- China

- /

- Basic Materials

- /

- SZSE:000877

Why Investors Shouldn't Be Surprised By Tianshan Material Co., Ltd.'s (SZSE:000877) Low P/S

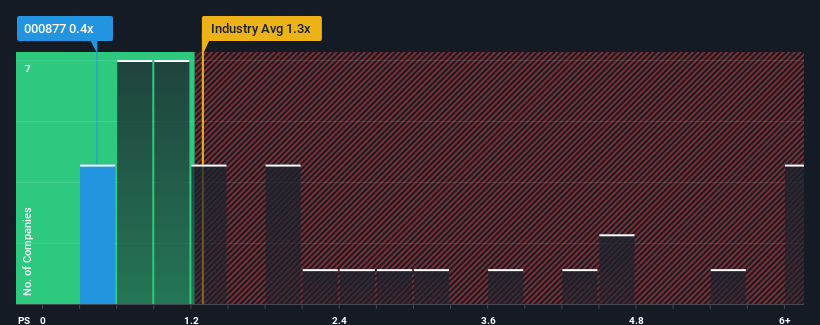

With a price-to-sales (or "P/S") ratio of 0.4x Tianshan Material Co., Ltd. (SZSE:000877) may be sending bullish signals at the moment, given that almost half of all the Basic Materials companies in China have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tianshan Material

What Does Tianshan Material's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Tianshan Material has been very sluggish. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Tianshan Material's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Tianshan Material?

Tianshan Material's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 1.9% as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 11% growth forecast for the broader industry.

In light of this, it's understandable that Tianshan Material's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Tianshan Material's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tianshan Material that you need to be mindful of.

If these risks are making you reconsider your opinion on Tianshan Material, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Tianshan Material, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tianshan Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000877

Tianshan Material

Produces and sells cement, clinker, and commercial concrete in China and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives