- China

- /

- Metals and Mining

- /

- SZSE:000723

Investors Still Aren't Entirely Convinced By Shanxi Meijin Energy Co.,Ltd.'s (SZSE:000723) Revenues Despite 29% Price Jump

Shanxi Meijin Energy Co.,Ltd. (SZSE:000723) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

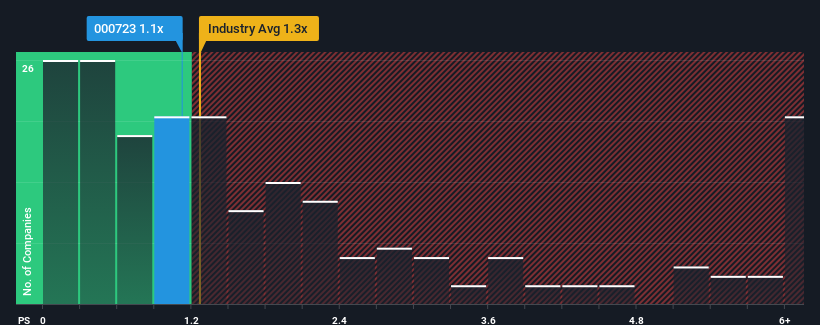

In spite of the firm bounce in price, it's still not a stretch to say that Shanxi Meijin EnergyLtd's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in China, where the median P/S ratio is around 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Shanxi Meijin EnergyLtd

What Does Shanxi Meijin EnergyLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Shanxi Meijin EnergyLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanxi Meijin EnergyLtd.Is There Some Revenue Growth Forecasted For Shanxi Meijin EnergyLtd?

The only time you'd be comfortable seeing a P/S like Shanxi Meijin EnergyLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 5.2% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 19% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this information, we find it interesting that Shanxi Meijin EnergyLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Shanxi Meijin EnergyLtd's P/S

Shanxi Meijin EnergyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Shanxi Meijin EnergyLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Shanxi Meijin EnergyLtd with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000723

Shanxi Meijin EnergyLtd

Produces and sells coking coal and coking by-products in China.

Moderate growth potential and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026