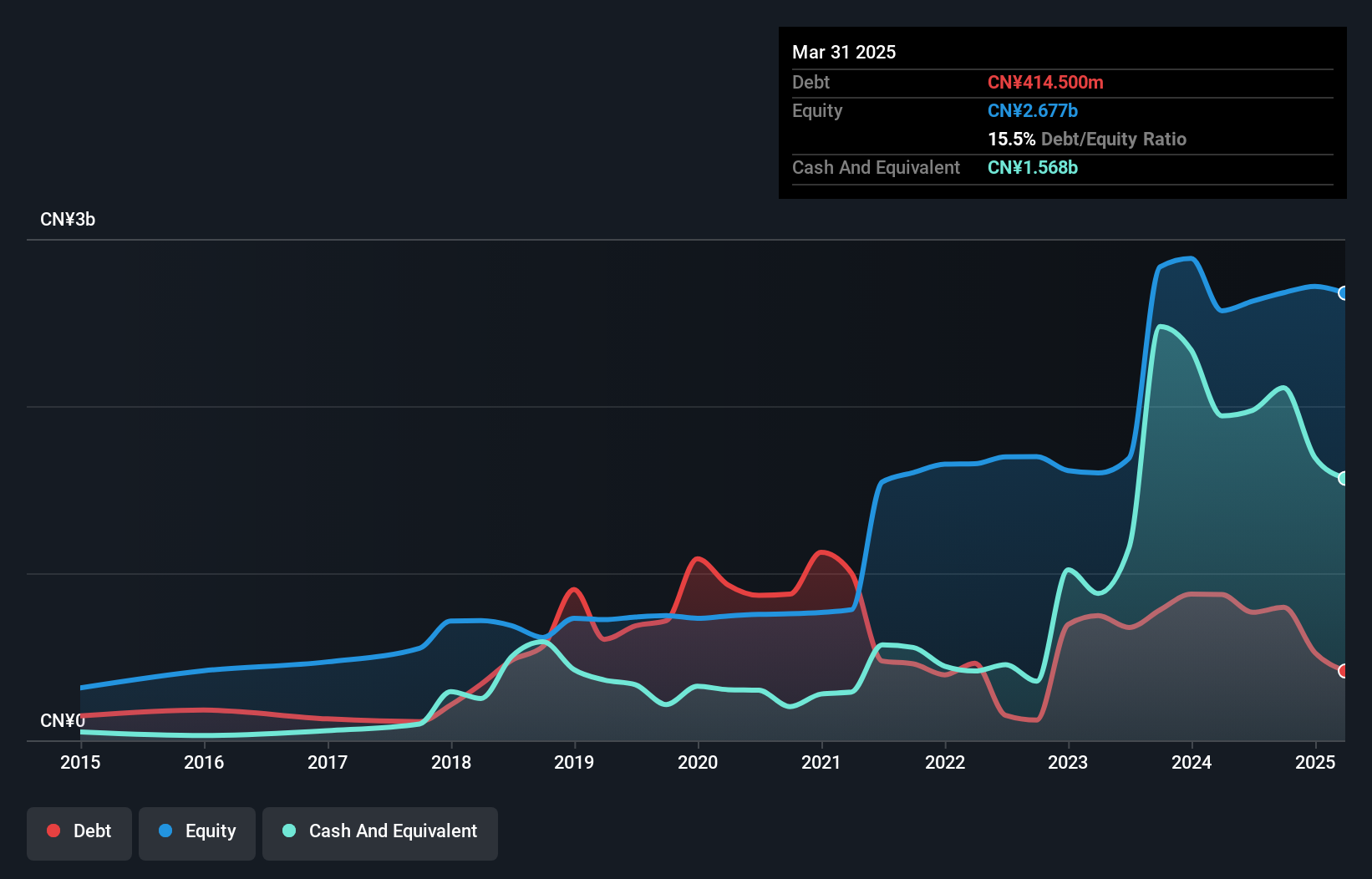

Focus Lightings Tech, a promising player in its sector, reported sales of CNY 2.02 billion for the first nine months of 2024, up from CNY 1.83 billion the previous year. Net income nearly doubled to CNY 159.57 million from CNY 77.08 million, with basic earnings per share rising to CNY 0.25 from CNY 0.14. The company's debt-to-equity ratio has improved significantly over five years, dropping to a more manageable level of about 29.7%. With a price-to-earnings ratio at an attractive level compared to industry peers and strong free cash flow, Focus Lightings seems well-positioned financially and operationally for future growth prospects.

- Unlock comprehensive insights into our analysis of Focus Lightings Tech stock in this health report.

Summing It All Up

- Reveal the 4638 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605228

Shentong Technology Group

Develops, manufactures, and sells automotive parts in China.

Adequate balance sheet minimal.

Market Insights

Community Narratives