Can Mixed Fundamentals Have A Negative Impact on Suzhou Nanomicro Technology Co., Ltd. (SHSE:688690) Current Share Price Momentum?

Suzhou Nanomicro Technology's (SHSE:688690) stock is up by a considerable 45% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Specifically, we decided to study Suzhou Nanomicro Technology's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Suzhou Nanomicro Technology

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Suzhou Nanomicro Technology is:

3.9% = CN¥72m ÷ CN¥1.9b (Based on the trailing twelve months to September 2024).

The 'return' is the yearly profit. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.04 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Suzhou Nanomicro Technology's Earnings Growth And 3.9% ROE

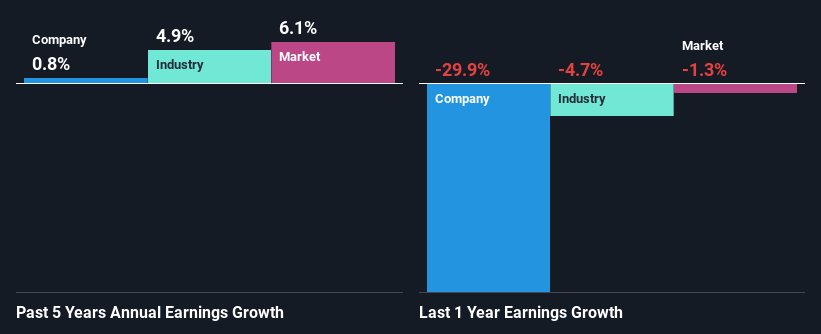

It is quite clear that Suzhou Nanomicro Technology's ROE is rather low. Even compared to the average industry ROE of 6.2%, the company's ROE is quite dismal. Hence, the flat earnings seen by Suzhou Nanomicro Technology over the past five years could probably be the result of it having a lower ROE.

Next, on comparing with the industry net income growth, we found that Suzhou Nanomicro Technology's reported growth was lower than the industry growth of 4.9% over the last few years, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Suzhou Nanomicro Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Suzhou Nanomicro Technology Using Its Retained Earnings Effectively?

Suzhou Nanomicro Technology has a low three-year median payout ratio of 21% (or a retention ratio of 79%) but the negligible earnings growth number doesn't reflect this as high growth usually follows high profit retention.

Moreover, Suzhou Nanomicro Technology has been paying dividends for three years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

Overall, we have mixed feelings about Suzhou Nanomicro Technology. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Suzhou Nanomicro Technology and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688690

Suzhou Nanomicro Technology

Engages in the manufacture and supply of spherical, mono-disperse particles for various industries and applications worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion