Market Cool On Sichuan Xinjinlu Group Co., Ltd.'s (SZSE:000510) Revenues Pushing Shares 33% Lower

Sichuan Xinjinlu Group Co., Ltd. (SZSE:000510) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

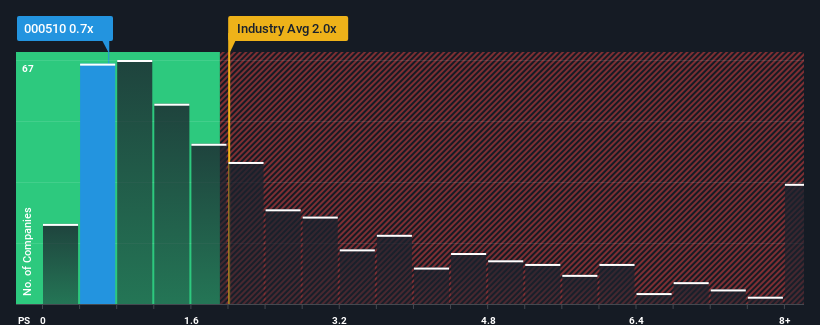

Since its price has dipped substantially, Sichuan Xinjinlu Group may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Sichuan Xinjinlu Group

What Does Sichuan Xinjinlu Group's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Sichuan Xinjinlu Group's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sichuan Xinjinlu Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Sichuan Xinjinlu Group?

In order to justify its P/S ratio, Sichuan Xinjinlu Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. The last three years don't look nice either as the company has shrunk revenue by 4.3% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 22% as estimated by the one analyst watching the company. That's shaping up to be similar to the 23% growth forecast for the broader industry.

With this information, we find it odd that Sichuan Xinjinlu Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Sichuan Xinjinlu Group's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Sichuan Xinjinlu Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Sichuan Xinjinlu Group with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000510

Sichuan Xinjinlu Group

Produces and sells chlor-alkali chemical products in China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives