Guangxi Hechi Chemical Co., Ltd (SZSE:000953) Stock Rockets 35% As Investors Are Less Pessimistic Than Expected

Guangxi Hechi Chemical Co., Ltd (SZSE:000953) shares have continued their recent momentum with a 35% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

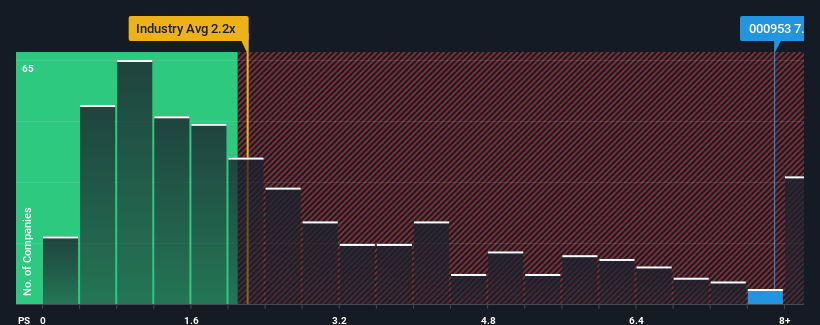

Following the firm bounce in price, you could be forgiven for thinking Guangxi Hechi Chemical is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.9x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Guangxi Hechi Chemical

What Does Guangxi Hechi Chemical's Recent Performance Look Like?

Guangxi Hechi Chemical has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guangxi Hechi Chemical's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Guangxi Hechi Chemical?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangxi Hechi Chemical's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. The latest three year period has also seen an excellent 39% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Guangxi Hechi Chemical's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Guangxi Hechi Chemical's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Guangxi Hechi Chemical revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Guangxi Hechi Chemical that you should be aware of.

If these risks are making you reconsider your opinion on Guangxi Hechi Chemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000953

Guangxi Hechi Chemical

Researches, develops, produces, and sells chemical raw materials and their preparations in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives