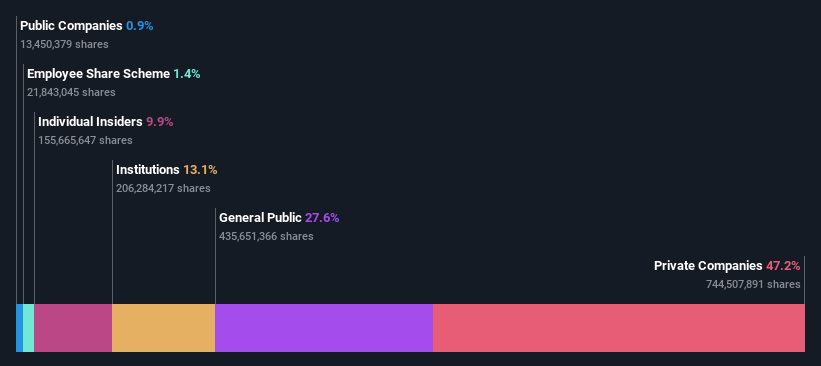

Zangge Mining Company Limited's (SZSE:000408) top owners are private companies with 47% stake, while 28% is held by individual investors

Key Insights

- Zangge Mining's significant private companies ownership suggests that the key decisions are influenced by shareholders from the larger public

- A total of 3 investors have a majority stake in the company with 50% ownership

- 13% of Zangge Mining is held by Institutions

A look at the shareholders of Zangge Mining Company Limited (SZSE:000408) can tell us which group is most powerful. And the group that holds the biggest piece of the pie are private companies with 47% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And individual investors on the other hand have a 28% ownership in the company.

Let's take a closer look to see what the different types of shareholders can tell us about Zangge Mining.

View our latest analysis for Zangge Mining

What Does The Institutional Ownership Tell Us About Zangge Mining?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

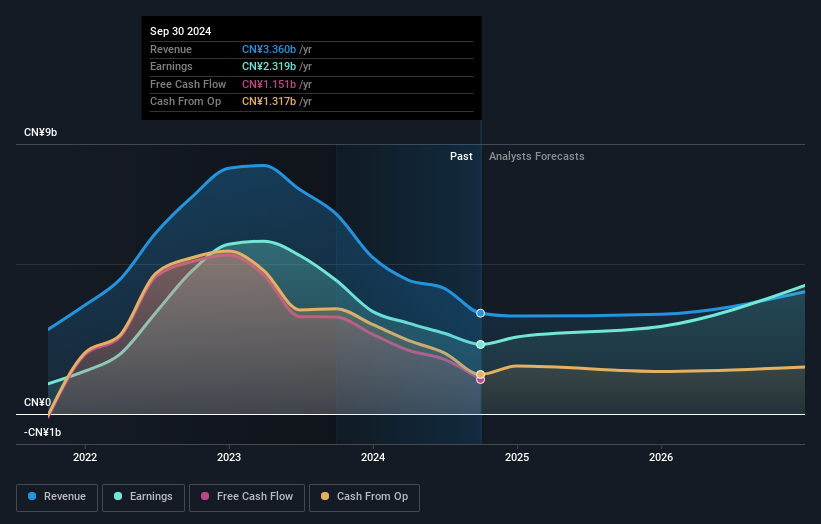

We can see that Zangge Mining does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Zangge Mining's historic earnings and revenue below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in Zangge Mining. Our data shows that Tibet Zangge Venture Capital Group Co., Ltd. is the largest shareholder with 23% of shares outstanding. In comparison, the second and third largest shareholders hold about 17% and 9.9% of the stock.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Zangge Mining

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in Zangge Mining Company Limited. This is a big company, so it is good to see this level of alignment. Insiders own CN¥5.1b worth of shares (at current prices). If you would like to explore the question of insider alignment, you can click here to see if insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 28% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 47%, of the Zangge Mining stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Zangge Mining better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Zangge Mining you should know about.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you're looking to trade Zangge Mining, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zangge Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000408

Zangge Mining

Engages in the production and sale of potassium chloride under the Blue Sky brand name in China.

Flawless balance sheet with reasonable growth potential.