- China

- /

- Basic Materials

- /

- SZSE:002066

Earnings Not Telling The Story For Ruitai Materials Technology Co., Ltd. (SZSE:002066) After Shares Rise 37%

Ruitai Materials Technology Co., Ltd. (SZSE:002066) shareholders have had their patience rewarded with a 37% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

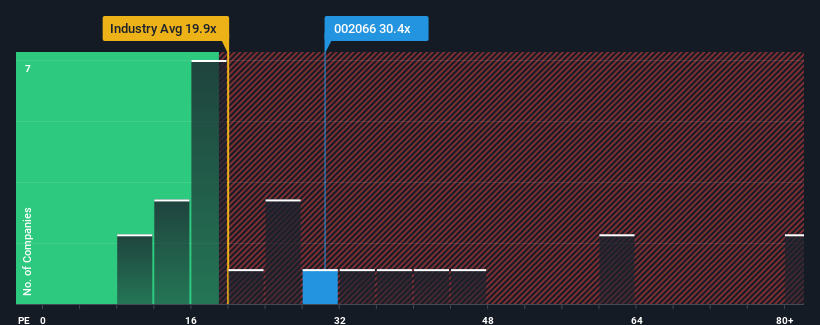

Although its price has surged higher, there still wouldn't be many who think Ruitai Materials Technology's price-to-earnings (or "P/E") ratio of 30.4x is worth a mention when the median P/E in China is similar at about 34x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ruitai Materials Technology has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Ruitai Materials Technology

Is There Some Growth For Ruitai Materials Technology?

Ruitai Materials Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. The latest three year period has also seen an excellent 64% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 8.4% per year as estimated by the sole analyst watching the company. With the market predicted to deliver 19% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Ruitai Materials Technology's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Ruitai Materials Technology's P/E

Ruitai Materials Technology appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ruitai Materials Technology currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Ruitai Materials Technology that we have uncovered.

Of course, you might also be able to find a better stock than Ruitai Materials Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002066

Ruitai Materials Technology

Engages in the research, production, sale, and service of refractories in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives