Earnings Troubles May Signal Larger Issues for Jiangsu Eastern ShenghongLtd (SZSE:000301) Shareholders

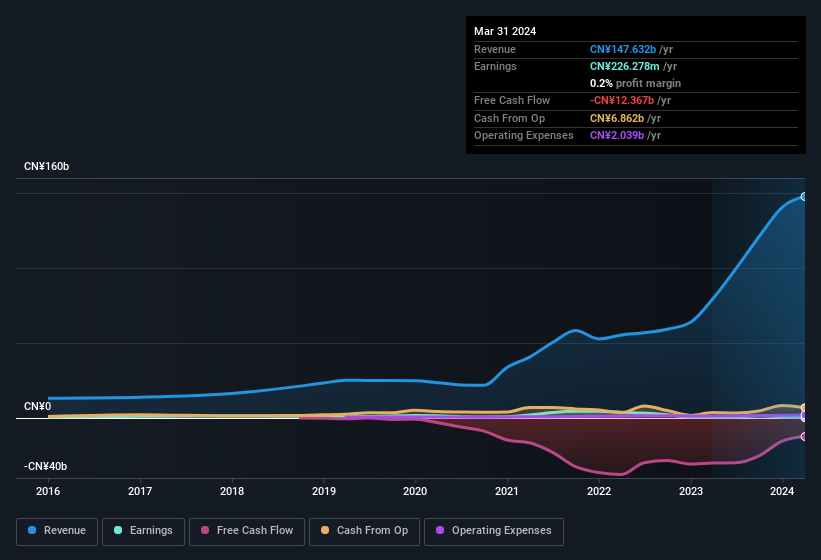

A lackluster earnings announcement from Jiangsu Eastern Shenghong Co.,Ltd. (SZSE:000301) last week didn't sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

See our latest analysis for Jiangsu Eastern ShenghongLtd

The Impact Of Unusual Items On Profit

To properly understand Jiangsu Eastern ShenghongLtd's profit results, we need to consider the CN¥291m gain attributed to unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Jiangsu Eastern ShenghongLtd received a tax benefit which contributed CN¥764m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Jiangsu Eastern ShenghongLtd's Profit Performance

In the last year Jiangsu Eastern ShenghongLtd received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. Considering all this we'd argue Jiangsu Eastern ShenghongLtd's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Jiangsu Eastern ShenghongLtd, you'd also look into what risks it is currently facing. Case in point: We've spotted 4 warning signs for Jiangsu Eastern ShenghongLtd you should be mindful of and 1 of them shouldn't be ignored.

Our examination of Jiangsu Eastern ShenghongLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000301

Jiangsu Eastern ShenghongLtd

Engages in the research, development, production, and sale of polyester filament, petrochemical, and new chemical materials.

Fair value with moderate growth potential.

Market Insights

Community Narratives